India’s warehousing sector is forecasted to clock strong growth in 2023 and the years to follow. According to the Credit Rating Agency of India Limited (ICRA) estimates, the warehousing sector is projected to grow at a CAGR of 10.5% through 2025, much higher than the average CAGR of 7.8% registered over the past five years.

The reasons are not hard to fathom. India’s consumption power is growing, and there’s an increasing demand for products to be delivered faster than before. E-Commerce businesses and traditional businesses, both require top-quality warehousing facilities, situated close to their largest pool of customers.

Among different cities in India, the Bengaluru warehouse market is witnessing a surge in investment. In this regard, white paper named ‘Ahead of The Curve – Bengaluru Warehousing’ has been prepared by India Sotheby’s International Realty Experts with inputs from India’s leading real estate data research company CRE Matrix.

Bengaluru Warehouse Market – Brief background

Bengaluru has witnessed significant Grade A warehousing build-up over the last 5 years with the advent of modern logistics in this country. E-Commerce players and Third-party logistics (3PL) solutions providers have added to the demand apart from the traditional manufacturing and retail sectors. Industries are increasingly choosing to outsource logistics rather than doing it in-house and utilising their own space for core operations. A 3PL provider offers greater efficiency tostore inventory, pick, pack, and ship products, and is a vital link between manufacturing operations and the end customers.

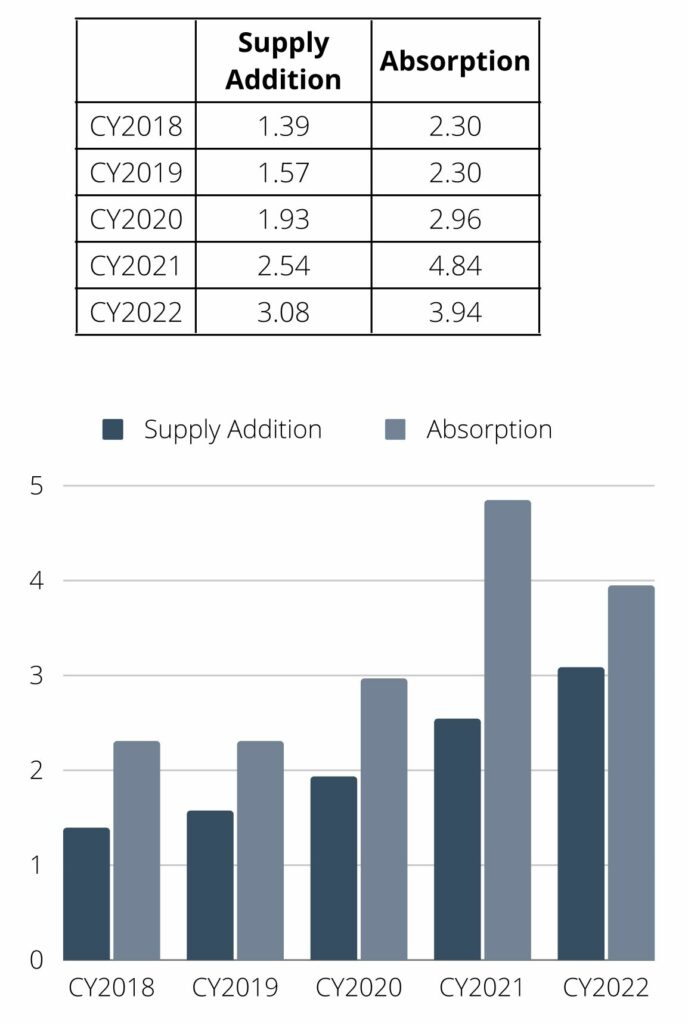

Bengaluru is the 3rd largest city/urban agglomeration in India and is one of the fastest-growing cities in the country. With its high per capita income and a populace with very high aspirations – it has a high consumption pattern which drives the demand for logistics. According to India’s leading realestate data research company CRE Matrix, warehouse absorption over the last five years has grown by a CAGR of 11% to reach 3.9 Mn sqft in 2022, while the supply of warehouses has grown by a CAGR of 17%. Despite supply growth outstripping demand, there is ademand-supply gap of about 20% according to market intelligence. The vacancy in Bengaluru’s warehousing real estate is at a low of 5%.

Gross Absorption and Supply in Bengaluru Over The Last 5 Years In Mn Sqft (Source – CRE Matrix)

Demand Drivers

THE POLICY EFFECT

India’s logistic sector is currently passing through a transformational growth phase. The Union Budget 2023 has announced several measures that are enablers for the growth of the warehousing sector. The most important one has been the enhanced capital investment outlay of Rs 10 lakh crore in infrastructure development, including roads and railways. We believe this will have a significant and positive impact on the logistics and supply chain industry.

Bengaluru, in particular, is amongst the 4 four cities to be selected as part of the 35 multimodal centres in India by GOI, showing Karnataka’s capital city’s importance as a major hub for logistics.

CONNECTIVITY

Geographically and economically, Bengaluru is strategically positioned in southern India and we believe it will continue to witness growth driven by consumption demand increase and industrial investments in cities umbilically connected to it.

Apart from being a consumption centre, Bengaluru has manufacturing clusters in Bommasandra / Jigani / Hosur (bordering the Tamil Nadu region), Narsapura towards Central East, Peenya / Neelamangla to North West (till Tumkuru).

There are key highways connecting Bengaluru to major cities such as the port cum Industrial city of Chennai, industrial cities of Pune and Hyderabad, and two other big consumption centres of Karnataka, namely Mangalore and Mysore.

Highway connectivity to these cities is also improving significantly, giving Bengaluru an added advantage. The expanded Bengaluru-Mysore Expressway is already operational and has cut down travel time between the two cities to a mere 90 minutes.

The much-awaited Bengaluru-Chennai Expressway is progressing well and is expected to be ready by 2024. Bengaluru-Pune expressway is in the offing even while the road between Tumkuru and Bengaluru is being widened. Banglore-Hyderabad Highway is also being expanded to 6 lanes from 4 lanes and Bengaluru -Vijayawada Expressway road contracts have been awarded.

The Bengaluru Peripheral Ring Road connecting Nice Road at Hosur Road and Tumkur Road (making fort he circular road) will connect Hosur Road, Old Madras Road, Bellary Road and Doddaballarpur Road and open newer warehousing clusters.

These highway developments will give a massive impetus to reinforcing Bengaluru’s position as a logistics hub.

THE SUPPLY GAP

The supply of quality large plate warehousing realty has significantly lagged behind net absorption over the last few years. Supply has lagged behind the net absorption by a third which points to the tightness in the market. The market rentals in the sector also rose by 10% in 2022, much more than the average rental hikes of 5-6% in previous years, indicating a further tightness.

What’s Expected?

Bengaluru Warehousing Leasing trends (By Sector) Source: CRE Matrix

Our estimates are that the demand increase for warehousing space in bengaluru will translate to increased land demand of about 250 acres + in the coming two-three years.

The good news is that the demand for land is likely to be equally divided among the clusters, around these clusters a) Anekal / Attebele / Hosur b) Hoskete / Mallur / Narsapura, c) Devenahalli / Doddaballarpur and Peenya / Neelamnagala / Dobespet – given that manufacturing and industry is spread out – for example, Foxconn facility is in North Bengaluru and Ola is at Hosur. The expansion of the city and the peripheral ring road together will enable transfer between clusters and consumption centres.

Manufacturing, 3rd Party Logistics Players, E-Commerce, and Retail will continue to account for most of the absorption. 3rd Party Logistics Players and Ecommerce have emerged as the major occupiers and will be the key drivers of the warehousing demand in Bengaluru.

Owners are able to negotiate far better rentals with new occupiers. This is evident from the substantial increase in market rentals of 10%, vis-à-vis the in-place rental increase of 2% in 2022. Contracted rentals do exhibit that 2022 could be an outlier and rental increases will be more moderate going forward.

“Bengaluru will be in the spotlight for investments in warehouses with greater capacity for e-commerce fulfilment. Based on the anticipated rise in demand, we project that more than 250 acre of land would be required in the periphery of Bengaluru city to develop new warehousing facilities,” said Mr Gagan Randev, Executive Director – Capital Markets, India Sotheby’s International Realty.

Another significant trend observed in the market is the notable and recent rise in market rentals within the sector. In 2022, market rentals experienced a remarkable increase of 10%, surpassing the average rental hikes of 5-6% witnessed in previous years.

“This upward trajectory indicates a further tightening of the market. As a result, owners have gained the advantage of negotiating more favourable rental terms with new occupiers. The considerable rise of 10% in market rentals, compared to the in-place rental increase of 2% in 2022, clearly reflects this positive trend,” opined Mr Harikesh Ananthamurthy, Senior Vice President – Capital Markets, India Sotheby’s International Realty.

He further said manufacturing, logistics players, e-commerce, and retail sectors will continue to drive the warehousing demand, with logistics players and e-commerce emerging as major occupiers.

Mr Randev added: “The involvement of larger organized players in the sector has driven a shift towards automation, IoT integration, enhanced warehouse management systems, security measures, and a focus on creating greener and sustainable built environments.”

In Conclusion

Organised large players with a long-term horizon are buying up large parcels of land keeping in mind the long-term demand and the business case for locking in land prices.

The challenge of course is the availability of large land parcels with clear titles. The acquisition process and conversion of land use in the locations and clusters which will drive demand is challenging. Compared to the other real estate asset classes which are more in-city play, warehousing is in the periphery of cities, which brings with it the need for larger aggregation and conversion from agricultural to industrial and the complexities thereon. There is also the tendency of landowners to raise expectations and asking price for the land. At the end of the day, valuation will be dictated by the expected earnings from warehousing rentals along with the cost of construction and approval costs. Large organised players are unlikely tomake aggressive bets if it does not make for a strong business case.

There are a number of organised players who have entered the warehousing segment inrecent years and have aggressive expansion plans. Top names such as All Cargo, Welspun, and IndoSpace are scouting for opportunitiesto expand. Others like The House of Hiranandani, Macrotech (Lodha), ESR, Capitaland, Morgan Stanley, Horizon Industrial Parks, and Greenbase have joined the warehousing bandwagon, along with fresh players such as Prologis, Panattoni, and RMZ. Funds like Blackstone and Prologis have partnered / are looking at partnering with strong domestic players who have the calibreto identify and accumulate large land parcels in a timebound and organised way. So far, this has proven to be tough given the land challenges.

The big change visible with more and larger organised players coming into the sector is a drive towards automation and IOT, superior warehousing management systems and security, and most importantly, a greener and more sustainable built environment.

White paper prepared By;