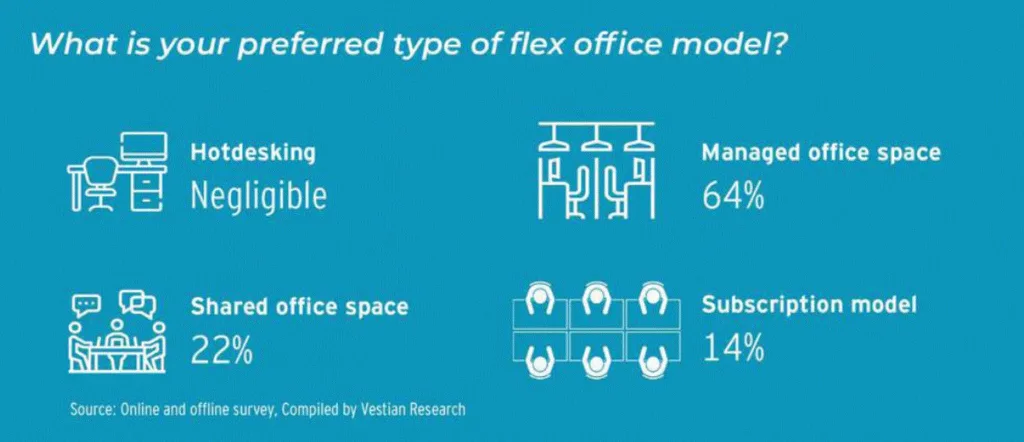

Indian office sector went through a radical change during the last decade as it transitioned from a conventional set-up of office space to a more collaborative approach. New-age flexible spaces can be customized as per the specific needs of occupiers and provide greater flexibility at a lesser cost. Amidst global headwinds, the agility inherent in flexible spaces, allows businesses a cautious means to navigate the prevailing challenges at optimal cost and space utilization. Illustrating this evolving trend, a recent comprehensive survey underscores that 64% of respondents demonstrate a distinct preference for managed office spaces, reflecting a departure from conventional shared office spaces. This transition signals a paradigmatic departure from the old norm towards dynamic, flexible workspace alternatives.

Shared office space concept is relatively new in India compared to more mature flexible workspace markets in developed countries. Wider adoption of flexible spaces in India started in 2015-16 when the market was fragmented and unorganized. However, it has since grown rapidly and become more organized. Flexible spaces are garnering significant attention not only from startups and SMEs but also from large enterprises.

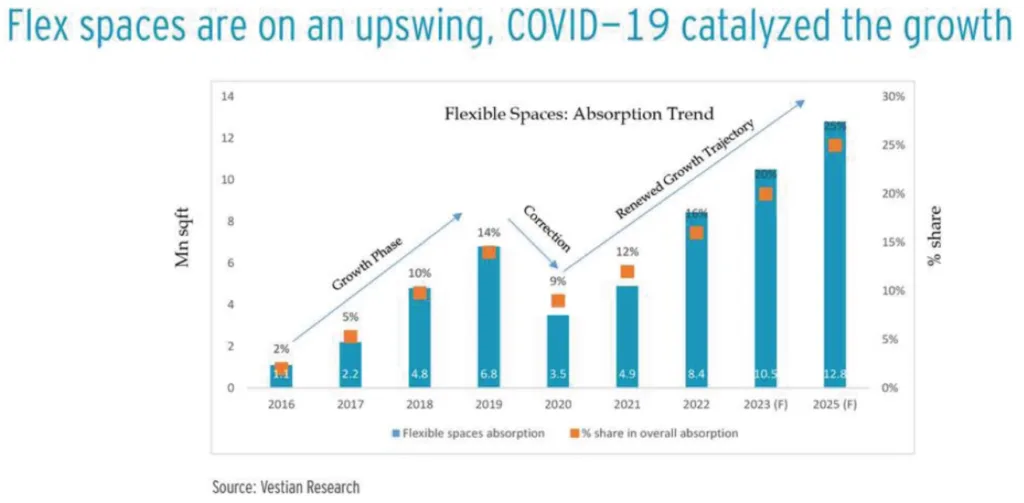

In terms of market metrics, the flexible office space inventory in India has surpassed the 50 Mn sq ft milestone, with projections indicating a growth to 81 Mn sq ft feet by 2025. Furthermore, flexible office sector is projected to constitute around 25% of the overall office space absorption by 2025. Bolstered by increasing support from private equity investments, flexible operators have experienced consistent growth, particularly in key regions such as Bengaluru and the National Capital Region (NCR).

Flexible spaces broadly include dedicated desks, hotdesking, coworking spaces, serviced and managed office spaces. While coworking centres are at the most flexible end of the spectrum, managed offices would be at the less flexible end.

“Core+Flex concept is gaining traction among occupiers as it provides a seamless way to integrate traditional leased space and flexible office arrangements into their portfolios.”

Classification of flex spaces

The Journey so far

Flex Spaces: Driving Office sector forward

Start-ups and SMEs have contributed significantly to the growth of flex spaces in the past couple of years. However, the demand is gradually shifting towards large enterprises post-pandemic due to flexibility and cost advantage. Presently, there are 50 major operators in the flex space market, out of which the top 10 flex operators account for nearly 84% of the total flex stock in India. SmartWorks topped the chart with 15% share, followed by WeWork India at 14%.

Top 10 flex destinations in India

Flex operators are known for providing office space at premium locations along with world-class amenities at affordable rates. As a result, majority of the flex spaces are present at premium office destinations in the city to cater to the demand for small ticket sizes.

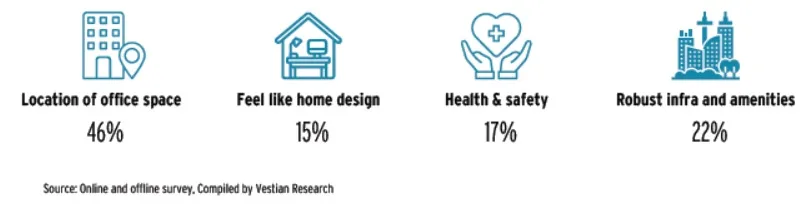

What is the most crucial factor for you while returning to the office?

Nearly half of the respondents consider office location to be a top priority while returning to the office. Flexible spaces provide an opportunity to bring back the employees to the office by distributing office spaces across cities and within city limits.

What is your preference for office space location?

While majority of the respondents prefer to work from a centralized office in a metro city, nearly 33% choose to work from flexible spaces in any city.

Flex operators are on a supply spree to cater to the increased demand

Flex operators gradually increased their portfolio in the past couple of years to cater to the increased demand. While the number of transactions peaked in 2019, the average size of transaction was less than 25,000 sq ft. In 2020, the average size of transaction more than doubled compared to the previous year. However, the number of transactions significantly dropped, which dictates that only large flex operators were active during the pandemic. Later, between 2021 and 2022, size and number of transactions started increasing which hints at active participation from small flex operators. However, size and number of transactions declined during H1 2023 as flex operators entered a wait-and-watch mode amid demand slowdown.

What will be the most preferred reason to select flex space over traditional office space?

Less commute time is the biggest advantage of leasing office space in flexible spaces, closely followed by improved corporate connections. Saving on employees’ commute time directly turns into a better work-life balance leading to a boost in productivity.

Flex operators’ confident of market growth

In 2015, average lease tenure by flex operators was more than 6 years with high rentals. It increased to more than 8 years in 2018 as the flex market matured over time. Longer tenure and larger transactions enabled flex operators to get the deal at lower rentals between 2018 and 2020. However, the COVID-19 pandemic shook the confidence of flex operators temporarily which resulted in a reduction in average tenure to 77 months in 2021. Average rent has also inflated along with it. However, the market is showing signs of strengthened confidence and growth. As of H1 2023, average lease tenure is around 6.5 years with an average rent of below INR 80/sq ft/month.

Private equity investments are on the rise

Flex operators received around USD 260 Mn of private equity investments since 2016. It peaked at nearly USD 90 Mn in 2019 but dropped significantly in 2020 amid uncertainty around the future of flexible spaces. Later, it recovered and reached USD 80 Mn in 2022.

- Nearly 96% of the private equity investments since 2016 were concentrated in Bengaluru and NCR

- Co-investments dominated the total PE investments since 2016 with a 68% share

“Flexible spaces sector is at a nascent stage in India compared to other countries such as USA and European countries. It has grown gradually in India and reached 53.4 Mn sq ft flexible office stock. Furthermore, the stock is anticipated to reach 81 Mn sq ft by 2025, growing at a CAGR of 23%, as COVID-19 catalyzed the market growth.”

Tapping new sectors

Presently, IT-ITeS commands the lion’s share, around 60%-70%, of the total absorption of flexible spaces. However, there are numerous other sectors that can contribute to the growth of the flexible space market. However, these sectors have several apprehensions when opting for flexible office spaces. Managing employees’ productivity and efficiency remotely, dilution of company culture, health & safety, technological challenges, etc. are some of the limitations of flexible spaces which need to be addressed to tap other sectors such as BFSI, telecom, media, pharma, manufacturing, etc.

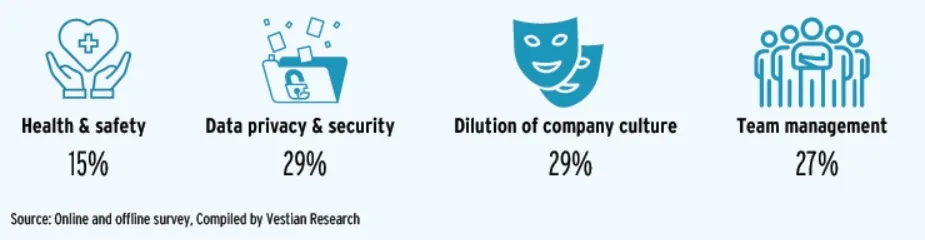

What is the biggest challenge while opting for flex office spaces?

Health and safety are no longer a concern for majority of the respondents while working from flex office spaces. Data privacy, security, team management, and dilution of company culture turn out to be the biggest limitations of flexible office spaces which need to be addressed quickly to lure new sectors.

Way Forward

The growth of flexible spaces has been phenomenal in the past couple of years, especially after the pandemic. Presently, flex spaces have around 53.4 Mn sq ft of stock spread across more than 1,000 centers. As per Vestian Research, the stock is estimated to cross 81 Mn sq ft in the next 2 years with increased adoption of flexible spaces by large enterprises.

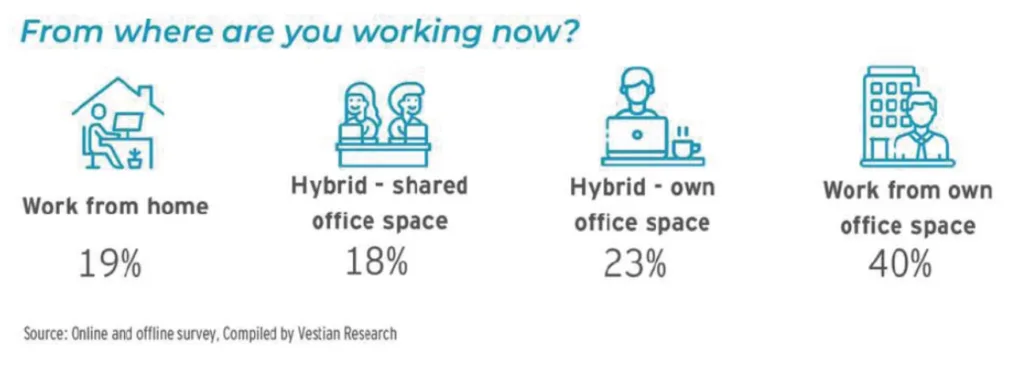

As several companies are urging their employees to head back to the office under a hybrid model, it is likely to increase the demand for flexible spaces. As per our research, office location plays a pivotal role in bringing back employees to the office. Flexible operators are capable of providing flexi desks, meeting rooms, and other amenities near the homes of employees. This may lead to less commute time and improved work-life balance for employees and cost saving for employers. Looking at the benefits, several tenants have already mandated a certain portion of their office space requirement to be fulfilled by flexible spaces.

In future, the line between flexible spaces and different asset classes of real estate is expected to blur. While commercial office developers are likely to build custom spaces specifically to be leased out to flexible operators, residential developers may also try to accommodate shared office area with few meeting rooms and office desks in their residential complexes. Other commercial asset classes such as hotels, malls, and shopping complexes have already started addressing the need for flexible spaces. This trend may promote work from near home.

Tier-2 cities in India have witnessed significant growth as flexible operators expand their footprint. This may amplify further with more operators establishing their bases in small cities to cater to the growing demand. While these cities reduce the cost of operations significantly along with access to a new local talent pool, employees get the benefit of a lower cost of living.

Overall, flexible spaces are likely to grow steadily in the coming years. Uncertainty is looming over office markets around the world due to the slowdown in world economy, and India is no exception. During this uncertain period, flexible spaces can provide flexibility in lease terms, less initial set-up cost, and flexibility of increasing and decreasing the required office desks/space. This may drive the next wave of growth for flexible spaces in India.

About Vestian

Vestian, is a contemporary workplace solutions firm that specializes in providing occupier focused solutions for commercial, residential, industrial, retail and hospitality sectors. Our service portfolio includes Integrated Service Delivery, Project Services, Investment & Consultancy Services, Transaction Advisory Services, Retail Business Solutions & Integrated Facilities Management Services.

We align and measure our key deliverables based on clients’ strategic business goals. Our commitment to achieve excellence and consistency in our service delivery models has helped us attain high standards of quality and raise the bar for the industry. Our experienced team has the required expertise and exposure in different sectors. Combining global best practices and local knowledge, the team provides an integrated solution for all real estate requirements. Moreover, the belief in our corporate philosophy – Delivering Measurable Results – helps us to provide solutions, in keeping with global delivery standards.

Vestian is certified in both quality management systems and environmental health & safety standards – ISO 9001, ISO 14001, ISO 37001 and ISO 45001. We are also a member of the Indian Green Building Council.

Investment & Consultancy Services (ICS) is the Research, Consultancy and Investment

solutions arm of Vestian. We provide value-added end-to-end investment advisory consultancy services. Our clients include multi-national and Indian corporations, investors, private equity (PE) funds, global and national financial institutions, government organizations, international, national and local real estate developers and landlorls in tier- I, II and III cities across the country.

Authored by

Assistant General Manager Research

Sr Executive Research