Digitization is about businesses encountering connected systems at every link in the value chain. It is about working with tools and practices based on information and communication technology. This understanding is changing the role of digital technologies. They are no longer mere tools to help companies do the same things a bit better. Instead, they fundamentally change the way business is done. Digitization permeates every part of every company multinationals and midcaps, all-rounders and specialists alike.

A glance at other industries shows the extent to which digitization is turning proven and familiar practices on their head. In the music industry, for example, digital offerings already account for 46% of total sales worldwide. On this kind of scale, it is certainly reasonable to speak of a revolution – especially as one has to assume that digitization has replaced legacy business models in their entirety.

A large majority of players in the construction industry today recognize how digitization is affecting every part of their business too. According to one study by the Association of German Chambers of Commerce and Industry (DIHK), 93% of companies agree that digitization will influence every one of their processes. This perception places construction on a par with retail and only just behind both the manufacturing industry and service providers – despite the fact that the needs and approaches of different actors vary very considerably. Producers of building materials tend to focus more on digitizing production and distribution (along the lines of Industry 4.0 and the design of the customer journey, for example). By contrast, construction companies concentrate primarily on the digitization of planning, construction and logistics (building information modelling – BIM – and the connected “building site 4.0”). For their part, building material traders add a strong focus on digital sales (online trading) to their logistical considerations.

Clearly, the industry is aware of the importance of the megatrend toward digitization. The problem lies rather with implementation. This is the finding of an exclusive Roland Berger management survey, above all among construction firms and their suppliers in Germany, Austria and Switzerland. The results of the survey paint an up-to-date picture of how industry players rate the potential of digitization and the extent to which implementation has progressed. We call the picture that emerges “Construction 4.0”.

Digitization gives players in the construction industry ways to improve their productivity. While other industries are already benefiting along the entire value chain construction still lags behind. Few players have yet turned to the potential of digitization as a way to resolve this problem.

Such hesitant implementation is all the more surprising when one considers the trend in productivity in the construction industry. Over the past ten years, productivity in Germany has edged up by a meager 4.1%. By comparison, productivity across the whole of the German economy has increased by 11% in the same period. The gap between construction and industry is particularly wide: Manufacturing has seen productivity rise by 34.1% on average over the past decade, against a gain of 27.1% for the whole of the secondary sector. In other European countries, productivity in the construction sector has actually declined – by 5% per annum in Italy and Spain in the period from 2010 through 2015. France just about managed a 1% per annum gain in the same period.

To find out more about where digitization is at in the world of construction, a survey of top management in the construction and supply industry was conducted in Germany, Austria and Switzerland. The survey also included in-depth interviews that let us drill down into specific approaches and problem areas. To capture the mood of the industry as a whole, talk was to nearly 40 companies of all sizes (whose business focuses on construction and building supplies). The respondent firms reflect the following revenue breakdown:

- Less than EUR 10 million: 13%

- > EUR 10 million to EUR 100 million: 26%

- > EUR 100 million to EUR 500 million: 32%

- > EUR 500 million to EUR 1 billion: 6%

- > More than EUR 1 billion: 23%

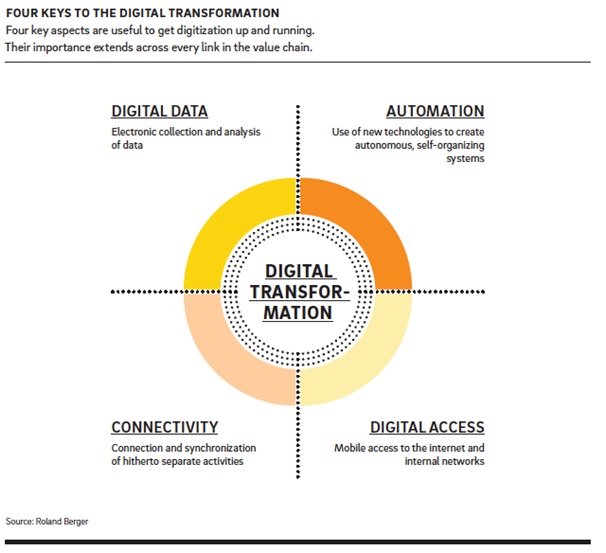

To clearly show how the potential of digitization is rated across individual divisions, departments and functions, we split it into four key areas: digital data, digital access, automation and connectivity. Digital data covers the electronic collection and analysis of data to gain fresh insights into every link in the value chain and then put these insights to good use. Automation groups together those new technologies that create autonomous, self-organizing systems. Digital access describes the potential afforded by mobile access to the internet and internal networks. Lastly, connectivity explores the possibilities to link up and synchronize hitherto separate activities.

One crucial factor regarding the vast potential of digitization is that each of these four keys can be turned at every link in the value chain. For players in the construction industry, the value chain breaks down into the following links:

- Logistics: Flow of goods, storage and transportation

- Procurement: Purchasing, supplier management and supplier evaluation

- Production/construction: Production and quality management.

- Marketing/sales: Sales/dealer management

- after sales/end-customer marketing: Pull marketing, user support and services

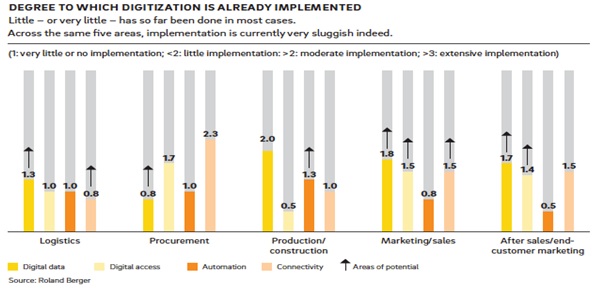

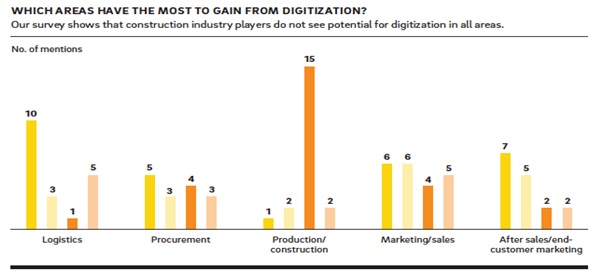

The precise content of each link in the value chain varies from player to player. While suppliers of building materials focus primarily on production, construction companies naturally concentrate more on completing building projects. Building material traders in turn apply themselves to procurement and sales, with a corresponding focus on logistical services. The findings of our survey of top management across players in the construction industry reveal a keen awareness of the potential of digitization at those links in the value chain where the benefits are most obvious. The highest scores were thus given to the potential of digital data in the context of logistics, as well as to automation in the context of product/ Construction.

Digital data and digital access were also frequently mentioned in the context of marketing and sales. On the other hand, procurement departments made little reference to the potential of digitization. Automation aside, respondents also saw little potential for digitization in production settings. In other words, there is a clear lack of awareness that all four keys to digitization are of real importance throughout the entire value chain. B The degree of across-the-board implementation in the corporate community is correspondingly low. Respondent firms were unable to name any division or department in which digitization has already been extensively implemented. Even “moderate” implementation currently only applies for connectivity (in the context of procurement) and digital data (in production). Cloud computing solutions for collaborative production processes are one example. At all other links in the value chain, however, respondents indicated that implementation is currently low, very low or non-existent. The figure at right also shows low to very low levels of implementation even in those areas where companies claim to recognize the potential of digitization. C Looking at the digital devices used as work tools by players in the construction industry, we see that, at most companies, more than 80% of employees have access to a PC and the internet. On the downside, there are still a very sizable number of firms where the corresponding figure is only between 20% and 40%. For smartphones the picture is even more ambivalent. Moreover, our survey clearly refutes the assumption that tablets are already a standard tool among modern players in the construction industry. At the majority of respondent companies, no more than 20% have access to a tablet. Not a single respondent claimed that more than 60% of staff has access to a tablet. The image of building workers organizing their work with tablets is evidently still far removed from reality on today’s building sites. Yet precisely these devices and the apps they contain hold out the promise of huge benefits, as we will see later on. D

RECOGNIZING POTENTIAL AND SEIZING OPPORTUNITIES: HOW DIGITIZATION RAISES PRODUCTIVITY.

The data in our survey testifies to an awareness that digitization has an influence on the industry. The problem is that, in many cases, little has yet been done about this realization. Above all, players in the industry seem uncertain about how exactly to realize the benefits of digitization at the various links in the value chain. The following matrix reflects the diversity of the methods and tools already in existence. Some of them have a powerful influence on the business of construction companies and their suppliers; others have a moderate to low influence. Some applications are already established in business practice, while others are still in the development phase. Based on this matrix, we would highlight eight technological developments and approaches that powerfully affect the business of construction industry players and whose degree of implementation is already sufficiently advanced to yield genuine benefits. Our recommendations include tools for every value chain link and all market players.

1. ELECTRONIC TENDERING IS BECOMING THE STANDARD

In Germany, calls for tender are already circulated electronically for 80 to 90% of public construction projects. The UK and Italy boast a figure of 100% for contracts with volumes in excess of EUR 90,000. Standards to ensure that tenders can be submitted securely andin compliance with formal requirements are already in place. At many construction companies, however, one gets the impression that phones, fax machines and paper are still the most widely used tools. That has to change. Not as an end in itself, but because electronic calls for tender are on the advance. The EU, for example, insists on digital calls for tender for public construction projects, because this channel ensures that contract award processes are more transparent and efficient. Players keen to win public contracts that nevertheless refuse to wave goodbye to phones and fax machines will therefore very soon find themselves left behind. Product specification too is increasingly going digital. In this whole area, digitization has the added advantage that electronic calls for tender reduce costs while increasing efficiency. For construction suppliers, the ability to contribute all products to planning processes via digital channels – through a CAD library, for example will be a critical success factor. At the same time, digital platforms are growing in significance for building material traders.

2. DIGITAL PROCUREMENT PLATFORMS SAVE TIME AND MONEY

Procurement and materials account for a large chunk of total costs in the construction industry. Digital platforms help keep these costs down. Electronic procurement permits savings of around 5% for catalog-basedpurchases and around 10% in the case of online auctions, for example. Swedish construction outfit Skanska does things differently, though, and already handles about half of its material sourcing via a digital platform. Tool manufacturer Hilti has outsourced all its indirect procurement processes and now commissions an external procurement management team to trawl through catalog, online shops and other electronic platforms in search of the most attractive prices and offerings.

3. SMART BUILDING SITE LOGISTICS HOLDS OUT POTENTIAL FOR OPTIMIZATION

Construction workers devote only about 30% of their working time to their principal activity. The remaining 70% is taken up by running errands, transporting materials, cleaning up, rearranging the building site and looking for materials and equipment. It is therefore perfectly understandable that many businesses see a need for optimization.

This is where digital technology can help. Supply software, for example, can be used to ensure that materials are delivered to the site just in time, i.e. precisely when they are needed. Storage and rearrangement work can be minimized as a result. Similarly, smart, connected construction machinery helps optimize capacity utilization for workers and construction vehicles alike. Via the internet of things, excavators can call a free truck whenever one is required. In return, the truck can inquire when and where what material is needed. Construction workers have fewer journeys to make and less coordination work, so less time is spent traveling and looking for things. Conversely this scenario can only work if digital devices are standard issue on the building site.

Apps are already on the market that uses GPS or other navigation technologies to locate products and materials. RFID2 technology in particular opens up all kinds of possibilities. Products fitted with this technology can be identified using electromagnetic fields. They can also be registered and scanned, which simplifies the hiring of equipment and creates transparency regarding the whereabouts of machinery and materials on the building site. It is even possible to fit freshly laid concrete surfaces with RFID technology in order to analyse them.

Software solutions that help building firms with every aspect of the logistical chain are also available. Building material manufacturers in particular are already making good use of such electronic portals. French company Saint Gobain is currently rolling out a new digital logistics concept in Germany. Its aim is to enable building sites to be supplied 24 hours a day, which in turn gives industry players the chance to order materials for very specific points in time.

4. DRONES AND ROBOTS MOVE OUT OF SCIENCE FICTION BOOKS AND INTO THE FUTURE OF CONSTRUCTION

Construction projects are becoming ever more complex. Equally, cost and time pressures are rising and quality expectations increasing. In response, the industry must find ways to reduce complexity and costs raise productivity and guarantee quality. The good news? The tools are already there!

Alongside advance planning, surveying the building land is one of the most important tasks in any construction project. 3D laser technology opens up new possibilities in this context. 3D lasers not only survey the land, but also very quickly identify water pipes, sewers, phone lines, fibre optic cables and power lines. They capture all this data and feed it into digital planning tools that are immediately available to the project manager. Drones are likewise already in operation in the construction industry. They survey the land, monitor large building sites and track the progress of construction projects. Where buildings have been completed, they also measure energy dissipation.

Mobile cloud solutions are growing increasingly important in the building trade. Studies show that communication occupies as much as 90% of construction project managers’ time. When problems arise if different players don’t have the same information or can’t access the data, for instance – the entire process can quickly grind to a halt. As things stand, most building firms still use project management programs that are installed on desktop PCs. Yet cloud-based and mobile solutions have the tremendous advantage of being available wherever you happen to be working. Here again, it becomes apparent how much sense it makes to work on site with mobile devices.

“Hadrian”, the brainchild of Australian enterprise Fast brick Robotics, showcases what construction robots are already capable of doing. Buildings that would have taken human brick layers several weeks to erect can now be completed by Hadrian in 48 hours. The robot is “fed” with 3D construction plans, in accordance with which it trims, processes and lays each brick. The benefits of this technology are obvious: Costs fall while the quality of the “workmanship” increases.

3D printers are another digital innovation with a bearing on the construction industry. One company in China has already seized the opportunity: Following the specifications of a 3D construction plan, it “prints out” building parts that are made from a mix of rapid hardening cement, industrial waste, rubble and glass. The printing process takes two days for a three-story building, slashing construction time by as much as 70% and manual labour by as much as 80%, as well as saving up to 60% of materials. Since the process produces virtually no waste and reuses existing waste, it is also kind to the environment. To service a major order for more than 20,000 houses in Egypt, the Chinese firm plans to use a sand-based mix. Its innovation thus takes account of regional considerations, which further improves efficiency. This development will also have repercussions for building suppliers and building material traders as it creates demand for the development and production of innovative materials.

5. BUILDING SUPPLIERS ARE LOOKING TO DIGITIZE PRODUCTION

Alongside 3D printing on the building site, this technology can also be used to produce building materials and construction products. Moreover, production in general has brought forth many innovative methods that have so far been largely ignored by makers of building materials. Take logistics, for example: It is very easy to integrate suppliers in digital data entry systems for purchase orders and for billing and quality processes. On the product side, there is the chance to develop new materials that feature high connectivity. Production itself can be automated by the use of robots to ensure that products can be extensively customized: Input screens allow customers to specify the precise products they want as soon as they place their orders. High-quality production is monitored with the aid of sensors, and high efficiency is, for example, guaranteed by energy-optimized production control based on the order position.

The movement of products can be traced everywhere and at all times thanks to integrated RFID chips. The production facility – and hence the logistics centre Innovative trading companies.Too – is supplied by autonomous vehicles. A high-level system controls and monitors the entire value chain. This, then, is yet another area where construction industry players are recognizing the potential of digital production (“Production 4.0”). But examples of existing implementations are few and far between. Perhaps it would help the industry to take a look at other sectors: In the auto industry, BMW is using collaborative robots, while Airbus deploys robots and 3D printing methods for production in the aircraft industry

6. DIGITAL SALES FACILITATES MORE DIRECT SERVICE

Players in the construction industry benefit by knowing earlier than their rivals what projects potential customers have in the pipeline and what the requirements will be. Buying external digital data – from project databases, for example – can give companies a head start in the race for information about forthcoming projects. Digital solutions also help improve customer relationship management by letting players analyse customer data. Moreover, digital sales channels add the benefit that customers leave a profile when they place orders via online platforms. This profile allows patterns to be recognized and tailor-made offerings to be prepared in response. Online retailer Amazon shows the extent to which these profiles can be used. And the enormity of potential in the construction sector is reflected by developments in the DIY segment: Since 2006, online sales here have jumped from EUR 24 million to EUR 212 million – an annual growth rate of just under 31%. This is very definitely a forward-looking market.

In the context of communication with customers, mobile apps make it possible to generate information that is updated daily and is thus a perfect fit. That adds value and cements customer loyalty. Insulation specialist Rockwool, for example, gives architects, craftsmen and building material traders an app that highlights potential savings as soon as building data and current energy prices have been entered. It is not unusual for this kind of service to convince customers immediately – and trigger spontaneous purchase decisions.

7. WHEN YOU’VE DONE THE BUSINESS, PREPARE FOR MORE

A number of special factors characterize relationships between construction companies and their customers. During a project, cooperation is intensive, but there are often lengthy gaps between projects. This “downtime” is exactly the right time to invest in long-term relationships with customers. Digital after-sales tools that add value for and provide useful services to customers are very useful in this regard. Building material provider CEMEX came up with Smart Silo, a product that measures and communicates how much cement is left in containers. The app ensures seamless supply lines: New deliveries arrive just when they are needed – and the customer doesn’t have to lift a finger.

8. BIM WILL SOON BE THE STANDARD FOR EVERYONE ON THE BUILDING SITE

Building information modelling (BIM) is already tremendously important to the construction industry. A 2014 EU directive recommends the use of BIM use as one of the criteria for the award of public contracts. The multiphase plan “Digital Planning and Construction launched by Germany’s Federal Ministry of Transport and Digital Infrastructure on December 15, 2015, follows the directive’s lead and makes the use of BIM compulsory for public infrastructure projects in Germany as of 2020. Similar rules already apply in the UK, the Netherlands, Denmark, Finland and Norway.

According to a study by the Fraunhofer IAO institute, however, only 29% of players in the German construction industry today use BIM as an object-oriented building model (3D), although 10% at least plan to do so in future. 4D BIM, which incorporates time as an additional planning dimension, is used only by 6% of players, while 7% plan to introduce it.

Clearly, the industry does not recognize the potential of BIM. The big advantage of this method is that a digital simulation of the project is created before the first brick is laid. BIM thus minimizes planning errors, permits fast calculations, quantifies extra costs and shows alternatives.

A lack of BIM expertise could therefore become a serious competitive drawback in the near future, although players in the construction industry are of a different opinion: Only 31% of the study respondents agree that producers who fail to supply BIM-compatible information will be at a severe disadvantage three years from now. A far higher proportion of architects – 68% – agreed with the same statement.

A recent construction industry study by Roland Berger and HypoVereinsbank also shows that many architects expect there to be negative consequences forcompanies that fail to keep up in the area of BIM. 23% “fully agree” and 45% “mostly agree” with the statement that producers who do not provide BIM-compatible information will already fall behind in three years’ time. Construction firms themselves demonstrate far less awareness of this danger, with only 15% “fully agreeing” and another 15% “mostly agreeing”. Obviously, players in the construction industry must take care not to underestimate the scope and importance of BIM.

As more and more planning is based on BIM, this will probably lead to a shift in decision-making structures on the building site. Up to now, construction companies and craftsmen have sourced building materials from manufacturers of their choice in line with specifications drawn up by planners and architects. Soon, however, the planners and architects will also decide quality issues and choose manufacturers. The result will be hitherto unheard-of costing accuracy. Yet at the same time, construction firms will evolve further in the direction of pure-play contractors. BIM could also shift construction activity from the building site to industry. Building suppliers will seek to raise their profile in BIM databases by providing end-to-end offerings and system solutions. Accordingly, questions are even being asked about the traditional three-tiered nature of the German construction market itself. It is likely that BIM will drive building suppliers’ direct sales activities onto the building site. The challenge to building material traders will be to turn the opportunities afforded by BIM to their own advantage and limit the growth of direct sales.

The digital documentation required by BIM will also cause the volume of product data to proliferate. Construction firms have to be able to cope with the resultant flood of data. Better still, analysing this data and putting it to profitable use will allow firms to exploit the full potential of this development. Buried under all these piles of data is valuable information that can lead to new business models or services.

BOTTOM LINE: IGNORING DIGITIZATION IS A MISTAKE.

The possibilities opened up by Construction 4.0 give players in the construction industry all kinds of ways to boost their productivity. A glance at other industries shows that these new approaches and tools do indeed affect every link in the value chain. Depending on their maturity, size and business model, digitization thus holds out potential for every corporate group in the German construction industry.

We have identified four keys to unleash the potential of digitization: digital data, digital access, automation and connectivity. And each of these keys can be turned at each link in the value chain: in logistics, procurement and production, in marketing and sales, and in after-sales and end-customer marketing.

Companies face the challenge of deciding which approaches suit them best and how they can be implemented. Ignoring digitization entirely is not one of the options. Recent developments in construction and other branches of industry show that there is no stopping the megatrend toward digitization.

It follows that players in the construction industry who move quickly to concern themselves with technological developments and think carefully about how to implement them all along the value chain have every chance of setting themselves apart from the competition. By introducing digital methods, these firms will become more productive and more effective. On the other hand, companies that ignore the keys to digitization run the risk of falling behind their rivals. One reason will be the loss of business. Another will be that they cannot improve their productivity as they would like to.

The profound impact of digitization will thus be felt throughout the entire construction industry. Whichever angle you take – the competitive situation or productivity considerations – companies have no choice but to tackle this vital issue.

Those companies that move early to develop and implement their own digitization strategy will be the winners as the construction industry goes digital.

The “construction firms of the future” will use digital tools to have materials supplied just in time, thereby cutting the cost of storage and transportation and increasing efficiency. They will source materials with electronic portals and, in so doing, optimize not only their prices but also their collaboration with suppliers.

In production, building suppliers will deploy smart machinery and applications that forge networks in which all production processes are planned in advance and operated with optimal efficiency. In marketing and sales, they will win over dealers and customers with digital sales applications. In after-sales, they will provide customers with new service and support that increases customer retention.

Building material traders will operate efficient platforms that add transparency while also making their customers’ processes more efficient. At the same time, they will harness the data generated to gain a better understanding of their customers and produce customer profiles.

Authored By;