According to Colliers’ recent report on ‘REITs- gaining larger ground in Indian Real Estate’, REITs have gained significant market as a promising alternate real estate platform and hold a huge potential to attract investments into the real estate sector.

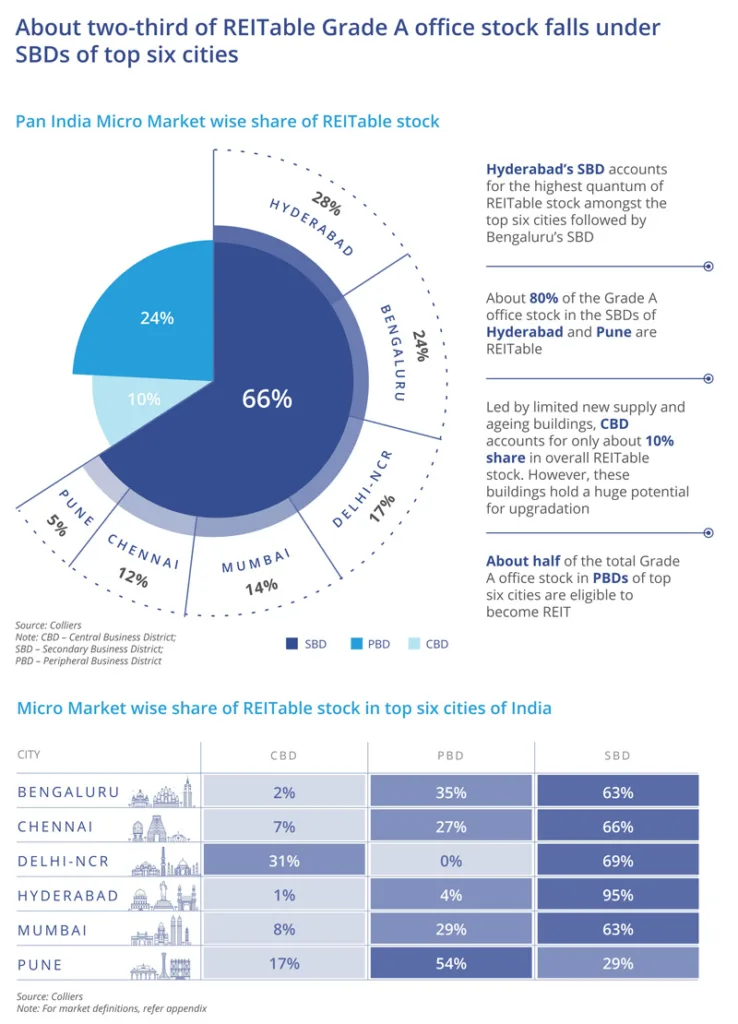

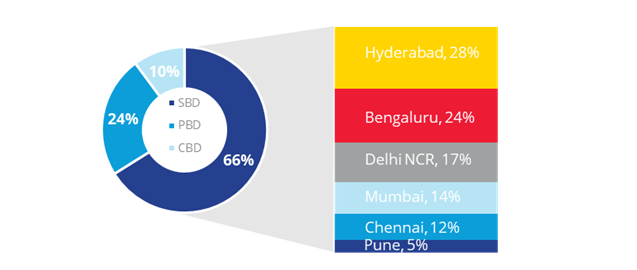

Colliers’ analysis indicates that about two-third of the REITable Grade A office stock falls in Secondary Business Districts (SBDs) of the top six[1] cities in India. Amongst these SBDs, the SBD of Hyderabad holds the highest quantum of REIT-worthy stock with 28% share, followed by Bengaluru at 24%. Further, over 60% of the Grade A stock within SBDs is REIT-worthy. At the same time, about half of the total Grade A office stock in Peripheral Business Districts (PBDs) across the top six cities is REIT-worthy. Understandably, the Central Business Districts (CBDs) have a relatively lower share of REITable stock, at 10%, due to limited new supply and presence of relatively older buildings.

A Snapshot of Indian REITs –

Pan India Micro Market wise share of REITable stock

Note: CBD – Central Business District; SBD – Secondary Business District; PBD – Peripheral Business District

SBDs of the top six cities include- Bengaluru- SBD 1, SBD 2, ORR; Chennai- Guindy, OMR Pre-toll, MPR, PTR; Delhi NCR- Southern Peripheral Road (SPR), Techzone Greater Noida, Udyog Vihar, Hyderabad- SBD, Off SBD; Mumbai- Andheri East, Worli/Prabhadevi, Lower Parel, Kalina, Powai; Pune- Baner, Balewadi, Bavdhan, Pashan, Hadapsar

[1] Top six cities include – Bengaluru, Chennai, Delhi NCR, Hyderabad, Mumbai, and Pune

At present, the three listed office REITs cumulatively hold approximately 74.4 mn sq ft of office REIT stock, representing around 11% of the total existing Grade A office stock.

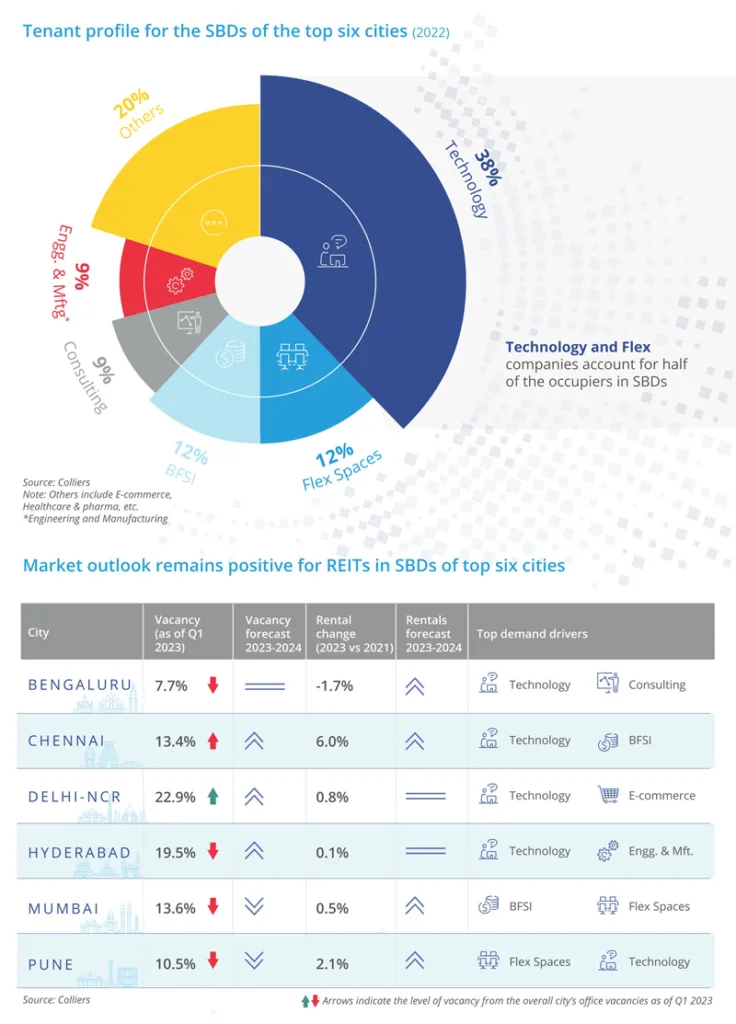

The underlying office sector has demonstrated resilience, particularly in the top six cities, with strong occupancy levels, despite looming externalities affecting demand. Office vacancy levels remained stable in Q1 2023 at 16.4%, pointing to a fundamentally strong commercial office market. The outlook for the office sector remains optimistic led by technology & flex space, with market likely to bounce back in the latter part of the year.

“REITs in India are still at their early stages compared to other regional markets. Strikingly, the market capitalization of Indian REITs is <10% compared to the USA, Singapore, and other countries in the APAC. Considering the size of the Indian office market there exists a huge potential for more number REITs and expansion of current REITs. The overall returns on listed REITs in India, including dividend yield, have been a major factor in the success of REITs in the country. The regulatory structure has also evolved and fallen in line with global best practices. In years to come, we are likely to see REITs expand to other asset classes such as Industrial, Data Center, Hospitality, Healthcare, and Education,” said Piyush Gupta, Managing Director, Capital Markets and Investment Services, Colliers India.

Untapped REIT potential at 57%, 380 mn sq ft of Grade A office stock on the platter

About 380 mn sq ft of the existing Grade A office space qualifies to be listed as REITs. Amongst the top six cities, Bengaluru leads with the largest share of REITable stock at 25%, followed by Hyderabad at 19%. Furthermore, an additional 41 mn sq ft of under-construction office stock, which is expected to enter the office market by the end of 2023, holds the potential to be REITed.

The three office REITs in India have been able to establish a strong platform to evince amongst global investors’ interest to commit funds in development-based assets. REITs are evolving and have paved the way for other asset classes as well. India’s first Retail REIT was listed on stock exchange in May 2023, expanding the investible cosmos for investors.

Market capitalization of REITs in India is <10% compared to the top global markets for REITs

India is still a relatively smaller market compared to its counterparts in APAC, Europe & America and this can be gauged from a comparison of the market capitalization of the listed REITs. India’s REIT market capitalization accounts for less than 10% of the market capitalization of other countries like the USA and Singapore. However, India’s REIT market is poised for higher growth and has significant potential. With an existing REIT penetration rate of 11%, India has significant room to increase its REITable share up to 68%, aligning with other APAC countries like Singapore and Japan which have more than 50% of their office portfolio under REITs. A larger share of REITs in office portfolio can lead to the corporatization of the office sector and enhance credibility for investors led by the stringent regulatory requirements for REITs.

“India’s office sector continues to remain upbeat despite global business slowdown. The strong underlying demand for office sector paired with relatively lower costs of quality assets & improving regulatory environment has created a conducive ecosystem for the growth of REITs in India. Albeit at a nascent stage, REITs already account for an impressive 11% of the overall Grade A office stock in the country with an additional unrealized potential of 57%, equating to about 380 mn sq ft of incremental REITable office space. The SBDs of top six cities hold the largest chunk of this potential stock, led by new-age quality assets with higher occupancy levels. With quality supply in pipeline, sturdy demand and shifting occupier preferences, SBDs are likely to see a higher proportion of REITable stock in the next few years,” said Vimal Nadar, Senior Director & Head of Research, Colliers India.

Way forward and opportunities for REITs in India

- With 379.5 msf of Grade A REITable stock, Indian office sector holds huge opportunity for REITs, especially in the SBDs of top six cities

- The looming recessionary concerns and reduced hiring in the tech space, might cause a short-term dent in demand for office spaces. However, the future of REITs look optimistic, led by its regulatory framework, robust demand and conducive ecosystem

- The framework for REITs has been constantly improving for better transparency, returns and policies to increase investor confidence. The policies can be further made more attractive by governing bodies by providing tax concessions and relaxing norms

- With the first few REITs having paved the way for success, REITs are likely to be expanded into diverse sectors like Industrial and Logistics and see further growth in office and retail sectors

- Taking cues from the global markets, developers can also consider exploring REITs in alternative asset classes such as data centers, hospitality, healthcare, education, etc.

- As sustainability is increasingly becoming a business norm in the real estate sector, green buildings are finding their way into funds and investment portfolios. Going ahead, we expect a larger share of green buildings in REIT portfolios

Post the maiden retail REIT, the market is ripe to see the listing of REITs in industrial & warehousing sector while it continues to gain larger ground in existing asset classes. As real estate continues to get regulated with best practices, unitization of assets will only aid in boosting investor confidence, enhancing trading & liquidity for a market price discovery while corporatizing real estate at large.

About Colliers

Colliers (NASDAQ, TSX: CIGI) is a leading diversified professional services and investment management company. With operations in 66 countries, our 18,000 enterprising professionals work collaboratively to provide expert real estate and investment advice to clients. For more than 28 years, our experienced leadership with significant inside ownership has delivered compound annual investment returns of approximately 20% for shareholders. With annual revenues of $4.5 billion and $98 billion of assets under management, Colliers maximizes the potential of property and real assets to accelerate the success of our clients, our investors and our people.