With the Baiyappanahalli-Whitefield metro project likely to be fully operational by mid-year, rentals of office spaces in Whitefield are likely to go up by about 8-10% over the next two years, as per Colliers’ latest report “Bengaluru Metro Rail: Key office market impact”. The growth in rentals will also hinge upon the overall occupier demand, macro-economic factors etc. The metro line towards Whitefield, which became partially operational in March 2023, has been one of the most anticipated lines in the city as it will connect the technology hub of Whitefield to the rest of the city.

Whitefield, the second largest office market in Bengaluru, has office stock of about 40.4 million sq feet, with vacancy levels hovering around 17.2% as of Q4 2022. However, metro project is likely to boost occupier activity in the region, with enhanced accessibility and reduced commute time.

Background

Bengaluru has transitioned from a cantonment to a public-sector led town, and now into a bustling metropolis over the last decade. The employment opportunities in the city has lent itself to a massive real estate growth. Over the years, Bengaluru has attracted large scale investments in real estate sector that has spurred growth of real estate and service-related industries. This has led to a rapid increase in population from 4.1 million in 1991 to 13.2 million in 20221, making it the third most populous city in the country.

Urban Infrastructure: Catalyst for office market growth in Bengaluru

With higher number of job opportunities, the development of office spaces in peripheral areas of the city has been inevitable. This has spurred real estate activity in the city, creating numerous opportunities for developers. Moreover, incentives such as increased FAR, TDR compensation, etc. have provided fillip to the sector. Incentives for redevelopment of old properties has further spurred real estate activity in old city areas leading to significant redevelopments. This has also led to an increase in land prices, along with appreciation in rentals and capital values.

Factors influencing workplace decisions in Bengaluru

Metro to aid growth of office markets of Bengaluru

The advent of large IT majors, prime educational institutes have supported the growth of large technology MNCs and startups in the city. As per Comprehensive Traffic & Transportation Plan (CTTP), Bengaluru is endowed with a radial pattern of road network converging in the core area of the city. The road network is organically developed and has been constructed in fragments leading to several bottlenecks and congestion issues. Several metro projects are being planned in the city to solve these bottleneck issues, providing seamless mobility across the city, reduce work-home travel time and improve livability and quality of life of the residents. The Metro rail transit system in the city has spurred commercial and residential development along the corridor, while improving connectivity to employment hubs and residential catchments.

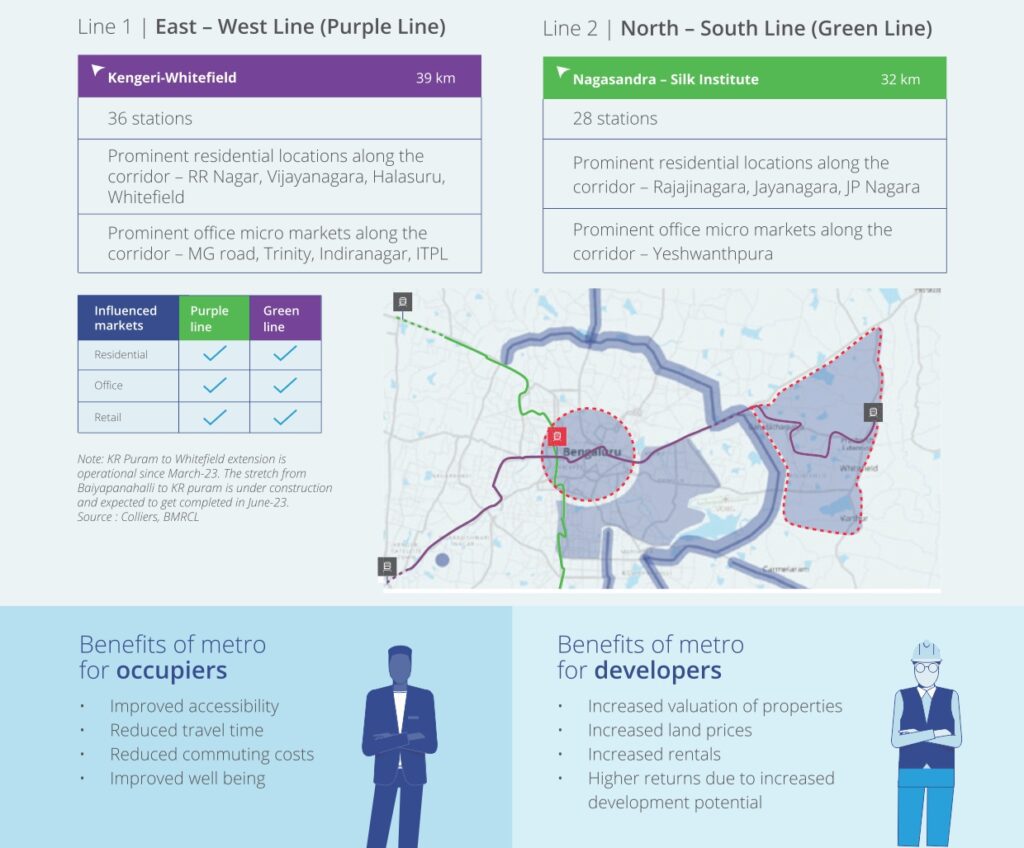

Overview of operational metro corridors in Bengaluru

CBD & Whitefield : Key office markets influenced by metro

The CBD micro-market which consists of locations in vicinity of MG Road, has seen the metro becoming fully operational since 2017. The Purple line metro, as seen above, connects the CBD with key residential hubs in Bengaluru. As a micro-market, the CBD continues to be a hub of economic activity, with the demand for land parcels having soared ever since the announcement of the metro project. Colliers evaluates the impact of metro on demand for office spaces over the years in the CBD, and how it is a precursor to the Whitefield metro.

Whitefield is an eastern peripheral office district that is witnessing tremendous growth in infrastructure. The ongoing metro project, which is an extension of the Purple line, became partially operational in March 2023. The complete extension will enhance Whitefield’s connectivity with central and western parts of the city, aiding further growth of the suburb. This complete extension of this phase is the most awaited corridor, as this micro-market holds about 22% of Grade A office stock of the city. In this report, Colliers assesses how the metro will impact office space dynamics in this location.

CBD: Established commercial market

CBD: Office market at a glance

The CBD has seen a spurt in growth since 2005 when the government approved the metro rail project. For instance, from 2005 through 2022, the grade A office stock in CBD increased more than two-fold to 7.0 msf. The development of the metro network led to increased preference of occupiers to be centrally located with good connectivity in quality Grade A spaces.

Grade A supply in CBD increased more than 4X post the Metro project implementation

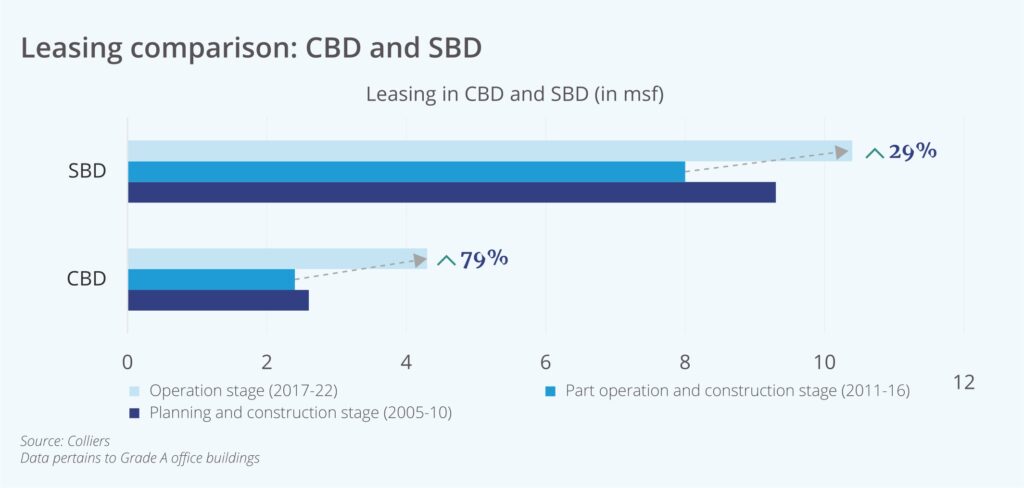

Leasing in CBD up by 79% during operation stage when compared to construction stage

While CBD continues to remain attractive over the years, lack of quality Grade A space has restricted leasing volumes. On the supply side, the Grade A supply increased during 2017-22 compared to the preceding six-year period, led by an increase in permissible regulations. Similarly, led by the presence of quality projects, office leasing rose during 2017-2022, as soon as metro started its operations.

Over the last 12 years from the time of project construction, about 64% of total leasing in CBD happened during the Metro operation stage (2017-22)

The SBD witnessed a spurt in quality Grade A supply which led to the shift of occupier focus with large floor space at competitive rentals. Over the years, the SBD has seen high volume of leasing activity, making it the third largest occupier micro-market in the city. However, when looked at the timelines, the CBD has witnessed a 79% spurt in growth with the operation of the metro project, while SBD witnessed a nominal increase of 29%.

Office rentals and capital values doubled with reduced travel time and enhanced connectivity

Bengaluru witnessed an increase in Grade A office rentals across all micro markets over the last decade. However, in CBD it has been observed that the rentals have risen significantly after the metro started its operation. The CBD has seen rentals rise by about 25% during 2017 when the Phase 1 of the Metro become operational.

The capital values and rentals for grade A office properties have gone up considerably post-metro operations in CBD. The capital values have witnessed an annual increase of 5-15% during the construction time and increased 7% YoY during 2017 with the operation of metro project.

New developments and enhanced connectivity fuel flex spaces

In the last 6 years, flex players has been the fastest-growing segment in the CBD. During 2017-2022, the CBD accounted for 38% of the leasing by flex operators in Bengaluru. Start-ups and technology companies took up space in flex centres in the CBD, as they sought office spaces with robust connectivity. Easy plug-in, flexible tenures and lock-in periods have proved to be a catalyst to support the expansion of flex operators with the added advantage of metro connectivity for office commuters.

CBD riding high on abundant possibilities with enhanced connectivity

Immense upgradation scope in the CBD

The metro connectivity has infused new life into Bengaluru’s CBD. The micro-market is likely to see almost 40% of its current office stock becoming operational in the next 2-3 years. Additionally, the CBD holds an upgradation potential of about 3.2 msf of outdated Grade A stock (buildings age >15 years). The utilisation of updated permissible regulations in the outdated properties along the corridor, can have a far-reaching impact in transforming the landscape of the CBD.

Further, with vacancy hovering as low as 3% as of Q4 2022, apart from quality incoming supply, we can expect the rentals in the micro market to see an upward movement. Colliers expects rentals in this micro market to surge at 5-8% by 2024. However, this will hinge upon the market conditions and larger parameters of occupier demand and economic growth.

Whitefield: A thriving Tech hub

Market Profile

From a quaint residential suburb, Whitefield has emerged as one of the most sought-after cosmopolitan localities and a prominent office hub in Bengaluru. The location saw the first IT project International Technology Park of Bengaluru (ITPB), which was established in 1998. ITBP and Development of Export Promotion Industrial Park (EPIP) further boosted real estate activity in Whitefield over the last two decades, signified by a growing residential catchment and office properties.

Whitefield: Office market at a glance

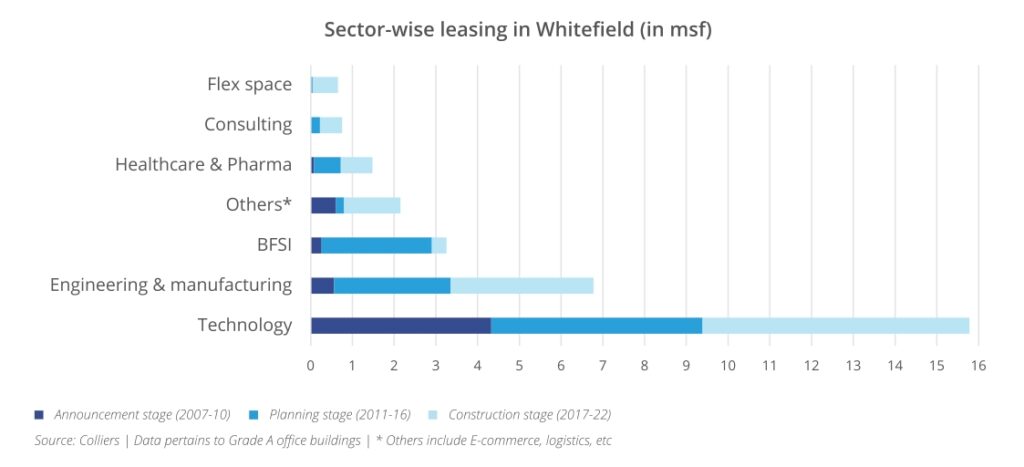

Whitefield has benefitted from rising demand from Tech occupiers owing to availability of large land parcels at competitive rates. The entire location has transformed into a Tech hub over the last decade housing big multinational companies, Tech companies and Start-ups. At present, Whitefield accounts for 22% of Grade A stock in the city with both SEZ and Non-SEZ campuses. Baiyappanahalli-Whitefield metro corridor is likely to further improve the accessibility of the area with central city, boosting real estate activity in the region.

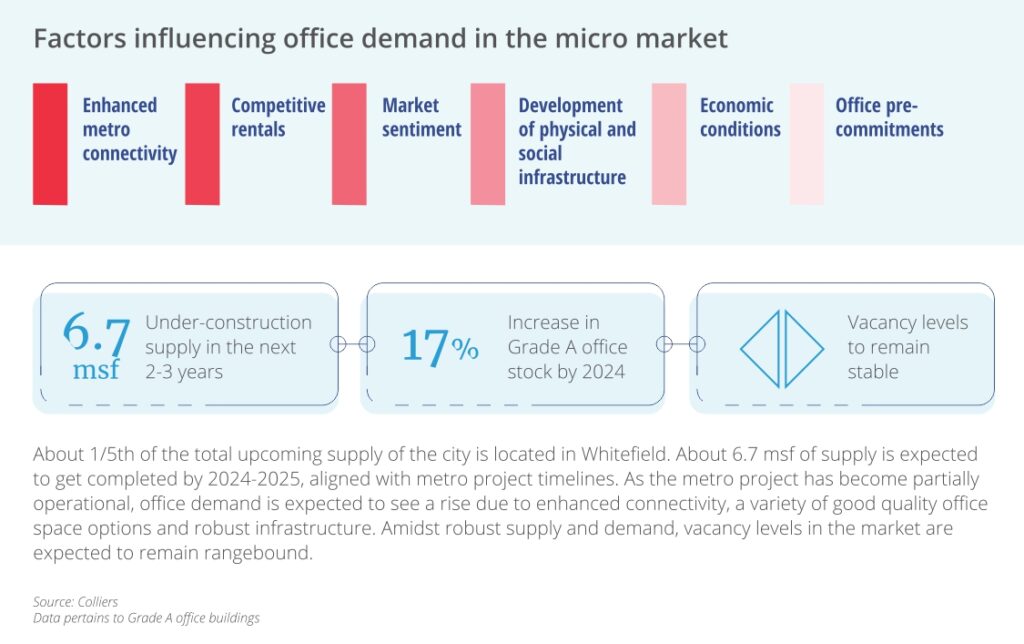

Demand and supply witnessed steady rise with the announcement of metro project

Whitefield has witnessed steady rise in office supply as well as absorption during metro project planning stage. The location saw a steep rise in office activity during the planning stage. However, the highest quantum of absorption and supply was seen during the construction stage, which also coincides with overall robust occupier demand in the city.

Whitefield to see robust supply and leasing activity as metro nears completion

Office rentals likely to increase by 8-10% amidst robust demand

Bengaluru witnessed an increase in Grade A office rentals across all micro markets over the last decade. The rental increments are largely dependent on the availability of quality supply and occupier demand. However, the infrastructure projects indirectly impact rents by providing occupiers seamless connectivity and thereby fostering demand. However, in CBD it has been observed that the rentals have risen significantly after the metro started its operation. The CBD has seen rentals rise by about 25% during 2016-17 when the Phase 1 of the Metro became operational.

Average Grade A office rentals

Whitefield has witnessed a steady rise in rentals over the years, despite pandemic hampering the demand during 2020-21. Capital values have increased more than 5% annually since 2011 (Planning stage). Rentals saw a stark rise of 50% during 2017-2019 period, just after the construction of metro work began. The rental growth was hindered during the pandemic years, however will likely pick up pace as the metro project nears completion.

Whitefield – an emerging attractive location for flex

During 2022, the demand in Whitefield is largely led by Tech companies with over 40% share, followed by engineering firms. Tech companies have been leasing large office spaces in campus developments and multi-tenant buildings in Whitefield.

Led by increased demand from large enterprises, demand for flex space has skyrocketed in the city. However, the expansion of Flex players has been limited in Whitefield. This is due to the location’s limited connectivity to other parts of the city, which is one of the most important parameters for flex spaces. For instance, during 2022, while flex space contributed to 13% of the total leasing of city, it accounted for only 2% of the total leasing of Whitefield.

However, once metro gets fully operational in Whitefield in 2023, enhanced connectivity from other parts of the city, apart from availability of good quality residences, presence of social infrastructure such as schools, hospitals and shopping malls will make Whitefield a favourable location for Flex operators.

We anticipate flex operators to strengthen their presence in Whitefield. As occupiers look at decentralized working, Whitefield has numerous advantages for flex spaces, ranging from a) Established residential catchment with the presence of young IT professionals and expats b) Seamless connectivity to other parts of the city once metro is operational c) Presence of Grade A office projects and d) Competitive rentals.

- Whitefield will cater to the spill over demand from Outer Ring Road and will become a preferred office location once the connectivity to central Bengaluru gets enhanced, with Tech major driving activity.

- Whitefield also caters to cost-sensitive occupiers, as it offers good quality Grade A office spaces at competitive rentals. The micro-market offers relocation and expansion opportunities to occupiers, as the rentals here are about 32% lower than Bengaluru average.

- With metro project getting operational in 2023, rentals in Whitefield are expected to significantly go up in next 2-3 years, hinging upon the overall occupier demand and macro-economic factors.

Overall, Whitefield has been on developers’ radar for a decade led by availability of large land parcels, lower land rates, and attractive ROI. While Whit