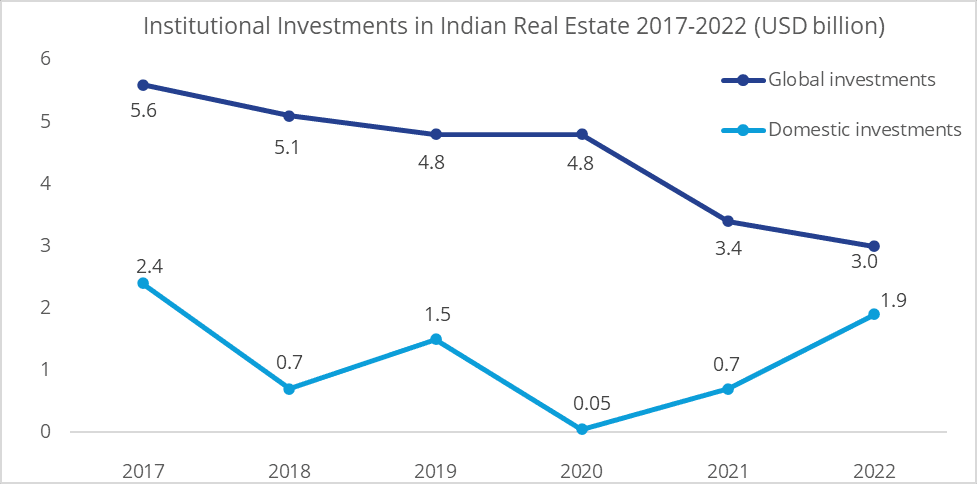

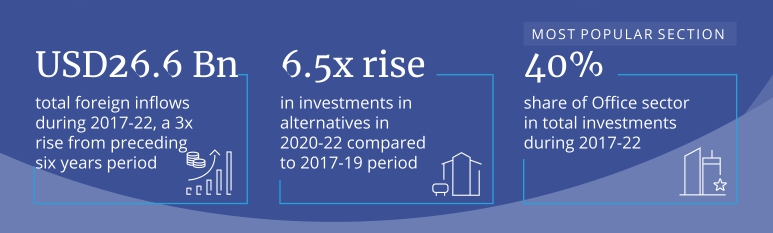

During the six-year period from 2017 to 2022, India received cumulative foreign institutional inflows of USD26.6Bn into real estate, a three-fold rise from the preceding six-year period. Foreign investments in India have been on the rise over the last few years as the industry underwent an overhaul, with major structural, policy reforms inducing transparency & ease of business operations, according to Colliers’ ‘India- High on Investors’ Agenda’ report. The report delves into the factors that make India a preferred choice for global investors and how it has stepped ahead of other emerging economies. The report also tracks the recovery & growth of the real estate market and explores opportunities for core as well as alternative asset classes such as Global Capability Centers (GCCs) and Data Centers.

“India’s favorable demographic indicators, deep digital talent pool, developmental government policies, infrastructure advancements and competitive costs have made it one of the top choices for global enterprises, fueling real estate demand in India. The strong economic & business fundamentals are enhancing institutional investors’ sentiments; forging strategic partnerships to expand their portfolios. Office sector saw the highest investments during 2017-22, accounting for about 45% of the total foreign inflows. While investors remain buoyant on office assets, their interest in alternative assets is surging,” says Sankey Prasad, Chairman & Managing Director at Colliers India.

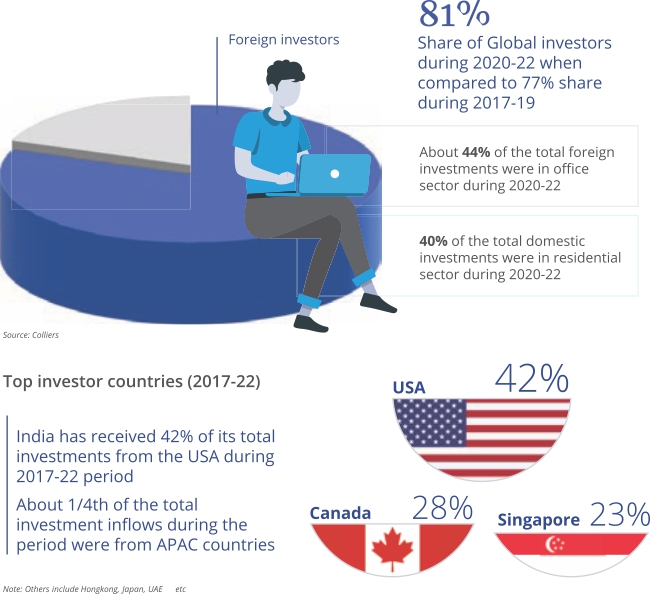

Over the years, global investors have favorably looked at Indian real estate given the resiliency, positive economic outlook, and promising growth prospects of the sector relative to its global peers. According to the report, foreign investments accounted for a sizeable share of 81% of the total investments in real estate during 2017-22. The country’s investor friendly FDI policies, increased transparency in deal structures, and higher investment limits through the direct route have encouraged global investors to invest in India’s real estate sector. Institutional investments in real estate continue to remain upbeat in Q1 2023 as well, rising by 37% YoY at USD1.7 Bn, led by office sector.

“India is on a long-term structural upcycle over the next few years and opportunities galore across spectrum and asset classes in real estate. Over the years, investment in Indian real estate has been getting broader and diversified with newer emerging concepts and themes. India’s attractiveness from manufacturers, occupiers, and investor’s perspective in the Asian Market is on the consistent upswing,” added Piyush Gupta, Managing Director, Capital Markets & Investment Services at Colliers India.

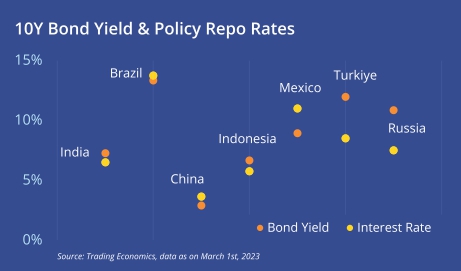

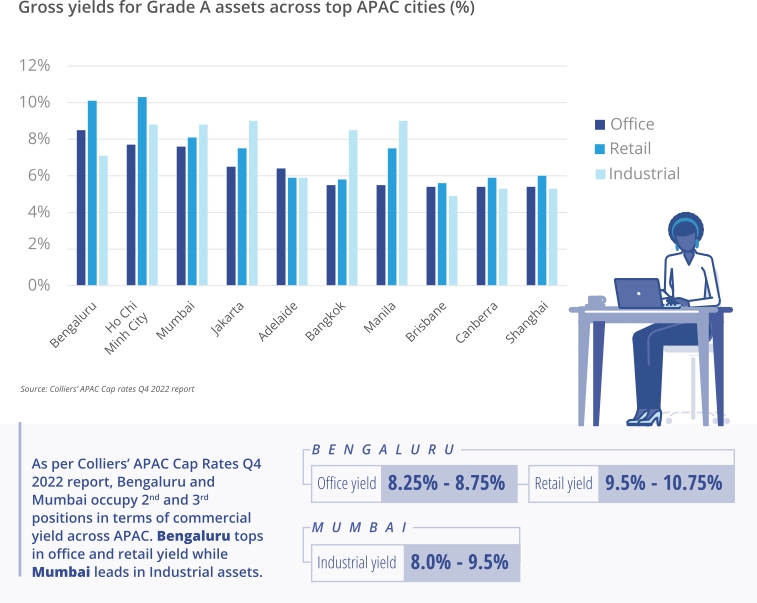

From the perspective of global and APAC investors, the Indian property market currently offers attractive pricing, better valuations, and higher yields. At the APAC level, India has become a preferred investment destination as Indian cities offer higher yields compared to other cities in the region at relatively lower pricing points. Major Indian cities like Bengaluru and Mumbai occupy the 2nd and 3rd positions, respectively, in terms of commercial yield across the APAC region. While Bengaluru leads office yields in the region, Mumbai leads in industrial assets yield. Further, with the Indian central bank pausing the streak of rate hikes, the bond yield is likely to remain range bound. With an expected reversal in the interest cycle over the next few quarters, the yield spread between bonds and real estate is likely to widen, making real estate an attractive proposition for investors.

Core sectors remain resilient while alternatives rise

Investments across various asset classes in real estate sector have seen promising inflows in the last few years. This reflects several opportunities for investors to recalibrate their strategy towards growth sectors. At the same time, investors are recalibrating their portfolio strategy to include new-age growth sectors in order to diersify and fetch higher overall returns. Major investments are already being directed towards alternative assets such as data centers, life sciences etc. While inflows in alternatives are rising, office sector continues to dominate the investment inflows. During 2017-22, office sector accounted for a notable 40% share of the total inflows, reaffirming the resilience and the long-term growth story of the sector. Investors will continue to allocate capital towards greenfield as well as ready to move quality office assets through large platform deals, with greater preference for sustainable assets.

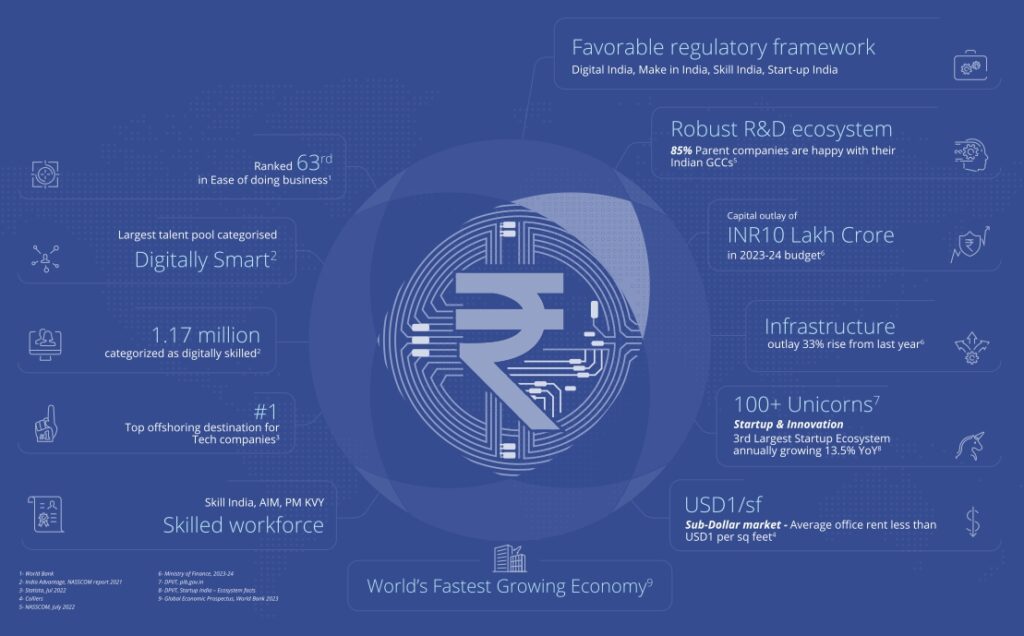

India Advantage

India – A preferred choice for global enterprises

The dynamics of global economic activities are shifting from the West to the East. India plays a pivotal part in the region and has attracted significant investments over the years. Over the decades, India has come a long way from being a back-office center to becoming a global hub for innovation and technology services. India’s thrust on innovation through technology, overcoming hurdles like red tapeism and bureaucracy to ensure better ease of doing business, and building quality infrastructure in its cities have strengthened its positioning compared to other emerging economies. Further, demographic indicators, a deep digital talent pool, favourable government policies and competitive costs have catapulted India as one of the top choices for global enterprises.

India at a bright spot

India to remainthe fastest-growing economy among major economies of the world at 5.4% GDP growth rate during 2023

In last 2-3 years, India has faced several challenges such as the Covid-19 pandemic, pause in economic activities due to the lockdowns, inflationary pressures and geopolitical tensions. However, since 2022, the Indian economy has staged a recovery, with GDP growth at 6.8% in 2022, led by private consumption & capital formation as per World Economic Outlook 2023, IMF.

The International Monetary Fund (IMF) has indicated a prolonged slowdown in the global economy with growth pegged at 2.8% for the year 2023 – the third lowest in three decades in its world economic outlook report 2023. Indian economy is expected to grow at 5.4% during 2023.

India shines among emerging economies

Given the resiliency and the optimistic economic outlook in India relative to its global peers, long term growth story continues to remain intact. Over the last one year, the Reserve Bank of India (RBI) has been increasing the repo rate to tame inflation levels. Since May 2022, the repo rate has increased by a cumulative 250 basis points.

Now with the March inflation within the RBI’s target, and with the central bank maintaining the repo rate in April 2023, the bond yield is likely to remain range-bound. Further, with expected reversal in the interest cycle over the next few quarters, the yield spread between bonds and real estate is likely to widen, making real estate an attractive proposition for investors.

India’s business confidence fell during Covid-19’s first wave but drastically picked up during 2022, indicating improved business confidence. India stands first among the EM7 (Emerging Markets), signalling renewed investors’ interest and confidence in the economy.

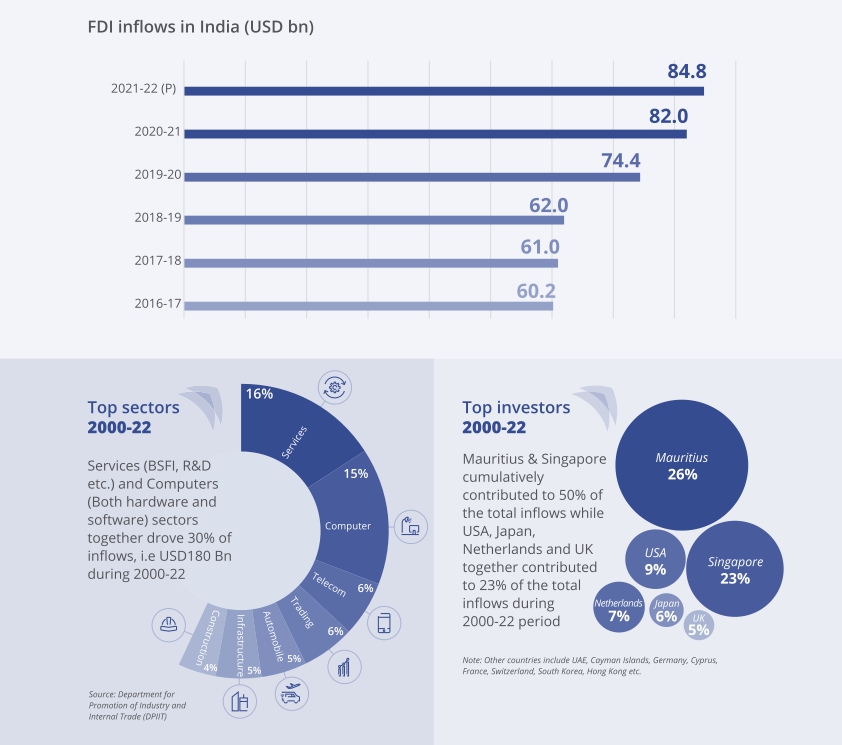

Investment inflows in India above pre-pandemic levels

India receives highest ever annual FDI inflows during FY21-22

India received its highest-ever total FDI inflows of USD84.8 billion during 2021-22. Investor-friendly FDI policies, improved transparency in deal structures and increased investment limits have enthused global investors towards India. Moreover, robust infrastructure growth, stable political climate and a resilient economy have further drawn investors from across the world.

Construction sector witnessing robust growth in India

Promising Returns

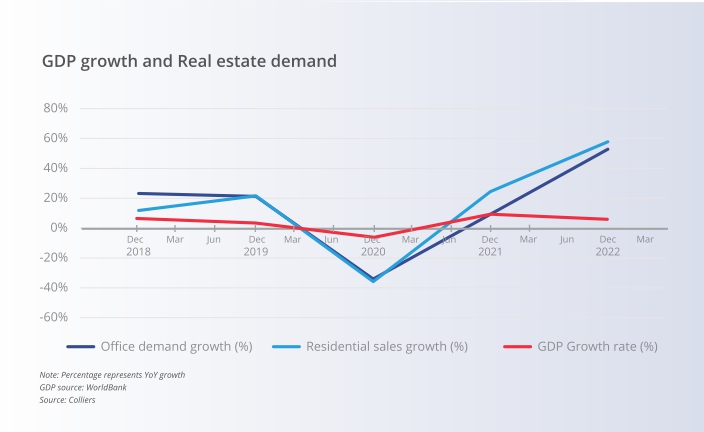

Real estate demand in sync with economic growth

Despite high inflation rates, rising interest rates, uncertain economic conditions and global market slowdown, 2022 witnessed robust growth in core real estate assets. Office demand touched new highs during 2022 while residential sales also remained robust. However, as the impact of economic headwinds continue, we expect overall demand to see some moderation during 2023 in certain sectors such as the commercial office segment, affordable and mid-housing etc. However, the Indian economy continues to be resilient, supporting growth across sectors such as data centers, industrial and warehousing, high-end and luxury housing etc.

GDP growth and Real estate demand

PE inflows into Indian real estate rise above pandemic levels

Global investors continue to deploy money into Indian Real Estate

Investment outlook for 2023

- Large global investors will continue to partner with domestic firms to set up investment platforms; investments in office and industrial assets to remain dominant

- Investors will be inclined towards Grade A high-performing green assets with premium construction standards

- Green financing to gain prominence

- Investments in alternatives to strengthen, led by data centers

- REITs likely to expand to other asset classes such as retail and industrial; First retail REIT likely to enter Indian market in 2023

Opportunities in core assets

What’s in store for the Indian Real Estate in next 2-3 years?

Office

- Global investors will continue to scout for good quality office assets and continue to partner with developers from early stages of asset development.

- Although some select office projects are already funded by top institutional investors, a healthy supply pipeline of 174 mn sq feet across top 6 cities in next 3 years will provide more opportunities in the space.

- Tier-II cities such as Indore, Ahmedabad, Coimbatore, Jaipur, Lucknow, Kochi etc. to see growth in office spaces backed by occupiers’ distributed workplace strategy and growth of startups in these cities

- Occupiers and investors likely to edge towards sustainable office spaces as they firm up their ESG strategies

- Hotelisation of office space and upgradation gaining pace

- Flex spaces to be an integral part of occupiers’ portfolio; office demand to be led by Technology sector

Residential

- Demand for high-end and luxury housing to continue to rise

- Sustained demand due to policy impetus (PMAY allocation)

- Tier II cities to witness growth

- Demand for green and smart homes to rise

- Use of PropTech to boost sales

Industrial

- 3PL, electronics to drive occupier demand

- Logistics network to get strengthened led by Government policies

- Increased global investor interest

- Continued tech enhancement

- Increased demand for in-city warehousing

Alternatives

Global Capability Centers (GCCs)

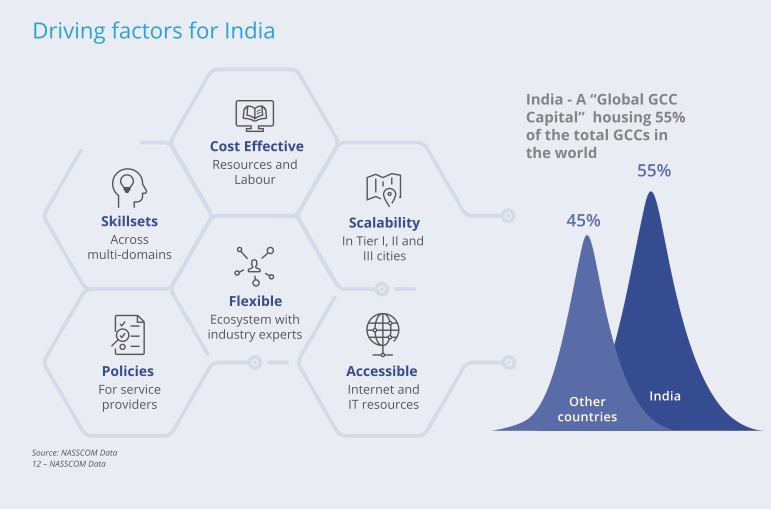

GCCs to grow 1.7 times by 2026 from 2015

India’s offshoring industry has matured over time from primarily being a provider of IT-BPO services in early 2000s to Knowledge Process Outsourcing (KPO) to becoming an established Global Capability Centers (GCC) destination. India currently hosts 1500+ GCCs employing over one million Global Talent. Led by its growing talent pool, service delivery excellence, innovation and cost efficient resources, the country’s GCCs market is expected to grow at CAGR of 6.5% by 2025, providing multiple opportunities for investors in the space. GCCs in India will continue to evolve as global centers for excellence, with greater expertise in advanced technology such as Artificial Intelligence (AI), Machine Learning (ML) and Digital Analytics etc.

Data Centers

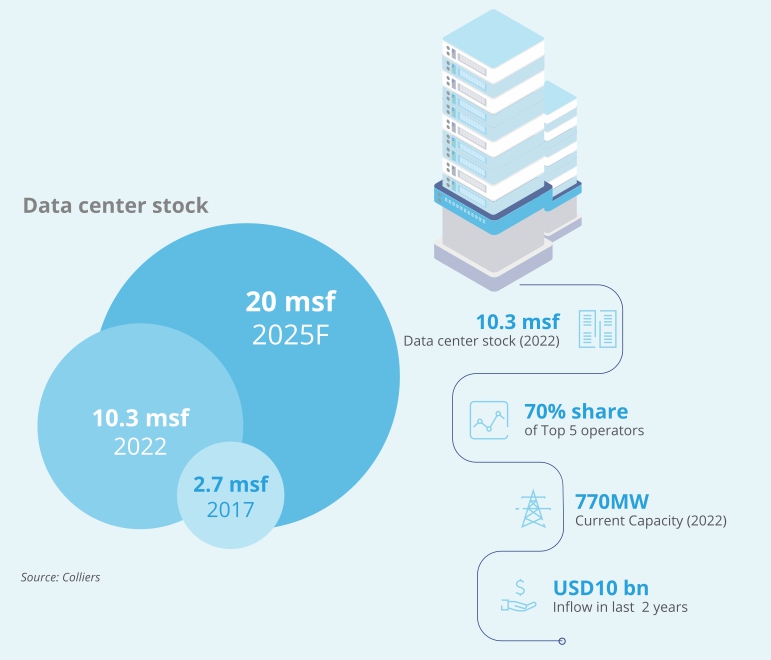

India’s data-center space footprint may reach 20 mn sq feet by 2025

Data center stock in India grew fourfold from 2.7 mn sq feet in 2017 to 10.3 mn sq feet in 2022 backed by a surge in E-commerce, cloud services, and government initiatives. Data center stock is likely to double by 2025 to 20 mn sq feet led by 5G, multi-cloud usage, and data localization. Investors have viewed data centers favourably due to their attractive yields ranging 16%-18%. According to Colliers’ report ‘Data centers: Scaling up in the green age’, Data centers have received cumulative investments of about USD10 bn since 2020.

Data Center Advantage

- Cheapest Data charges

- 60% lower development costs than matured regions

- Availability of Engineering skillset

- Subsidized power supply and fuel prices

- Government incentives

- Focus on advanced Tier IV datacentres

Conclusion

Foreign investments in industrial assets also have been on the rise. Foreign investments constituted 87% of the total investments received in industrial and warehousing during 2017-22 period.