Sales of construction equipment seem to have bottomed out after a 25% drop in the first half of the fiscal, thanks to a revival in government projects, especially in the southern states.

The industry reported marginally improved sales over preceding months in September, October and November although none of these months recorded growth year-on-year, two industry insiders told.

Construction equipment include machines used for earth moving, road building, handling concrete, material handling, and material processing, among other special equipment.

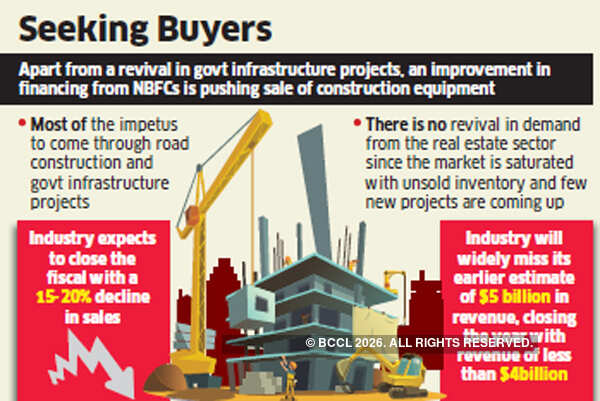

Apart from a revival in government infrastructure projects, an improvement in financing from non-banking financial companies (NBFCs) is pushing sales, said Ravi Chawla, managing director at Gulf Oil Lubricants. NBFCs had tightened their lending in the aftermath of the IL&FS crisis last year, drying up funds for potential buyers, thus sending the manufacturing and housing sectors into a tizzy.

“Most of the impetus will come through road construction and government infrastructure projects,” said Chawla who is also a spokesperson for construction equipment expo Excon. Several of these are coming up in Karnataka, he told .

However, there is no revival in demand from the real estate sector since the market is saturated with unsold inventory and few new projects are coming up, he said.

Another industry executive said demand has especially increased in states bound for elections in the coming two years. “Some of the states which are heading towards election are putting a lot of money into developmental projects,” said the person who requested not to be identified. “In some of the product categories, Tamil Nadu has done even better than last year.”

The industry expects to close the fiscal year with a 15-20% decline in sales, as per data from Excon, which is organised by Indian Construction Equipment Manufacturers’ Association and Confederation of Indian Industry.

The industry will widely miss its earlier estimate of $5 billion in revenue, closing the year with revenue of less than $4 billion. This, after four consecutive years of growth and gross sales of 97,835 units in FY19. “Major demand drivers going ahead will be roads sector, irrigation, railways, ports, mining,” a note from Excon said.