COVID-19 has changed the course of Indian real estate in many ways. While regular commercial real estate is under pressure, there are new opportunities for some emerging sectors in India. In the post-pandemic world, the self-storage segment is a direct beneficiary of an otherwise disrupted real estate marketplace.

What is, and who does it?

Self-storage facilities are warehousing spaces where household and office furniture and equipment, as well as automobiles, can be stored safely for both short and extended periods, at reasonable rentals. Presently, the prominent self-storage players operating in India include Your Space, Safe Storage, Self Storage, Storagians, StowNest Storage, and Orange Self-storage, among others.

With many firms having extended the work-from-home option, an increasing number of working professionals in cities like Bengaluru, Mumbai, Pune, Hyderabad, Gurugram and Noida have relocated to their hometowns. With every intention to return once the situation normalizes or their firms insist, they need spaces where they can temporarily store their household items and automobiles.

Likewise, many businesses impacted by the pandemic – including start-ups, gyms, parlours, restaurants and playschools – currently prefer low-cost storage over cost-intensive rented office spaces when it comes to storing their furniture and equipment until the dust of the pandemic settles and businesses resume more or less normal operations.

This is not the first time that self-storage facilities have come into the limelight. The US witnessed a similar dynamic during the recession period; though the recession officially lasted from the end of December 2007 to mid-2009, the country’s economy tool much longer to recover to pre-GFC levels in terms of employment and output. In these years, the self-storage industry thrived when most other businesses downsized, moved or faced foreclosure.

Self-storage Vs. Regular Warehousing

What differentiates self-storage from a regular warehousing facility are features such as individual secured self-storage cubes, safe lockers, personalized digital surveillance and electronic access, fire/pest-proofed spaces, back-end customer support – and, of course, safety and security from theft.

In the new COVID-19 world, few self-storage operators in the US are using technology to provide a contact-free experience to their customers via website, kiosk, mobile app and keyless entry

How international markets ‘stock’ up

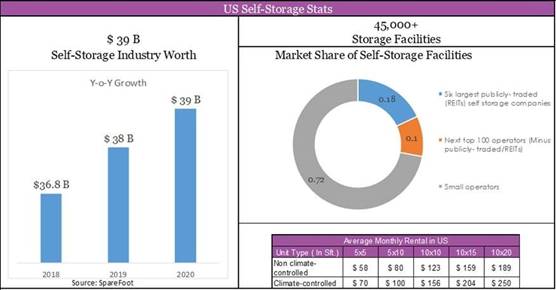

The self-storage industry in international markets like the US has seen steady growth and remarkable resilience over the years. According to SpareFoot, an integrated marketplace for moving and storage, the US self-storage industry was worth a whopping USD 39 billion in early 2020, with the number of storage facilities ranging between 45,000 – 60,000 and a total rentable space of over 1.7 bn sq. ft. area.

Likewise, Europe’s self-storage market was valued at USD 3.11 billion in 2019, with the UK comprising a share of more than 47%. Internationally, the industry is pegged to reach nearly USD 3.97 billion by 2025, growing at a CAGR of 4% in the 2020-2025 period.

In contrast, the self-storage market in the Asian markets of Hong Kong, Singapore and Japan is still at a nascent stage. While self-storage is gaining momentum on the pandemic-defined landscape, these eastern countries are still seriously under-supplied. The demand for self-storage spaces in Western and Asian markets is currently driven by a rising exodus to downtown areas of crammed cities and the need of smaller businesses to stock extra inventory.

The increasing dominance of micro-apartments in Hong Kong, for instance, and an acceleration towards co-living are driving demand for self-storage there. However, though many of the European and Asian markets are slated to witness a veritable self-storage boom going forward, they are still far behind the US self-storage industry – and it will still take several years for them to catch up.

Self-storage in India – gathering ground

The self-storage sector in India is still at a fledgling stage with only a handful of organized players – with limited space capacities – in the top cities. Amidst the pandemic, demand for external storage facilities is rising across cities. In IT-driven cities like Bengaluru, the new WFH population and businesses facing temporary closures are a main focus area.

Many of the firms providing storage facilities are already running out of space. To overcome this problem, players can consider taking up vacant retail sites and converting them into storage centres – as has been witnessed in the US. Prominent Indian cities with rental storage facilities include Bengaluru, Mumbai, Pune, Hyderabad, Noida and Gurugram.

What self-storage costs

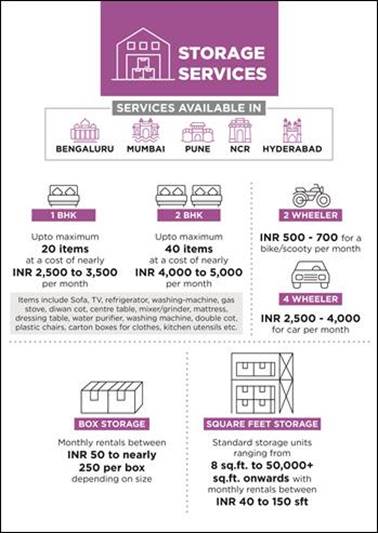

The players operating in these cities cater to a wide range of storage requirements at reasonable rentals, depending on factors like size, location and storage duration.

Safe Storage and Storagians provide the option of storing 1BHK household goods (up to 20 items) at a cost of approx. INR 3,000 per month. For 2BHKs with a maximum capacity of 30-37 items, the monthly rentals are between INR 4,000 to INR 4,500, and so on. Some of the items that can be stored include TV, refrigerator, gas stove, diwan bed, centre table, mixer/grinder, mattress, dressing table, water purifier, washing machine, double cot, plastic chairs, carton boxes for clothes, kitchen utensils, etc.

Other personal items that can be stored include cars and bikes whose monthly rentals depend on the vehicle type – from INR 500/month for a bike to nearly INR 4,000/month for an SUV. Box storage facilities come with monthly rentals between INR 50 to INR 250 per box, depending on the size of the boxes – small, medium or large.

Awaiting Investment Push

In the West, investors have shown immense confidence in the self-storage sector due to its underlying attributes and resilience. Despite recessions and demographic shifts, private equity, institutions and private wealth of varying magnitudes continue to have an appetite for it.

In India, investments into this sector are yet to pick up appreciably – but considering rising demand and the fact that many vacant spaces can be reconfigured for self-storage, investments are likely to pick up going forward. Urban Indian is gradually adopting this essentially western concept in the COVID-19 world. Existing players are using this opportunity to expand their network.

Comments are closed.