Marketplace payment solutions are critical for organizations looking to expand worldwide since they enable frictionless transactions across borders and currencies. The correct payment system streamlines transactions while simultaneously promoting development via quicker processing, improved security, and worldwide access. Small and medium-sized businesses (SMEs) may benefit from features such as multi-currency accounts, quick payment processing, and robust security measures on platforms like WorldFirst. These solutions enable organizations to grow effectively and handle foreign payments easily.

Features of a Global Marketplace Payment Platform

Seamless Global Transactions

Global marketplace payment solutions enable firms to deal seamlessly across borders. With integrated payment methods, these platforms offer real-time transactions with no delays, giving companies the freedom to operate in numerous countries without having to deal with separate currencies or banking systems. WorldFirst, for example, provides a comprehensive solution for SMEs, assisting them in streamlining their operations and reducing friction during cross-border transactions.

Multi-Currency Accounts and Conversion

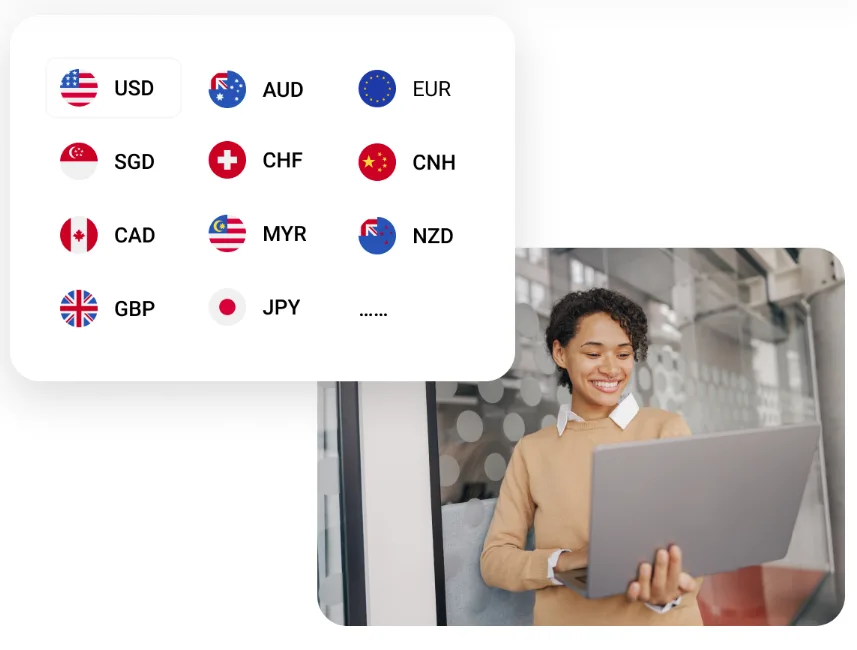

One important characteristic of global payment systems is the ability to handle various currencies in a single account. This allows firms to receive, keep, and convert cash in many currencies without the need for separate accounts in each nation. WorldFirst’s multi-currency accounts enable companies to readily convert money at competitive exchange rates, providing them more control over their finances and the opportunity to respond swiftly when market circumstances change.

Local Support and Global Reach

Effective payment systems provide local assistance while preserving global reach. This dual strategy guarantees that companies may get quick help in their time zone, hence improving customer experience. WorldFirst distinguishes itself by providing specialized help from local professionals in 32 worldwide locations, ensuring companies manage international payments comfortably and effectively no matter where they are.

How Fast Payment Solutions Enhance Business Growth

Instant Account Setup and Payment Processing

Instantaneous payment systems such as WorldFirst make it possible for companies to create accounts in a matter of minutes, which enables them to rapidly reach international markets. By removing the need for long waiting times, instant account creation and payment processing help businesses accomplish their activities more quickly. Because of this immediacy, companies are able to keep their momentum going, which is particularly important in a competitive market where every second counts. This ensures that funds are there when they are required.

Faster Fund Transfers and Currency Conversions

Velocity is crucial in the contemporary, rapid corporate environment. Platforms like WorldFirst provide swift financial transfers and currency conversions, greatly improving cash flow and company flexibility. By providing transfers that occur within hours or even seconds, firms may seize opportune opportunities, ensuring they maintain a competitive edge in global marketplaces without concerns over payment or conversion delays.

Simplified Cross-Border Payments

The procedure of making payments across international borders might be difficult, but current payment technologies make it easier. Through the use of features such as local account data and interaction with domestic payment networks, platforms such as WorldFirst guarantee the speedy and effective processing of foreign payments. As a result of this simplicity, firms are able to keep their operations running smoothly, minimize the number of mistakes they make, and improve their capacity to handle international transactions.

Why Security and Compliance Are Crucial in Payment Systems

Secure Data and Transaction Protection

Dealing with sensitive financial data requires the highest level of care. Protecting sensitive information and financial transactions from fraud and cybercrime is a top priority for payment systems. WorldFirst uses technology driven by Artificial Intelligence (AI) to safeguard data and transactions, demonstrating their strong regard for security. Companies may confidently accept payments since their advanced security measures completely protect their customers’ and investors’ financial information from any potential threats.

Compliance with Global Banking Standards

Trustworthy payment solutions must demonstrate that they are in compliance with the standards that govern international banking. All transactions are completed in line with the most recent compliance regulations since WorldFirst is committed to adhering to stringent global banking standards. In addition to shielding companies from any legal problems, this compliance also helps to improve the reputation of their activities worldwide.

Trusted Partnerships with Leading Financial Institutions

Payment platforms that are reliable build robust connections with respected financial institutions in order to ensure both the integrity of their operations and the safety of their customers. In order to guarantee the safety of money, WorldFirst collaborates with reputable financial institutions like JP Morgan, Barclays, and Citibank to maintain them in separate accounts. Having the knowledge that their transactions are being handled by reputable organizations gives companies the confidence they need to take advantage of these trustworthy connections.

Conclusion

For companies that are interested in expanding their operations to a worldwide scale, successful marketplace payment solutions are important. Businesses are able to function effectively across international boundaries because of features such as the implementation of seamless worldwide transactions, support for several currencies, rapid payment processing, and robust security measures. By choosing a platform like worldfirst, businesses can gain access to a reliable, fast, and secure payment system, which is critical in driving growth and enabling success in international markets.