Nearly a year after hiking property taxes in urban local bodies across the state, Tamil Nadu government on Tuesday turned the clock back on the steep hike citing representations from various quarters about the ‘hefty tax.’

It has now set up a committee to examine the representations received from various quarters about revising the tax.

Though the rollback has come at a time when voters are expecting a formal announcement on the much-delayed local body elections in the state, municipal administration and water supply minister S P Velumani said the decision has nothing to do with the polls.

Government has decided to withhold its July 2018 order on property tax hike which was given retrospective effect from April 1, 2018, said the minister on Tuesday. “There were several representations from property owners to reduce tax.

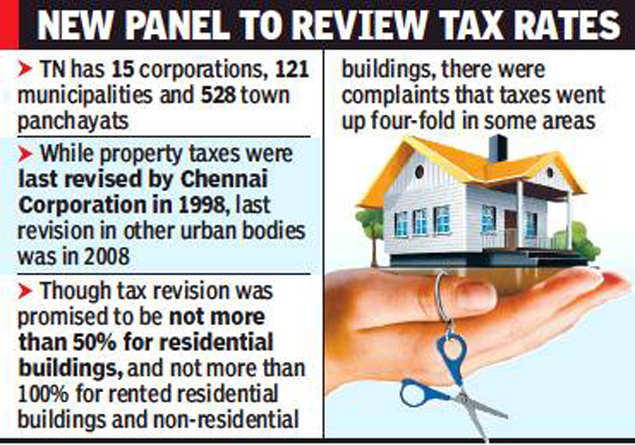

The demand echoed in the legislative assembly. Until the government receives the committee’s report, the tax payers shall pay what was in force ahead of the general revision of April 1, 2018. The move has nothing to do with local body polls,” the minister said. The state has 15 corporations, 121 municipalities and 528 town panchayats.

Principal secretary, finance (expenditure) will be the chairman of the proposed committee whereas commissioner of municipal administration will be its member-convenor. Town panchayats director and commissioner of Greater Chennai Corporation will be members. “The committee report will be available as soon as possible,” Velumani said.

The Chennai Corporation revised property tax last in 1998, while the other corporations, municipalities and town panchayats revised them in 2008.

After an intervention by the Madras high court, the municipal administration and water supply department issued the order to carry out general revision of property tax in all urban local bodies in Tamil Nadu. Tax revision was promised to be not more than 50% for residential buildings, and not more than 100% for rented residential buildings and non-residential buildings.

However, there were complaints from certain rural pockets that the hike was four-fold. After a hue and cry, the government issued another order a week later providing tax not more than 50% for all residential buildings, including rented residential buildings.

According to official sources, the government has been receiving several representations in all forums and it felt the heat after media reports on the revision due to revised zonal rates, guideline value, causing financial hardships. Even commercial associations represented to the state to consider the “current economic slowdown” and reconsider 100% tax hike for non-residential buildings. “The government has to put on hold the revision order given the proximity of elections,” said an official.

Re-measurement of properties was taken up in all the municipal corporations, municipalities and the town panchayats in 2017-18 to identify the under-assessed buildings and buildings with change in use and revised the property tax considering the actual measurement of the buildings and period of construction with imposition of penal action and taxes.