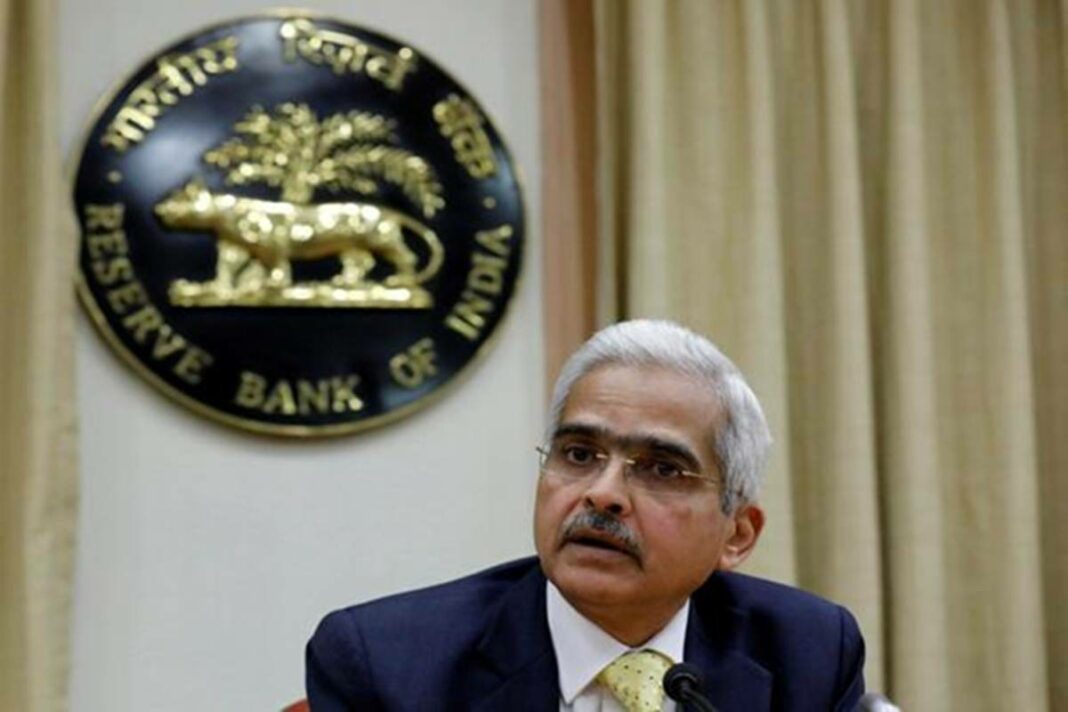

Reserve Bank Governor Shaktikanta Das declared the resolution of the Monetary Policy Committee (MPC) today. The Monetary Policy Committee (MPC) has decided to maintain status quo and keep interest rates unchanged. Currently, the repo rate is 4 percent and reverse repo rate is 3.35 percent. Reserve Bank of India (RBI) Governor Shaktikanta Das said the policy stance continues to be “accommodative”. The MPC has retained its GDP growth projection of 9.5 percent for FY22.

The RBI is closely watching the stressed assets situation in the banking sector, particularly in the retail and micro, small and medium enterprises segments (MSME), said MK Jain, one of the deputy governors at the Reserve Bank of India. However, there is no alarming situation at this point, said Jain. There is some stress visible in the retail and MSME segments. “We are closely monitoring…there is stress but not alarming,” said Jain.

The RBI is closely watching the stressed assets situation in the banking sector, particularly in the retail and micro, small and medium enterprises segments (MSME), said MK Jain, one of the deputy governors at the Reserve Bank of India. However, there is no alarming situation at this point, said Jain. There is some stress visible in the retail and MSME segments. “We are closely monitoring…there is stress but not alarming,” said Jain.

Post declaration, Mr. Surendra Hiranandani, Chairman and Managing Director, House of Hiranandani shared his views on the RBI Monetary Policy announcement.

“The Consumer Price Index inflation rate of more than 6% for May-June was beyond the Reserve Bank of India’s (RBI’s) tolerance mark. The RBI’s accommodative monetary policy and unchanged low-interest rates could become a challenge for it if inflation spikes again. While the status quo maintained by the RBI is appreciated, the focus should be on boosting growth with the right fiscal measures and policy support. This is especially important at a time when the International Monetary Fund has cut India’s growth estimate from 12.5% in April to 9.5% in July”, said Mr. Mr. Surendra Hiranandani.

As the second wave of the COVID-19 pandemic comes to an end and supply chains show signs of recovery, the real estate industry is inching towards normalcy. We are hopeful that the RBI and the Central Government will make announcements that trigger demand and boost the residential market segment. Just like the fiscal measures adopted last year, we are keen to see steps that enhance the market’s momentum and spur greater economic growth, he further exclaimed.