A recent study conducted by Colliers India reflects that the student housing sector is emerging to be a sought-after asset class, given the rising demand for quality student accommodation. Up until recently, the sector was unorganized and unregulated even though thousands of students migrate to the metro cities each year to pursue higher education. The poor conditions of campus hostels and PG homes along with scaling rentals gave birth to the need for quality student housing across the country, especially in education hubs that have a high footfall of students each year.

1. How rentals have shaped up year on year in key education hubs like Pune, Bangalore, Mumbai, Delhi etc?

The student relocation within the country currently stands at ~11 million and is expected to touch 31 million by 2036. Further, there are only 7.5 million student beds at on-campus accommodations pan-India, not enough to serve the current demand and far from being able to meet the projected future demand. There is immense potential for growth given this high demand-supply gap in the sector.

“There will be immense requirements for shared student accommodation in the coming years due to new education policies by the Government, innovative technologies, and the in-migration of students to pursue higher education. A shared space with excellent amenities, same age-group community, convenience in commute, and assistance in day-to-day activities – are the requirements of our young generation. Pre-pandemic, many start-ups ventured into the purpose-built student accommodation sector, and very few have survived to become seasoned players with large portfolios across the country,” says Swapnil Anil, Executive Director & Head, Advisory Services at Colliers India.

At present, there are a few players in the sector who have a growing presence in the country. Stanza Living currently has 70,000 beds across Dehradun, Vadodara, Indore, Coimbatore, Jaipur, Kota, Ahmedabad, Manipal, Kochi, Vadodara, Vidyanagar, and Nagpur. Housr Co-Living has a presence in Gurgaon, Hyderabad, Pune, Bangalore and Vishakhapatnam, with plans to expand in Delhi and Kota by the end of the financial year. Another leading operator, Your Space, has 5,500 beds across Delhi, Mumbai and Pune and aims at having a total of 20,000 beds by 2024 in prominent education hubs like Jaipur, Bengaluru, Hyderabad, Chennai, Kota, and Kolkata. Finally, Olive Living, managed by Embassy Group, has a stock of 2,500 beds and looks at adding another 20,000 over the next few years.

2. Growth of student housing brands in India?

Student housing is a Nascent and fragmented industry in the early stages of institutionalization, and huge unmet demand creates immense potential for purpose-built student accommodation (PBSA) service providers.

The market has seen immense growth in recent years, which results in higher demand for safe and quality accommodation. Currently, many private investors and developers are planning an expansion into student housing facilities in India.

A few of the prominent Student housing operators are mentioned below:

• Stanza Living currently has 70,000 beds pan India and is targeting to expand to 30,000 beds by 2023 year-end. In cities like Dehradun, Vadodara, Indore, Coimbatore, Jaipur, Kota, Ahmedabad, Manipal, Kochi, Vadodara, Vidyanagar, and Nagpur.

• Hosur Coliving, established in 2018, currently has a presence in Bengaluru, Delhi NCR, Pune, and Hyderabad cities with a total stock of 3,250 beds, and it has planned to add 7000 beds by 2023-24 in cities such as Delhi, Kota, Bengaluru, and Hyderabad.

• Your Space is one of the leading student housing operators. It has a presence in Delhi, Mumbai, and Pune with a total of 5,500 beds, and it has plans to reach a total of 20,000 beds by 2023–24. in cities like Jaipur, Bengaluru, Hyderabad, Chennai, Kota, and Kolkata.

• Olive Living student housing and coliving is managed by Embassy Group which is one of the leading developers in real estate industry, Currently they have a presence in Bengaluru and Chennai with a total stock of 2,500 beds and it is planned to expand by 20,000 beds in the next few years in cities like Delhi, Hyderabad, Pune, and Mumbai.

3. Student housing Growth Drivers in India?

1. Student Relocation

The Student housing market demand is majorly from the student migrating from other cities for education purposes. The student relocation for higher education is expected to grow at a CAGR of 7.5% p.a. from 11.3 Mn (2021-22*E) to 31.1 Mn in 2035-36 P. This will result in a rise in total student enrolment rise from 42.3 MN in 2021-22* to 92.0 Mn by 2035-36. Hence, there will be a greater demand in the market of student housing.

2. Increasing Gross Enrolment Ratio (GER)

As per the NEP 2020 targets, student enrolment in higher education is expected to reach 92.0 Mn with 50.0% GER by 2035-36 P.

• Various initiatives have been announced by the NEP to achieve the targeted enrolment such as Focus on developing new HEIs in Tier II/Tier III cities and providing quality infrastructure, Unique initiatives in the higher education market to encourage more participation: Introducing multi-disciplinary curriculum, integrating vocational training, multiple entry and exits during a course, flexible course duration with 3 years and 4 years option.

3. Lack of Structured PBSA Offering

• The current student housing stock comprises of a residential building with rental units, paying guest (PG) and aggregator operators • Negligible focus on ESG aspects, unhygienic conditions

• Lack of services from management staff and poorly maintained properties.

4. Limited Number of On Campus Beds & Insufficient Inventory in Student Housing

There are limited Student hostel beds available as compared to total student enrolment in higher education, currently, there are only 7.5 Mn hotels beds available whereas the total student relocation is 11.3 Mn as of 2021-22*E, Therefore, There is a demand-supply gap of 3.5 Mn beds in the market, translating to a demand of 2 students per bed.

5. Attractive Opportunities for Investors

• Stable and resilient cash flow

• Immense untapped potential since 90% of the market is unorganized

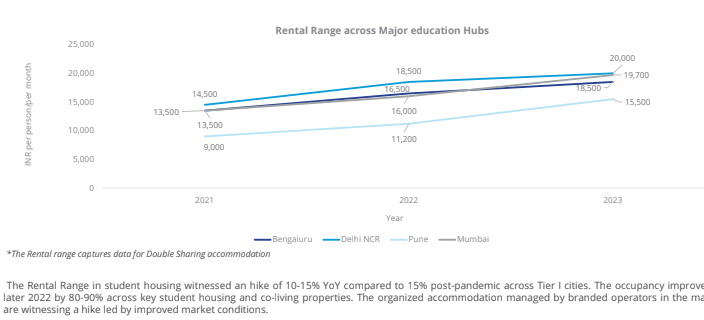

Post pandemic, student housing rentals have been steadily rising by 10-15% YoY, reaffirming the scaling demand for quality student homes. With student enrollment in higher education projected to cross 92 million by 2036, there is untapped opportunities for investors and developers and tremendous scope for the sector’s growth. It is likely that the market will see the emergence of new players and perhaps even global investors in the Purpose Built Student Accommodation (PBSA) market.

About Colliers

Colliers (NASDAQ, TSX: CIGI) is a leading diversified professional services and investment management company. With operations in 66 countries, our 18,000 enterprising professionals work collaboratively to provide expert real estate and investment advice to clients. For more than 28 years, our experienced leadership with significant inside ownership has delivered compound annual investment returns of approximately 20% for shareholders. With annual revenues of $4.5 billion and $98 billion of assets under management, Colliers maximizes the potential of property and real assets to accelerate the success of our clients, our investors and our people.