Indian real estate was devoid of any appreciable forward momentum in 2019. Dwindling consumption, lacklustre investment appetite and the global slowdown overshadowed all possibilities for growth. India’s GDP growth rate stuttered and sunk to a six-year low of 4.5% in Q2 FY20.

The real estate sector’s performance – a reliable barometer of India’s overall economic health – painfully reflected the macro-economic state of affairs. The liquidity crisis did not relent and dented any ‘real’ growth during the year.

Anuj Puri, Chairman – ANAROCK Property Consultants says, “Multiple developers fell off the grid while others still struggle to stay viable. However, strong players with healthy balance sheets – in many cases diversified beyond real estate – sailed through 2019 and recorded decent housing sales and revenue growth. Towards the end of 2019, more than 72% (approx. USD 47 bn or nearly INR 3.3 lakh crore) of the total loans advanced to Grade A builders (USD 65 bn) are safe and stress-free. Grade B and C developers collectively accounted for just USD 28 bn of the total loan advances.”

Commercial office real estate flourished and remained the top-ranking real estate asset class. Residential continued to struggle under the funding crunch and slow annual sales growth. Other asset classes like co-working, logistics & warehousing, co-living and student housing gained traction in 2019, attracting slow but steady investments (collectively USD 210 mn).

Government’s Housing Interventions – Amidst the gloom, the government gave real estate major shots in the arm in the first leg of its second term in office. There were concerted attempts to revive the economy while simultaneously addressing challenges in the struggling automobile, real estate and retail industries. Most notable among these:

- The creation of an alternative investment fund of INR 25,000 Crore for last-mile funding of stalled housing projects

- Deep cuts in corporate taxes.

- Further relaxation in FDI norms for single-brand retail and expansion of the definition of mandatory 30% domestic sourcing norms

While these interventions have not shown any significant impact so far, they have boosted the confidence of India Inc. and the affected sectors.

“2019 saw RERA gain firmer ground with over 40% growth in project registrations,” says Anuj Puri. “To make under-construction projects more attractive, the government slashed GST rates to 5% – unfortunately, without ITC benefit. The government also took a major step towards safeguarding homebuyers’ interests by banning the once-popular (but often misleading) subvention schemes. RBI reduced the repo rates by a significant 135 bps all through 2019 and mandated commercial banks to link home loan rates to it.”

All in all, in terms of policy interventions in 2019, real estate drew considerable fire but failed to display appreciable growth. The seeds sown in 2019 are expected to bear visible fruit in 2020.

Residential in 2019 – Only Affordable Housing Shone

For the housing sector, 2019 was a non-event in terms of sales growth and investor interest. Sentiments remained subdued, sustaining almost solely on end-user activity focused on ready-to-move-in or almost-complete homes.

Branded developers gained ground, with some listed players performing exceptionally well on sales and commensurate revenue growth. As per ANAROCK research, the housing sales value of India’s top 9 listed players touched INR 108 billion in the 2nd and 3rd quarters of 2019, amounting to a 5% q-o-q growth. However, some other big names were dragged into insolvency.

Smaller developers continued to perish or collaborate with the big players due to extreme financial constraints. To be certain, the liquidity crisis gave no respite to the housing sector. Private equity inflows in residential real estate remained subdued, with major PE funds focusing on the commercial segment.

For the housing sector, the only light at the end of the dark financial black hole was the announcement of the alternative investment fund (AIF) of INR 25,000 Crore to facilitate the completion of stuck affordable and mid-segment homes.

In fact, affordable housing remained upbeat in 2019 thanks to multiple government sops throughout the year. First-time homebuyers were given further tax deductions (now amounting to INR 3.5 lakh in a year) on interest amount of home loans below INR 45 lakhs availed within FY 2020 end. Luxury and ultra-luxury segments remained limited to end-user interest, with no serious investor activity.

Of the estimated 2.3 lakh new unit launches in 2019 in the top 7 cities, nearly 40% or approx. 92,000 units were in the affordable segment, followed by mid-segment with a 33% share. The luxury and ultra-luxury segments accounted for the least share with 10% (approx. 23,000 new units).

- Housing sales in 2019 saw a modest 4-5% annual growth with over 2.58 lakh homes sold during the year. (Over 2.48 lakh housing units were sold in 2018.)

- New housing launches in 2019 saw 18-20% annual growth with new launches in the region of over 2.3 lakh units. (1.95 lakh units were launched in 2018.)

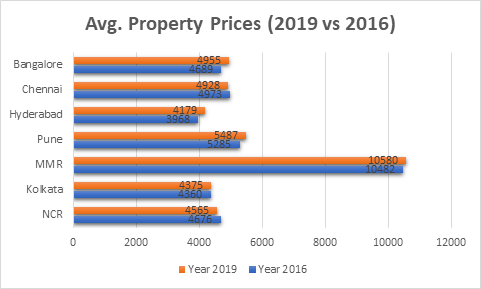

Housing Prices Remained Stagnant in 2019

Average housing prices in 2019 maintained status quo across the top 7 cities, with a minuscule 1% yearly gain in MMR, Pune, Bangalore and Hyderabad. NCR and Chennai saw no change at all, while Kolkata saw a 1% decline in 2019. Interestingly, between the pre-and-post DeMo period (2016 vs 2019), the end-user and IT-driven markets of Bangalore, Hyderabad and Pune saw the maximum price increase in three years – at 6%, 5% and 4% respectively.

Commercial in 2019 – The Year’s Torch-bearing Sector

India’s office real estate sector was decidedly vibrant in 2019, with demand for Grade A office space spiralling upward while vacancy levels in prime locales reduced. India’s first REITs received an overwhelming response and within just six months of its launch, its value increased over 37%. Thanks to REITs, India entered the league of mature markets in 2019.

India also jumped to 63rd position in World Bank’s ‘Ease of Doing Business 2020’ report, both reflecting and attracting the confidence of both local and global entities. Unlike in previous years when most funds looked at only income-yielding assets in commercial real estate, 2019 saw major funds focus on the development of office assets.

Post the global WeWork debacle, India’s co-working boom came under closer scrutiny and raised some pertinent questions about this ‘poster-boy’ of Indian commercial space. However, the demand for co-working spaces in the country by entrepreneurs, tech start-ups and even big multi-nationals remains strong and growing.

- By December-end, office supply in 2019 will have risen by 13% against 2018, touching 43.3 mn sq. ft. this year as against 38.2 mn sq. ft. in 2018

- Absorption will have seen a 11% yearly growth in 2019, to touch approx. 37 mn sq. ft. and thereby reaching 2015 levels.

- Commercial spaces continued to attract maximum PE investments, totalling close to USD 3 bn funds in the first three quarters of 2019. In the corresponding period of 2018, total inflows within this segment equalled nearly USD 2.1 bn, thus rising by 43% in a year.

- Vacancy levels have also come down from 14.6% in 2018 to nearly 14.3% in 2019 (vacancy was as high as 16.5% in 2013). The larger Indian cities will witness strong office absorption along with rising supply pipeline in the coming years.

Retail in 2019 – Sluggish Consumption Cramps Growth

Consumer spends took a major hit in 2019, both in terms of purchase volumes and ticket sizes. Inevitably, overall retail leasing activity reduced drastically by as much as 35% in the top 7 cities alone. Seasonal discount shopping gained prominence over brand loyalty. The struggling automobiles, fashion and telecom industries derailed both consumer spending and space absorption and only F&B, family entertainment centres, cinemas and beauty/wellness boutiques saw appreciable growth.

Retailers had to seriously re-vision their strategies in 2019. More players started to harness technology to compensate for reduced manpower. Analytics-driven decision making aided by expert retail leasing consultancies proved to be immensely important during the year. Strengthening customer loyalty was the watchword throughout 2019.

The government’s further relaxation of FDI norms for single-brand retail and the widened definition of mandatory 30% domestic sourcing norms benefited players like IKEA, Apple, H&M etc.

- The top 7 cities saw retail leasing activity drop by 35% in 2019 over 2018 – from 5.5 mn sq. ft. in 2018 to 3.6 mn sq. ft. in 2019.

- The share of organised retail gained ground in 2019. While it currently still accounts for only a 8% share of the overall Indian retail market, it is set to reach 13% by 2020 end on the back of government interventions.

- Average vacancy levels have come down to almost 14% in 2019 as against nearly 15% a year ago.

- Total PE inflows in retail touched nearly USD 260 mn between January to September 2019, compared to USD 355 mn in 2018 – an annual reduction of 27%.

Indian Retail Demand-Supply Dynamics – 2019 vs 2018

- Retail leasing in the top 7 cities dropped by 35% in 2019 over 2018 – from 5.5 mn sq. ft. in 2018 to 3.6 mn sq. ft. in 2019. The peak year (2011) saw three times more leasing activity than 2019.

- Average vacancy levels have come down to almost 14% in 2019 as against nearly 15% a year ago.

- With ample new retail supply (of approx. ~7mn sq. ft.) projected to enter the top cities in 2020, average vacancy levels may increase marginally .

Warehousing supply & absorption:

- As per ANAROCK research, the top 8 cities – Bangalore, Chennai, NCR, MMR, Hyderabad, Pune, Ahmedabad and Kolkata – together saw new supply of nearly 28 mn sq. ft. of Grade A & B logistics and warehousing space in 2019.

- Of this, nearly 20 mn sq. ft. have already been leased by various players.

Other Sunshine sectors

After a fairly scintillating performance in 2018, the logistics & warehousing sector failed to show much growth in 2019. In fact, it witnessed a 27% decline in total PE inflows in the first three quarters of 2019, equalling nearly USD 200 mn as against USD 275 mn in 2018.

However, the majority of available space in this sector is still unorganized and can, therefore, be tapped for future ROI growth potential. Initiatives like ‘Make in India’ will boost activity in manufacturing, e-commerce and retail – which will call for quality warehousing spaces. Its lower growth in 2019 does not really reflect future trends.

2019 also saw alternate real estate asset classes like student housing and co-living gathering momentum.

Fast Forward – 2020 May Bring Revival

As 2020 dawns on Indian real estate, expectations will initially overtake on-ground improvement. The current trends indicate that H1 2020 will not see much growth over the patterns of 2019. However, the H2 does hold promise as the positive impacts of various government measures kick in.

Some major trends to watch out for in 2020 include:

- Consolidation and mergers will continue across all real estate sectors.

- Environmental concerns will gain prominence, such as was seen by the construction ban to combat air pollution in Delhi. Developers will have to accept and embrace these concerns in 2020 and reorganise launch rates and construction labour.

- Some large stuck realty projects will be revived by government funds.

- Residential property prices will remain stagnant.

- While new launches will remain muted, housing sales could see improvement – especially ready properties or those nearing completion.

- Branded players will gain more strength

- Private investment could increase from H2 2020 onwards, depending on macroeconomic factors in the first half.

- More commercial REITs to be listed in 2020 as more commercial developers look to unlock the value of their assets to raise capital.

Authored by