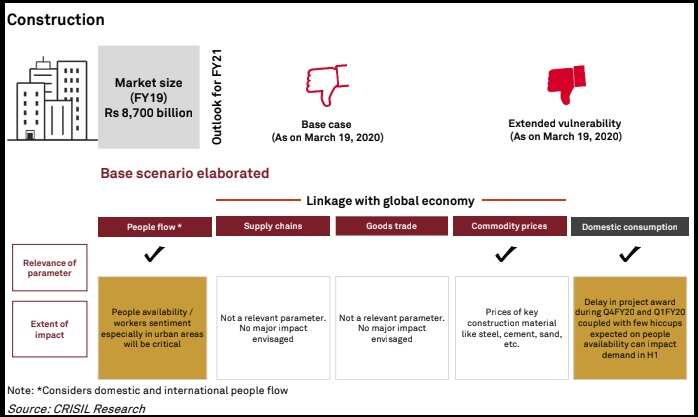

The construction sector has seen credit pressure this fiscal because of slowdown in public spending and stretched working capital cycles, according to CRISIL.

With state resources focused on fighting Covid-19 and issues of labour availability, order execution and/or receivable collections are likely to be impacted, adding to working capital pressure, the company said in a recent report.

Weak business sentiment and some issues on labour availability can derail execution of real estate projects, especially on the urban side during Q1 fiscal 2021.

Extended impact would hit construction primarily led by non-availability of people and lockdown. Sales in real estate – specifically, the mid and high category – could be impacted as consumer sentiment remains weak. Commercial real estate demand could also decline, the report said.

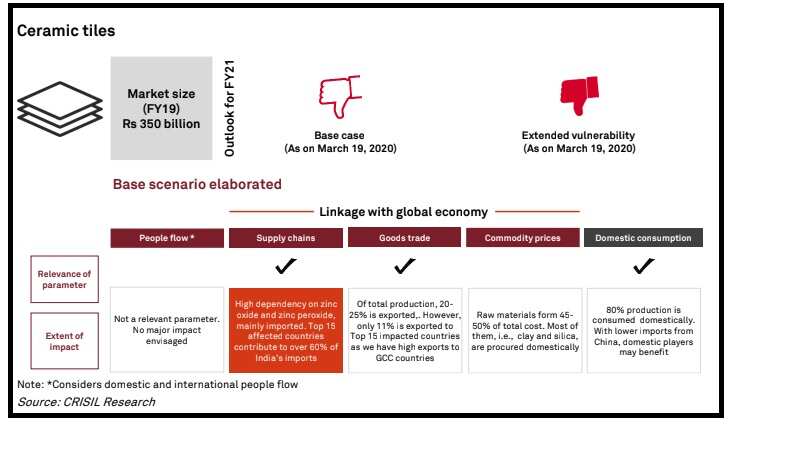

Ceramic tiles industry may see decline in export sales

India is a net exporter of ceramic tiles. The top three exporters in the world (Italy, Spain, and China form more than 70% of world exports) are Covid-19-affected. The ceramic tiles industry, having high contribution from MSMEs (mainly from Morbi), depends mainly on domestic construction (75-80% of total demand) followed by exports (mainly to the Gulf Cooperation Council countries).

CRISIL expects slowing construction activities to affect domestic demand since 80% of production is domestic, including new construction and replacement demand. Non-availability of labour on construction sites, too, may impact deliveries of ceramic products. Further, both commercial and retail real estate demand will be hit, impacting tiles’ sales considerably.

With weak global demand, export sales may see a decline. Domestic demand will also remain weak in first quarter of the year. However, given supply-chain disruptions from China, pricing may improve. Some raw material procurement is dependent on global supply chains and this will be a monitorable.

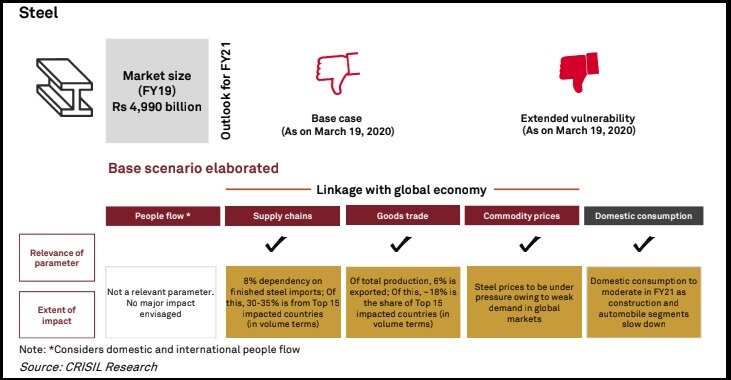

Steel prices may come under pressure

Domestic demand may become sluggish given the impact of lower construction (60-65% of domestic steel demand) and weak automotive and capital goods production, said CRISIL.

Benefit from exports may also be limited as global demand weakens from the first quarter of fiscal 2021. Global steel prices are expected to come under pressure in the wake of muted demand prospects, especially from China, in H1 2020, noted the report.

Stoppage of construction activities in case of lockdown and poor export prospects will hit steel players hard. Further global prices can willow down in case of global slowdown, though anti-dumping duties will continue to protect domestic manufacturers.