The year 2022 was not just about pent up demand from the preceding two years, but it was also a year of recovery and growth. The growth in traditional and flex spaces has been robust in 2022 as occupiers were more optimistic about leasing space and expanding their footprint. In this report, Colliers takes a look at how offices have changed over the last five years the key factors that are likely to influence the office sector, at a time when the definition of “office” has taken a new meaning since the pandemic.

The latest report by Colliers, in collaboration with FICCI, highlights how, hybrid working is likely to optimize space utilization and will continue to influence physical work infrastructure and how we work. Further, flex spaces will continue to be a major focal point for landlords and occupiers.

“The growth in traditional and flex spaces has been robust in 2022 as occupiers were more upbeat about leasing space and expanding their footprint. In 2023, despite the office market being riddled with uncertainty, the office sector is poised for growth, provided the economic environment remains bright. We do not expect the leasing numbers to fall below the peak pandemic levels of leasing even in a pessimistic scenario. The key fundamentals of office market will follow the trajectory of demand and supply to maintain a balance in the market,” said Peush Jain, Managing Director | Office Services at Colliers India.

“Growth in traditional and flex spaces regained momentum in 2022 as occupiers became more optimistic about expanding their footprint. In the post-pandemic workspace domain, the genre of office space underwent a sea change as occupiers began focussing on de-densification of spaces, and additionally, began prioritizing employees’ experience, wellness and productivity, whilst also, given ongoing recessionary concerns, seeking ways and means to institute cost control measures.”, Raj Menda, Joint Chairman, FICCI Real Estate Committee and Corporate Chairman, RMZ Corp.

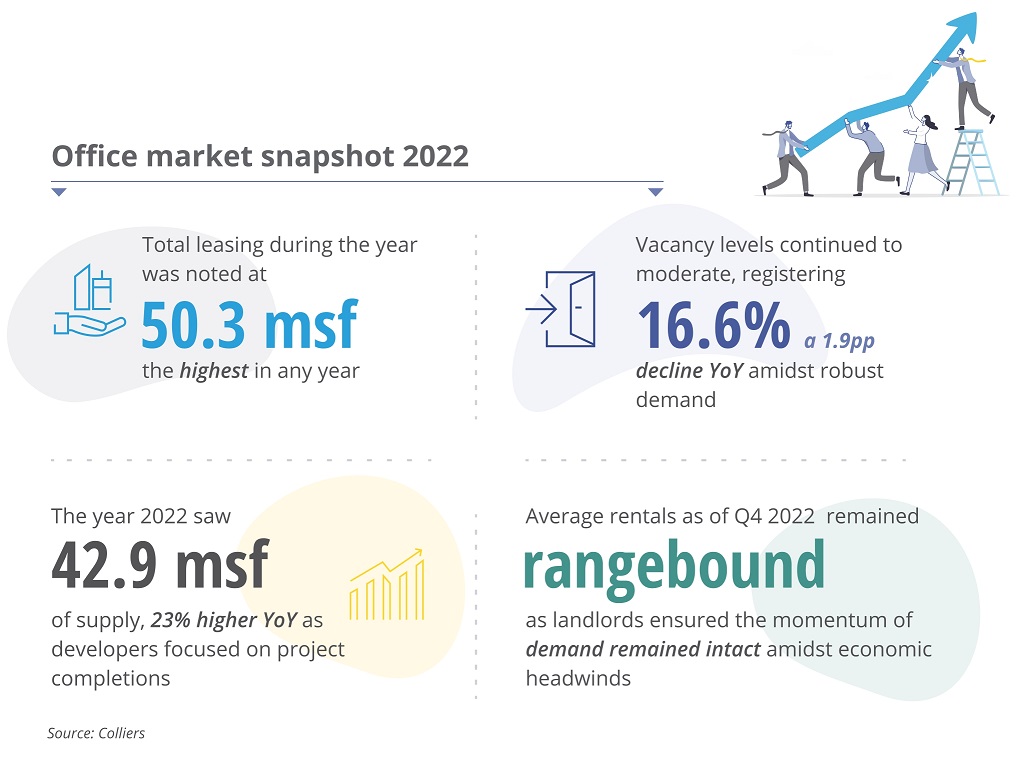

Office market snapshot 2022

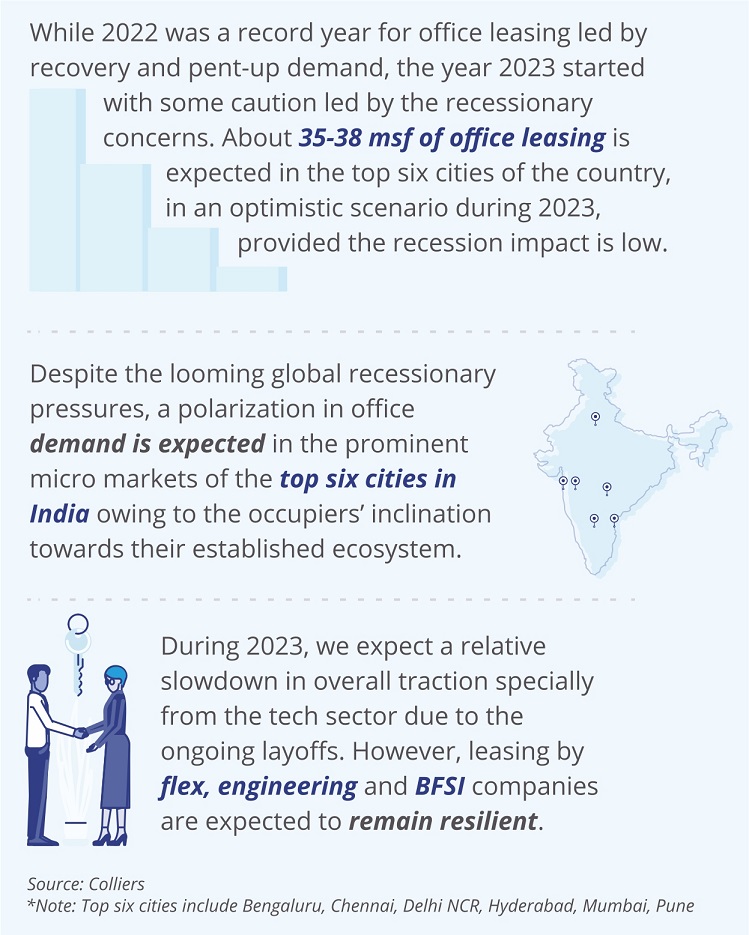

Does the office market look resilient for 2023 or will it experience a slowdown?

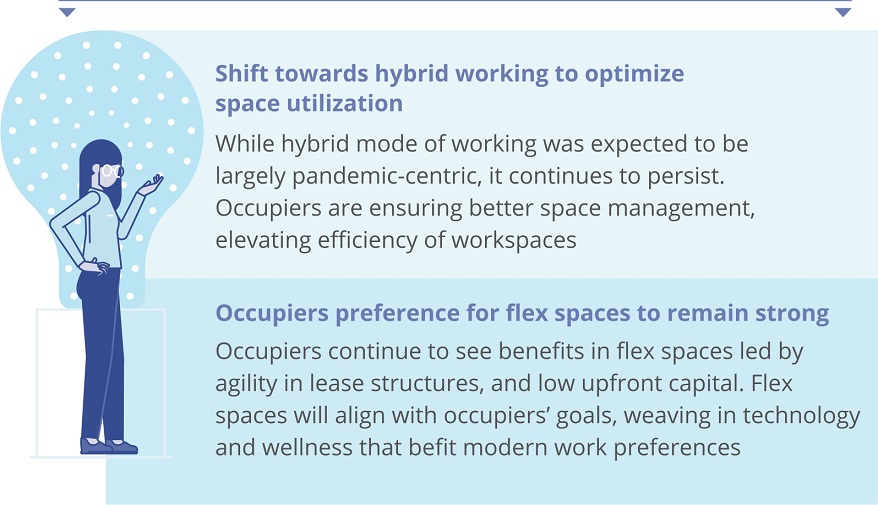

Key trends for office market for 2023

Focal points for the “now and beyond” of the office spaces

The shift in the world of work

The notion for work spaces has evolved significantly over decades. However, the Covid-19 pandemic proved to be the biggest nudge, which has led to a change in the landscape of workplaces. From stringent rules about offices to workplaces being a place of only work to workplaces being seen as a place for ‘collaboration and ideation’, the definition of ‘work’ is seeing a structural shift. Occupiers are transitioning towards hybrid work to give employees the flexibility of working as per their choice on some days. Going ahead, the hybrid model of working is likely to evolve to become more outcome-based. Occupiers will focus towards toning down the disparity between the virtual form of teamworking and physical working in a hybrid working model.

Hybrid working: Optimizing office space utilization

Over the years, occupiers’ are focusing on building employees’ experience, wellness and productivity. At the same time, with the ongoing recessionary concerns, occupiers are looking at measures to aid cost control. On the workspace front, post pandemic, the nature of office space take up is undergoing a change as occupiers are focusing on de-densification of spaces. Led by various employee-centric and operational benefits, occupiers are embracing hybrid working model, which is now here to stay. As per an occupier survey conducted by Colliers on Hybrid working in September 2022, 63% of the occupiers are embracing hybrid working model. The increased adoption of hybrid working model is parallelly having an impact on office market dynamics.

Some of the broader themes emerging for hybrid working model for the office market are mentioned below.

Hybrid work pivoting the office market dynamics

“Hybrid working has been a game-changer in the future of work. To accommodate employees’ changing needs, occupiers are likely to switch gears towards adoption of hybrid model. This would benefit companies through optimal space utilization. Occupiers are also likely to split their large offices into satellite offices, to bring offices closer to employees’ home. As a byproduct, the demand for flex spaces is likely to see an uptick. In the next few years, hybrid working is likely to pivot key office fundamentals, and will be especially critical for the growth of flex spaces,” said Vimal Nadar, Senior Director and Head of Research, Colliers India.

Hybrid working model holds significant potential and is yet to become more prominent in the office environment in the near future. The demand is already seeing a shift and the market is set on the new growth trajectory. While the market is resetting, the complete impact of hybrid working on office market dynamics will be seen over the course of next few years.

Making hybrid work more efficacious

Though the hybrid work model is now being embraced across organizations, it still lacks synchronization between work output, work environment and employee. In the future of work, hybrid working model will mature in a way that occupiers will relook their hybrid plans and effectively organize them to optimise productivity. The evolved matrix of hybrid work below, highlights the focal points that occupiers can look at for improving efficiency in operations and hence increase employee productivity.

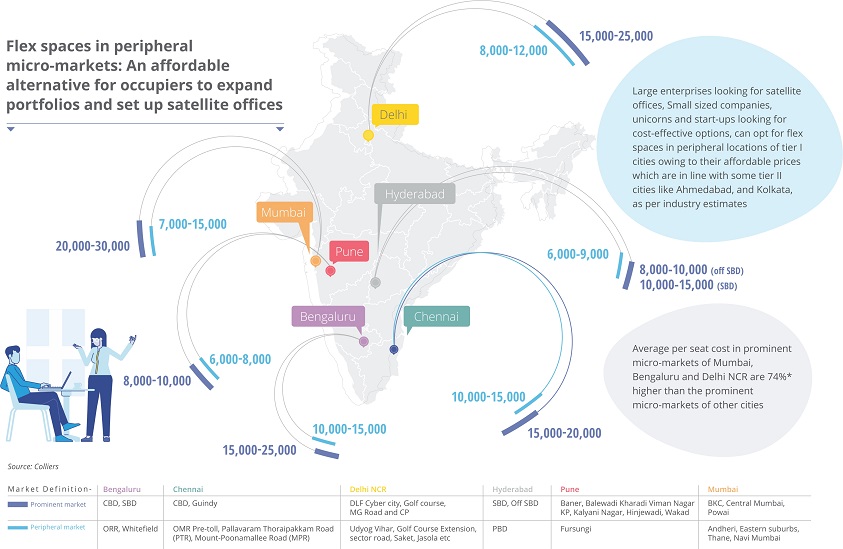

Flex spaces remain buoyant

As offices become more resilient to the unprecedented changes be it pandemic or recession, occupiers are opting for flex spaces to optimize their needs. They are seeking ways to seamlessly weave hybrid mode of working through flex spaces – which are a one-stop solution for occupiers.

Flex spaces improve collaboration and improve employees’ efficacy through tailor-made solutions for the occupiers

Tech players eyeing space uptake in flex spaces

Tech sector has always remained the top occupier in office spaces. However, the year 2022 saw a dip of 6 pp in leasing share by tech companies in contrast to 2021. A subdued scenario is likely to continue in the sector, amidst the looming global recession and layoffs.

However, tech companies are likely to take up space amidst the ongoing flux in the sector. While the momentum of demand can be relatively slower in the first half of the year, a rebound is likely in the second half of 2023.

At the same time, top players are now seeing a surge in demand from BFSI and healthcare firms too.

How flex space operators are adding newer services to attract tenants

Flex players can look at some of the offerings mentioned below to upgrade their centres and offer world-class facilities. Since occupiers are now focusing on improving employee experience, this could lead to tenant retention and elevated occupancy levels.

| Parameters | Features |

| Tech specific to improve operational efficiency | RFID*, enhanced security for internet, UPS(Uninterrupted power supply) backup |

| Design related | Office suite**, theme based offices, creative fit-outs |

| To improve health and wellness | Updated standards for air quality, wellness rooms, gym/yoga memberships |

| To improve collaboration | Workshops, functional kitchen, game zone |

| Sustainability features | Opting for green certified buildings |

Source: Colliers

Note: *Radio-Frequency Identification

**office suits are fully furnished office spaces conference rooms and private amenities as shared add-on amenities

Strategies adopted by Global players to attract tenants

Outlook for office market 2023: Stakeholders to remain watchful

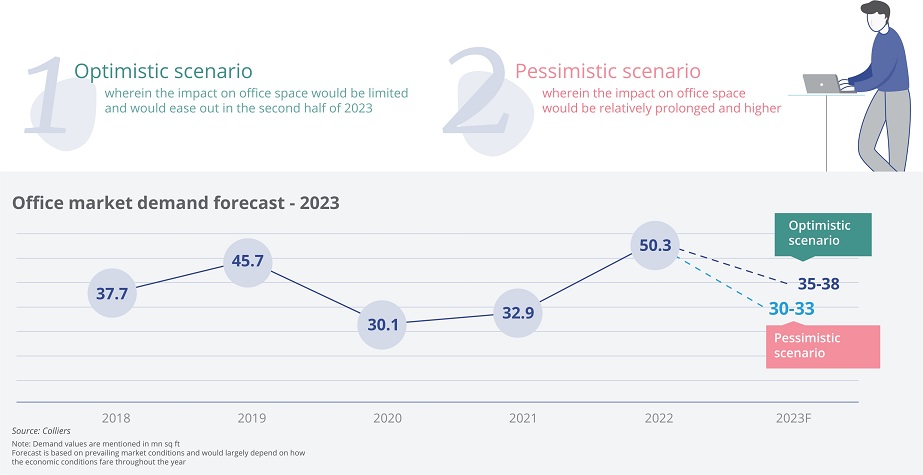

The growth of the office market will largely be led by the CRE (Commercial Real Estate) appetite of occupiers, hinging upon the dynamic global economic situation. Amidst the prevailing recessionary concerns and uncertainty, we have analysed the office market demand based on two scenarios – optimistic scenario & pessimistic scenario.

In an optimistic scenario, we expect the economic headwinds to ease out, not causing a significant dent to overall occupiers’ confidence. In such a situation, Colliers expects total office leasing of about 35-38 mn sq ft in the top six cities, wherein the impact of externalities would be low. As American and European companies look at cost control, they may explore expanding or relocating their technology operations in India. Further, occupiers are likely to remain optimistic to take up office spaces especially flex spaces led by their flexible lease terms and to provide the right working environment to their employees.

In a pessimistic scenario, we expect the impact of economic headwinds would be prolonged, leading to slackening in leasing activity and postponement of leasing decisions by occupiers, as they hold on expansionary strategies. In such a case, we expect office leasing to hover around 30-33 mn sq ft. We however expect leasing activity to pick up from mid-year, led by Global capability centers, BFSI companies and start-ups with sound business models.

While there is significant new supply in pipeline across the top markets, the actual influx of office supply is likely to closely follow the demand trajectory and hinge on the market conditions and pre-commitments to neutralise the market fundamentals. Further, limited demand might slightly push up vacancy levels. The rentals are expected to remain rangebound to keep the momentum of demand intact, in a volatile situation. Overall, since the office market has shown quick recovery post Covid-19, on similar lines the market might bounce back with relative ease despite the global headwinds.