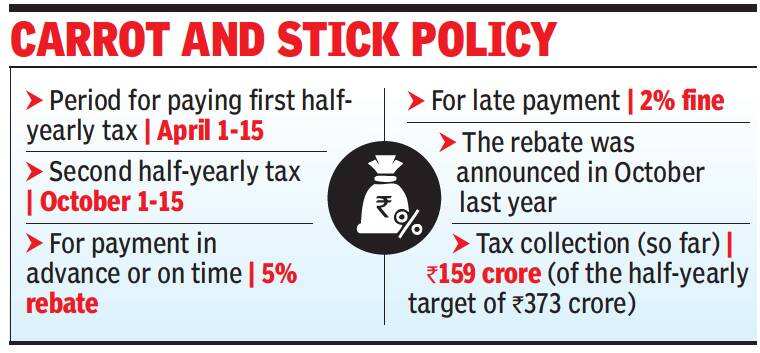

City residents can pay their half-yearly tax in advance from October 1-15 and get a 5% rebate, Greater Chennai Corporation has said. A delay in payment will attract a 2% penalty.

This will be applicable even for those who have already paid, said a corporation revenue department official. “The additional amount will be reflected in their account and will be adjusted in future payments,” he said.

The corporation in 2018-19 revised taxes after base street rates of zones were revised. The revision, however, was revoked and rates applicable in 2017-18 fixed again. After most residents paid revised taxes that were 200%-500% higher than the previous amounts, corporation officials said the additional amount would be adjusted.

Since August this year, the civic body collected 159 crore from 12.43 lakh assessments against the total demand of 373 crore for the half year.

Confusion, however, persists. T Nagar resident V S Jayaram says the corporation is yet to update accounts with the revised taxes.

“A senior citizen in our apartment complex had paid 1,115 as the revised tax amount. However, since the tax was restored to 2018-19 values, her tax was 464. But the new amount is showing 795. When we took this up, we were told she hadn’t paid her 2015-16 taxes. She has all the receipts of payments made. In another case, the person’s tax was not restored to previous calculation. It was showing the revised amount. We had to write to the corporation and escalate the issue for it to get resolved. Why are they [corporation officials] making so many errors in the calculations,” he asked.

Jayaram added that though the corporation’s intention was good, the errors and omissions committed prevent them from making the payment.

“We have advised residents not to make the payments till the accounts are rectified to their satisfaction,” he said.

Corporation officials said all errors would be looked into and rectified.