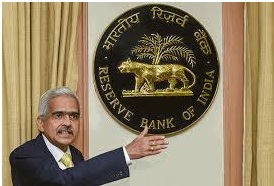

Governor Shaktikanta Das announced the Monetary Policy Committee’s decision to hold the key interest rates at existing levels. Currently, the repo rate stands unchanged at four percent, and the reverse repo rate at 3.35 percent. The MPC voted 5:1 to continue with its ‘accommodative’ stance. The RBI revised its consumer inflation forecasts. It now expects retail inflation at 5.1 percent in Q3, and 5.7 percent in Q4, but has maintained its FY22 projection at 5.3 percent. The RBI retained its real GDP growth forecast at 9.5 percent for FY22.

The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI), based on an assessment of the macroeconomic situation and outlook, on Wednesday voted unanimously to maintain status quo with regard to the policy repo rate, and by a majority of 5 to 1 decided to retain the accommodative policy stance. The Monetary Policy Committee (MPC) on December 8 retained the key lending rate, repo, at 4 percent, and maintained its stance as “accommodative”. Repo is the rate at which the Reserve Bank of India lends short-term funds to banks. This is the ninth consecutive policy meeting where the rate setting panel has maintained the key lending rate.

How did the market react?

Mr. Harresh Mehta, Chairman & Managing Director, Rohan Life capes

“RBI decided to keep the repo rates unchanged at 4% and reverse repo rate at 3.35% amidst fears of Omicron. This is the ninth consecutive time RBI upheld the status quo, while the unchanged repo rate will keep up the impetus amongst the Home loans borrowers and real estate at large.”

Mr Ramesh Nair, CEO| India, and Managing Director, Market Development| Asia, Colliers.

On expected lines, RBI has kept repo rates unchanged at 4% for the 9th consecutive time. This accommodative stance will aid demand dynamics and propel economic growth to mitigate the impact of Covid-19. This will support RBI’s vision of GDP growth of 9.5% for the year. At the same time, the growth will also hinge upon the new variant of covid-19 and its impact. The unchanged repo rate will continue to improve sentiments in the real estate sector. The housing sector is already seeing a revival in sales, led by low home loan rates, pent-up demand, and stable prices”.

Anuj Puri, Chairman – ANAROCK Group:

With Omicron throwing a shadow of doubt across the world and in India, the RBI has decided to keep the repo rates unchanged at 4% and reverse repo rate at 3.35%. This was expected, and is the ninth consecutive time that the RBI maintained status quo amid current uncertainties.

The unchanged repo rates will help maintain the status quo on the prevailing low interest rate regime for some more time. This works well for all home loan borrowers as the environment of affordability will continue.

Mr. Amit Goyal, CEO, India Sotheby’s International Realty

We welcome RBI’s status quo on policy rates. This means that the home loan interest rate will remain at the current level of sub 7% per annum. Besides that, the Governor rightly said in his statement that recent reduction in excise duty and state VAT on petrol and diesel will support consumption demand by increasing purchasing power. We expect demand in the housing market to improve further.

All eyes are now on the upcoming budget. It will boost the real estate sector if the government enhances deductions against home loans in Budget 2022.

Suren Goel, Partner, RPS Group

RBI decision to maintain status quo on the interest rate means home loan rates will continue to remain at a record low level. This augurs well for the housing sector and the real estate sector as a whole. With reasonable prices, lower interest rates and sufficient options to choose from, this is perhaps the best time to buy a dream home and we are hopeful of witnessing an uptick in demand.

Mr Pradeep Misra, MD, New Modern Buildwell Private Ltd, a real estate company having projects in Varanasi and Allahabad

The lower home loan interest rates would help the real estate sector, particularly in tier 2 & 3 cities. As interest rate along with house pricing is one of the biggest influencers of individuals’ buying decisions, we expect reasonable demand for housing over the next few months.