Price remains muted and demand fails to recover. Our channel checks with dealers suggest that cement price correction continues in September with Rs3-5/bag (1-2%) mom correction across India. Cement demand failed to sustain the marginal growth of July and declined by 0-2% on a pan-India basis in August. With this, 2QFY20E should see 4-5% qoq lower realizations and flat volumes. Lower fuel cost benefits should largely reflect in 3QFY20E; however, with the recent spike in crude prices, the cost relief could be short-lived. Weak fundamentals are catching up, we remain cautious on the sector.

Realizations remain muted—price correction continues in September and spreads pan India

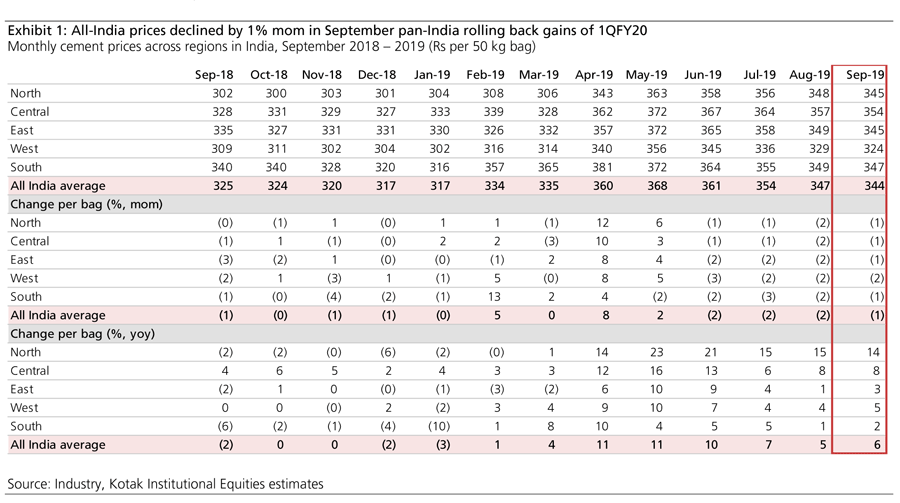

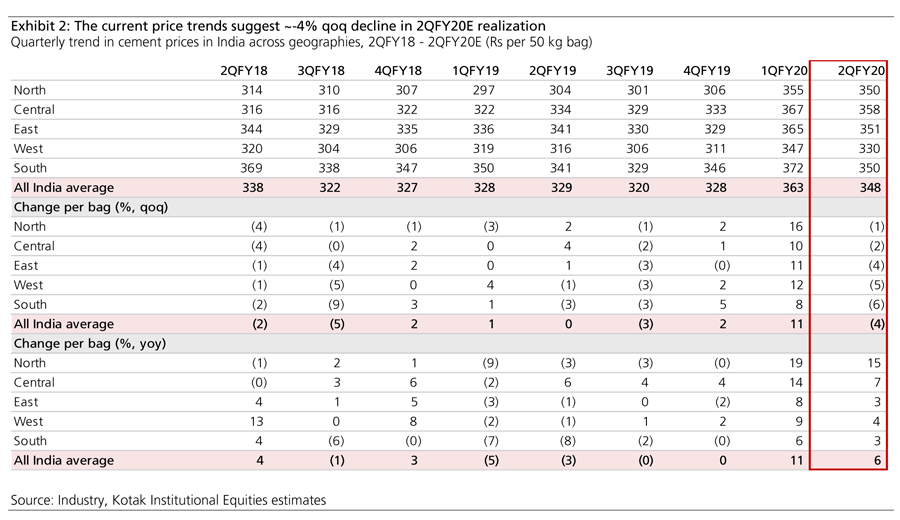

Our channel checks with dealers suggest all-India cement prices have declined by 1-2% mom to Rs344/bag in September 2019 after a 2% mom fall in August. The September price correction, although lesser than previous months, is the fourth consecutive cut after prices peaked in May 2019. We note that the current cement prices are down 6% from May 2019 peak whereas 2QFY20 prices are down -4%qoq on a pan-India basis. Further, we hear that the non-trade segment has seen sharper price cuts than trade due to weak demand during the quarter.

Region-wise price trends. Price cuts in September were across the five regions with price correction in tighter markets such as North and Central now at similar pace to East, West and South. Regional prices fell from Rs3-5/bag across most regions led by West and East. From 2QFY20E perspective, South is most impacted with prices down -6% qoq followed by West (-5% qoq), East (-4% qoq), Central (-2% qoq) and North (-1% qoq).

Demand recovery pushed to 2HFY20E as August fails to sustain July momentum

Our channel checks with cement companies and dealers suggest that demand recovered with growth of 1-2% yoy in July. However, given floods and delays in various projects, August witnessed a 0-2% yoy decline in demand on a pan-India basis. With this, 1HFY20E is poised for 0-1% yoy demand decline and with our expectation of 5-6% yoy demand growth in 2HFY20E, FY2020E should see 3% yoy growth. Given the fiscal challenges of the government and slowdown in the economy, we see more downside risk than upside risk to our 2HFY20E demand recovery expectations.

Coal price correction to reduce cost pressures but it could be short-lived

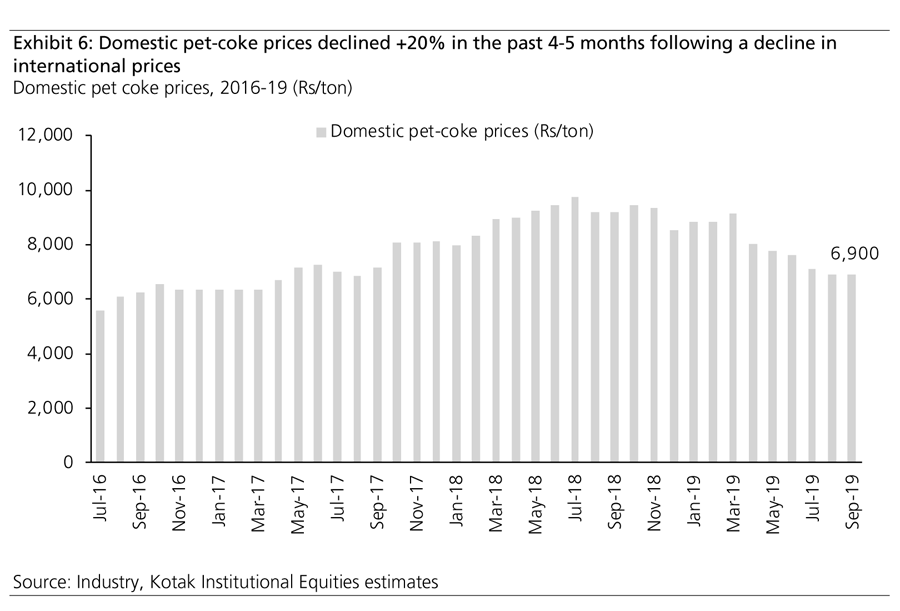

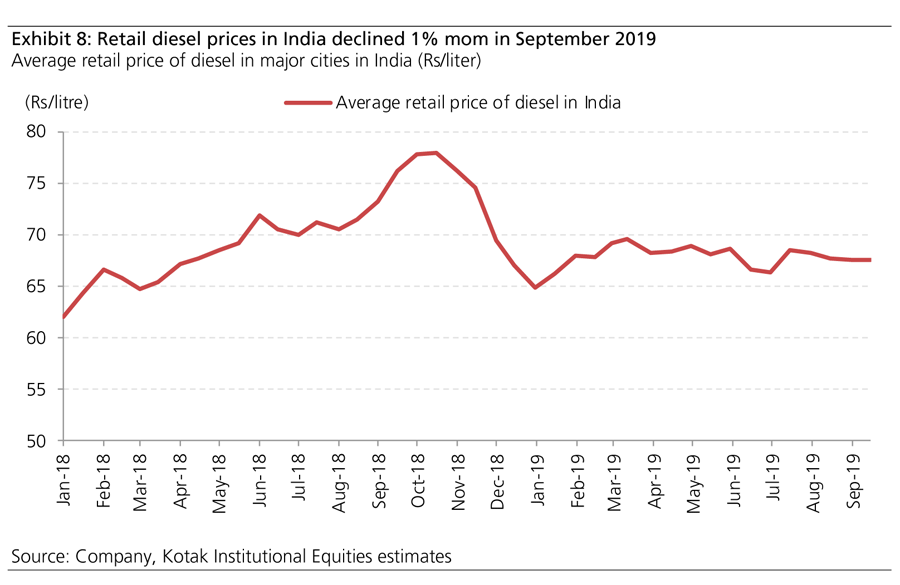

Key commodity prices, driving the variable costs for cement companies (power, fuel and freight costs), remain soft with declining pet coke, thermal coal and flattish diesel prices. Both imported and domestic pet-coke prices has corrected by +20% in the past four to five months and currently at US$80/ton and Rs6,900/ton, respectively. Domestic thermal coal availability has improved with normal inventory at power plants and e-auction premiums have declined. Also, international thermal coal prices are down 20% in the past five months. However, high cost inventory should limit fuel cost reduction gains in 2QFY20E. We estimate Rs70-80/ton cost reduction in fuel costs from 3QFY20E and only a part of it to reflect from 2QFY20E. However, given the spike in crude oil prices due to disruption in Saudi, the cost relief could be shot-lived.

Maintain cautious stance on the sector given weak fundamentals and expensive valuations

With weak demand trend unlikely to see a sharp recovery in the near term, we believe margins for the sector has peaked in 1QFY20. Large capacity additions should keep industry utilizations low (<70%) over the next two years. With weak fundamentals, earnings will remain volatile, driven by pricing discipline and the sector is unlikely to witness sustainable margin improvement. We maintain a cautious stance on the cement sector on expensive valuations with large cap cement names such as UTCEM and SRCM trading at 12-15X EV/EBITDA FY2021E.

Region-wise cement price trend and dealer feedback for September 2019

- North—prices declined marginally by Rs3/bag. Cement prices in the North declined by Rs3/bag to Rs345/bag in September 2019-price declines have moderated post a sharp decline in August. Dealers expect demand to recover in October, which should help sustain current price levels. Prices declined by Rs3-7 per bag in Punjab and Haryana, but were flat in Himachal Pradesh and Jammu & Kashmir and Rajasthan.

- Central-prices declined by Rs3/bag. Cement prices in the Central region declined by Rs3/bag mom to Rs354/bag. Per our channel checks, prices declined by Rs5/bag in Madhya Pradesh whereas prices were flat in Uttar Pradesh. This continues to be the second month of price decline. Dealers suggest flat to marginal decline in sales and expect sales to remain muted for the coming month as well.

- West- prices declined by Rs5/bag. Cement prices declined the most in the West region by Rs5/bag to Rs324/bag. West region prices have now come close to 6-month lows. However, dealer checks suggest a recent hike in prices by Rs10/bag, the sustainability of which is unlikely given the sluggish demand. Heavy monsoons have led to poor demand. Prices declined by close to Rs8/bag in Maharashtra while in Gujarat prices have remained stable. Demand appears stable in cities such as Ahmedabad and Nagpur while demand declined sharply in Pune, Baroda and Surat. The primary reason of low demand was lack of payments to contractors engaged in government projects.

- South-prices declined by Rs2/bag. Cement prices declined by Rs2/bag on an average in the South region to Rs347/bag, thereby erasing almost the entire gains from price increases in 1QFY20. This marks the fourth month of continuous price declines. The region witnessed a sharp increase of Rs20/bag in the beginning of September, but given the lack of demand or rather no demand, most regions have rolled back this price hike. Prices declined by Rs8-13/bag in Andhra Pradesh and Kerala. Prices remain elevated in Karnataka for now but are expected to taper down. Demand continues to be poor as a result of stalled government projects in various regions.

- East-prices declined by Rs5/bag. Cement prices in the East declined by Rs5/bag to Rs344/bag in September 2019. The region continues to face tepid demand due to shortage of labor and water in the regions. Prices declined by Rs5-10/bag in states of Bihar and Odisha while prices remained stable in Assam, West Bengal and Other North Eastern states due to high demand on account of construction activity.

“Each of the analysts named below hereby certifies that, with respect to each subject company and its securities for which the analyst is responsible in this report, (1) all of the views expressed in this report accurately reflect his or her personal views about the subject companies and securities, and (2) no part of his or her compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in this report: Sumangal Nivatia, Murtuza Arsiwalla, Prayatn Mahajan.”

Ratings and other definitions/identifiers

Definitions of ratings

BUY. We expect this stock to deliver more than 15% returns over the next 12 months.

ADD. We expect this stock to deliver 5-15% returns over the next 12 months.

REDUCE. We expect this stock to deliver -5-+5% returns over the next 12 months.

SELL. We expect this stock to deliver <-5% returns over the next 12 months.

Our Fair Value estimates are also on a 12-month horizon basis.

Our Ratings System does not take into account short-term volatility in stock prices related to movements in the market. Hence, a particular Rating may not strictly be in accordance with the Rating System at all times.

Other definitions

Coverage view. The coverage view represents each analyst’s overall fundamental outlook on the Sector. The coverage view will consist of one of the following designations: Attractive, Neutral, Cautious.

Other ratings/identifiers

NR = Not Rated. The investment rating and fair value, if any, have been suspended temporarily. Such suspension is in compliance with applicable regulation(s) and/or Kotak Securities policies in circumstances when Kotak Securities or its affiliates is acting in an advisory capacity in a merger or strategic transaction involving this company and in certain other circumstances.

CS = Coverage Suspended. Kotak Securities has suspended coverage of this company.

NC = Not Covered. Kotak Securities does not cover this company.

RS = Rating Suspended. Kotak Securities Research has suspended the investment rating and fair value, if any, for this stock, because there is not a sufficient fundamental basis for determining an investment rating or fair value. The previous investment rating and fair value, if any, are no longer in effect for this stock and should not be relied upon.

NA = Not Available or Not Applicable. The information is not available for display or is not applicable.

NM = Not Meaningful. The information is not meaningful and is therefore excluded.

Article Contributed by Kotak Institutional Equities (Kotak Securities Limited)