Palm Beach County’s building at a pace it has never seen. Officials project the taxable value of new construction will top $5 billion in 2025 after nearly 6,500 homes hit last year’s tax roll—an all-time record.

That momentum shapes 2026. While national headlines warn of a cooling market, this corner of South Florida still attracts cash buyers, corporate transferees, and retirees, keeping demand strong.

This guide shows why builders keep pouring concrete, where the busiest projects are rising, and how updated codes, incentives, and policies influence your options so you can buy confidently in 2026.

Why Palm Beach County is building so many homes

Population growth keeps pressure on supply

People keep coming. Snow-weary Northeasterners chase the sunshine, Wall Street firms move talent south, and retirees trade high-tax states for Florida’s friendlier ledger. County officials logged nearly 6,500 new residences on the 2025 tax roll and still call demand “strong,” noting Palm Beach remains “insulated” even as other markets cool.

Every new arrival needs a roof. When resale inventory thinned during the pandemic run-up, builders filled the gap. That pipeline is reaching buyers now, giving 2026 the largest wave of new-home construction Palm Beach County has seen in more than a decade.

Put simply, migration lights the fuse and construction delivers the fireworks. The show isn’t over yet.

Inventory is finally catching up

Palm Beach buyers remember the 2021 frenzy: 12 offers in 12 hours, inspections waived, heartbreak routine. Those days are gone. Active listings at the end of 2025 climbed more than 20 percent year over year, according to RE/MAX tracking, and analysts project another 10–15 percent bump during 2026.

That surge rewrites the playbook. With more homes on the shelf, sellers (and even builders) now court you, not the other way around. Prices still rise, but at a measured 3–5 percent rather than double digits, and homes sit on the market roughly 40 days instead of a single weekend.

What does that mean for you? Breathing room. Schedule a second showing. Negotiate closing costs or ask a builder for a rate buy-down. The market isn’t fully in buyers’ hands, but for the first time in years the field feels even.

Watch months of supply. Healthy balance sits near five to six months; Palm Beach County is drifting toward that zone after years stuck well below it. As the figure approaches equilibrium, your choices—and bargaining strength—expand.

Bottom line: inventory now works in your favor. Use it to compare, question, and secure the deal that matches your plan instead of surrendering to scarcity.

Builder data backs this up.

Local brokerage SquareFoot Homes keeps a weekly tracker of which incentives each major builder is currently offering.

Scanning https://www.squarefoothomes.com/ before you even step into a model shows exactly which rate buydowns, design credits, or closing-cost perks are active that week, arming you with instant leverage when you negotiate across town.

SquareFoot Homes New Construction Incentives Tracker Screenshot

It also rebates 1 percent of a new-construction home’s purchase price back to its clients at closing—a credit large enough to cover most first-year insurance or HOA costs—giving shoppers a clear benchmark when they negotiate concessions elsewhere.

Building boom: where and what is being built

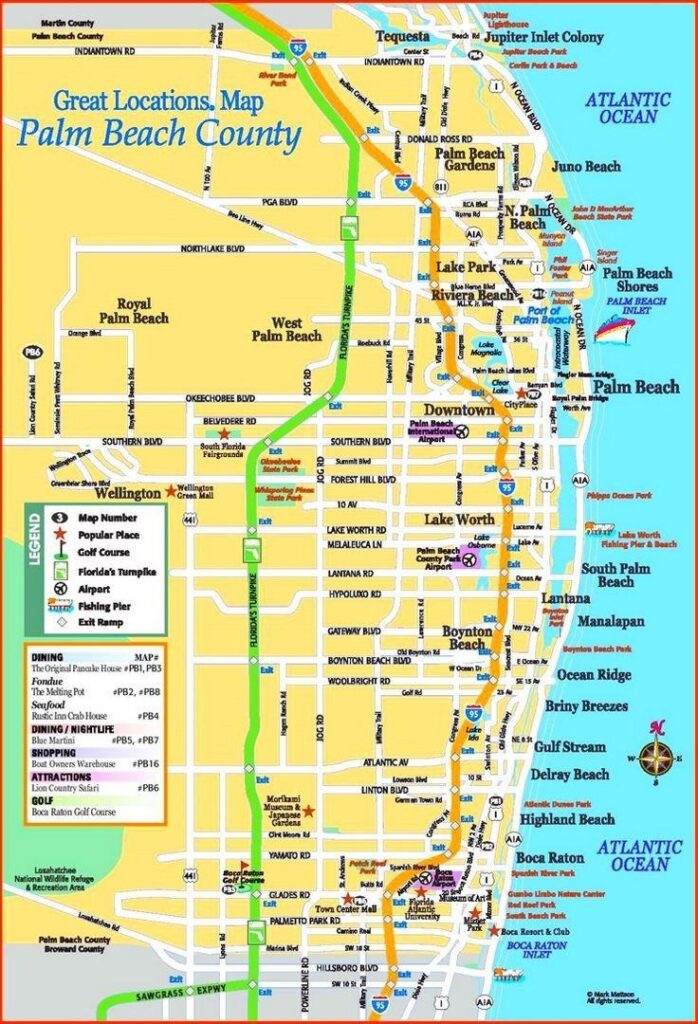

Palm Beach County Map Showing Westward Expansion and Coastal Cities

Westward expansion: from groves to master-planned cities

Drive twenty miles inland and the view shifts. Former citrus fields now carry street grids, playgrounds, and model-home flags that wave like welcome signs. Westlake, incorporated in 2016, is the showcase. Approvals top 6,000 homes, and national builders keep buying dirt; GL Homes recently paid $80 million for its next 1,000-home neighborhood. Reporters covering the deal summed up the broader pattern: “Homebuilders in South Florida are increasingly moving west because of a lack of available land closer to the coast.”

Land scarcity east of I-95 fuels the shift. Out west, parcels are large, zoning is friendlier, and developers can still deliver a three-bedroom, backyard dream at prices many families consider reachable. In Westlake some models opened in the mid-$400s, complete with community pools, new schools, and a planned town center.

The same trend shows up in Avenir, a 4,700-acre project near Palm Beach Gardens, and in agrihoods that mix working farms with trail networks. Each master plan promises breathing room plus resort-style amenities, benefits hard to recreate inside built-out coastal towns.

For buyers, the message is clear. If you want a new home below seven figures, head west. The trade-off is a longer commute and a farther drive to the beach, but builders compensate with larger lots, clubhouses, and often lower insurance premiums thanks to current codes.

Western Palm Beach County is no longer fringe; it is the county’s next growth engine and the bulldozers keep rolling.

Urban infill and vertical living

Head east and the skyline tells another story. Cranes punctuate downtown West Palm Beach, raising glass and concrete towers that promise water views and walk-to-everything convenience. According to CitizenPortal.ai, city commissioners relaxed height limits along key corridors when developers reserve workforce-priced units, a swap allowed by Florida’s Live Local Act. Buildings once capped at three stories can now reach seven if they allocate apartments for nurses, teachers, and first responders.

That policy change set projects in motion quickly. Luxury rentals rise along Rosemary Avenue, boutique condos line Flagler Drive, and mixed-use complexes replace tired strip plazas. Vertical living adds perks suburban homes cannot match: secure lobbies, rooftop pools, walkable restaurants, and zero lawn care.

Prices mirror the lifestyle. A two-bedroom condo downtown often lists above $1 million, yet demand stays solid because buyers prize location over square footage. Others aim for the workforce units, trading a shorter commute for below-market rent. Either way, infill broadens choice beyond drive-until-you-qualify suburbs.

If a lock-and-leave home, morning coffee strolls, and waterfront festivals sit high on your list, watch new permits downtown. More mid-rises will enter the market through 2026, and early buyers usually capture the best floor plans.

Coastal tear-downs and pocket subdivisions

Even in built-out Boca, Delray, and Jupiter, hammers keep swinging. Owners of dated ranch houses sell mainly for land value; builders clear the lot and raise sleek, Cat-5-rated estates that move before the paint dries. One century-old bungalow in Boca’s Golden Triangle recently became a four-bedroom modern coastal home and sold for triple its previous price. Stories like that echo up and down the Intracoastal.

Pocket subdivisions follow a similar script. A five-acre nursery off Military Trail converts to a dozen single-family lots, each with a three-car garage and pre-wired EV station. Buyers land the coveted east-side ZIP code and new construction without high-rise HOA fees.

These projects will not flood the MLS with hundreds of homes like Westlake, but they reshape established neighborhoods. If you want modern systems yet refuse to give up a five-minute drive to the ocean, track these infill lots. They often sell quietly and quickly, long before glossy listing photos appear.

New construction vs. resale: picking your play

Why new construction often wins

Step into a model home and the benefits hit you in the nose: fresh paint, zero pet dander, that “never-lived-in” glow. Yet the perks run deeper than scent.

Start with cost of ownership. Insurers reward new builds because they meet the toughest wind and flood codes, which translates into premiums hundreds, even thousands, lower per year than a 30-year-old house down the block. One local broker, as quoted by HomesAroundJupiter.com, calls those savings “the easiest money buyers leave on the table.”

Maintenance follows the same logic. New roof, new HVAC, new wiring, all under warranty. For the first decade, surprise repairs are rare, and when something hiccups, the builder pays, not you.

Builders sweeten the pot further in 2026. Inventory is up, so they offer mortgage-rate buydowns, closing-cost credits, and free design upgrades to keep sales moving. These concessions can cut tens of thousands from lifetime housing costs at a stroke. The resale market rarely matches that generosity; individual sellers seldom absorb a buyer’s discount.

Finally, consider energy use. Spray-foam insulation, low-e impact glass, and high-efficiency air handlers come standard in most new communities. Utility bills fall, comfort rises, and eco-minded buyers start with a smaller carbon footprint.

Add it up: lower insurance, fewer repairs, financial incentives, and cheaper monthly utilities. New construction makes a strong economic case, even when the sticker price sits higher than a comparable resale.

Where resale still shines

New does not mean perfect. Higher purchase prices remain the blunt reality. Builders pass land and material costs straight to the sticker, so you may pay a 15–20 percent premium per square foot compared with an older neighbor on the same street.

Location is the next curveball. Most large tracts left for building sit far from the coast. If you dream of morning surf checks or want Boca’s walkable restaurants at your door, a 2026 model home may force a longer commute or a bigger budget for a coastal tear-down.

Character matters, too. Mature oak canopies, no-HOA freedom, and mid-century charm live in resale land. Many buyers would rather renovate an existing shell than give up those intangibles for fresh drywall.

Finally, think about supply risk. In a master-planned community the builder controls release schedules. If hundreds of copies of your floor plan hit the market every year, short-term appreciation can lag. An older home in an established enclave has built-in scarcity, which often softens value swings during slow cycles.

Weigh these factors honestly. The best deal is rarely universal; it depends on how you balance lifestyle, budget, and long-term equity goals.

Questions to ask before you sign on a new build

- What warranties come standard? Nail down coverage for cosmetic items, major systems, and structural elements. One year on paint is common; 10 years on the foundation should be non-negotiable.

- Are there community development district (CDD) fees? Some master plans fund roads and sewers with long-term bonds that add thousands to annual tax bills. Know the number now, not after closing.

- Which incentives are on the table today? Inventory levels change weekly. Ask for mortgage-rate buydowns, design-center credits, or closing-cost help, then get it in writing.

- When is completion and how are delays handled? Supply chains still hiccup. Clarify penalties or accommodations if the timeline slips.

- Will future phases mirror my floor plan? Scarcity supports resale value. If hundreds of identical homes launch next year, factor that into your equity outlook.

Clear answers turn showroom sparkle into a contract that protects both your wallet and your peace of mind.

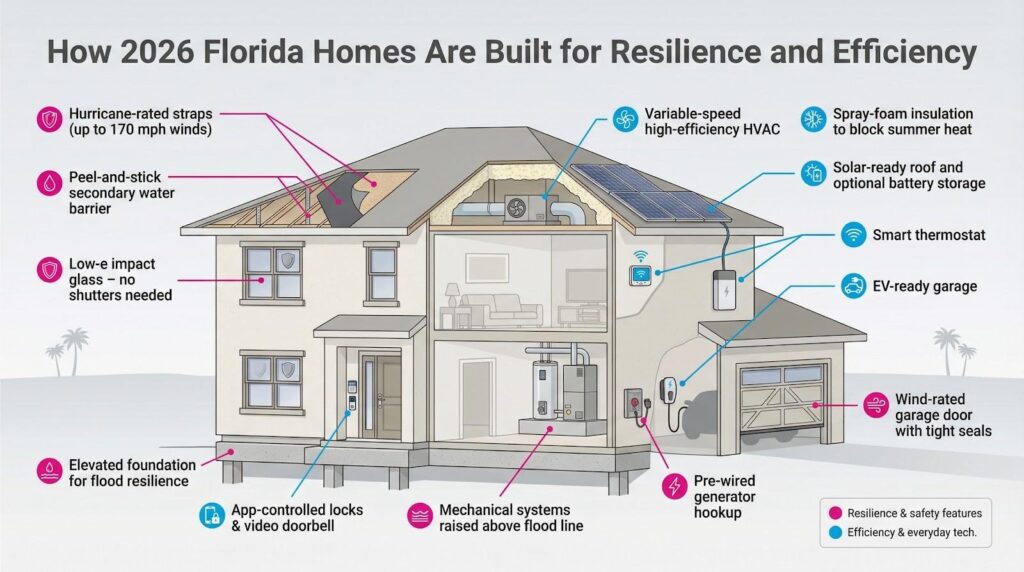

How 2026 homes are built differently

Building for resilience

Walk through a 2026-built home and you feel the muscle before you see the marble. Rafters connect to walls with metal straps rated for 170-mile winds. Roof decks hide peel-and-stick secondary water barriers that block driving rain. Every pane of glass is impact-rated; no need to scramble with shutters when a storm shifts at midnight.

These upgrades are no longer extras; they are the baseline under Florida’s 2024 building code and often exceed it through voluntary FORTIFIED Home standards. The payoff is clear: fewer claims bring lower premiums, and insurers openly list discounts for homes that prove their hurricane strength.

Engineers also plan beyond wind. In flood zones, foundations stand higher, garage doors seal tighter, and ground-floor mechanicals sit on raised platforms. Some coastal builders pre-wire quick-connect generators so freezers keep humming when the grid fails.

The result is a structural safety net older houses cannot match without six-figure retrofits. If you prize peace of mind alongside stone counters, new construction serves that need straight from the blueprint.

Energy efficiency and everyday tech

Efficiency now sells homes as much as quartz counters. Builders fill attics with spray-foam insulation that blocks summer heat before it reaches living space. Low-e impact windows trap cool air and mute traffic. Variable-speed HVAC systems sip electricity, trimming bills even as temperatures rise.

Tech adds comfort. Every new garage is pre-wired for an EV charger. Standard smart-home bundles include Wi-Fi thermostats, app-controlled locks, and video doorbells. Forget the keys or want the AC running before you arrive? Your phone handles it.

Solar readiness is moving from novelty to norm. Conduit runs and reinforced trusses let you add panels later without tearing up the roof. Some communities go further, offering builder-installed arrays with battery storage so outages feel like a blip instead of a crisis.

Together these features lower ownership costs, soften environmental impact, and set the home up for tomorrow, benefits that help when resale day comes.

Rules and reforms shaping what gets built

Legislation steers growth as much as buyer demand. In mid-2023 Florida’s Live Local Act cleared a quicker path for mixed-income housing. West Palm Beach seized it, letting developers add extra height when they reserve apartments for nurses, teachers, and first responders. That single change turned three-story limits into seven-story approvals and set an example other cities now study, according to SouthFlorida.com.

Statewide insurance turmoil nudged change too. Lawmakers curbed frivolous-lawsuit incentives and opened the door for new carriers. Steadier premiums reassured underwriters, which kept lenders and builders funding projects instead of hitting pause.

Safety rules climbed as well. The eighth edition of the Florida Building Code, effective 2024, raised wind-load thresholds, tightened roof-deck fastening, and required secondary water barriers. A 2026 home therefore qualifies for the highest wind-mitigation credits insurers offer, a quiet win for your wallet.

County commissioners still balance westward growth with infrastructure. Many approvals now hinge on builders paying for road widenings, school seats, or freshwater wells. The trade-off is slower but more orderly development. For buyers, that means master-planned communities should open with the promised roads, parks, and classrooms rather than half-finished amenities and traffic jams.

Conclusion

Bottom line: recent policy favors resilient construction and wider housing choices while aiming to keep homes affordable for working households. Understanding that backdrop helps you read the signals when a vacant lot suddenly sprouts cranes or a new tower lands on next week’s agenda.