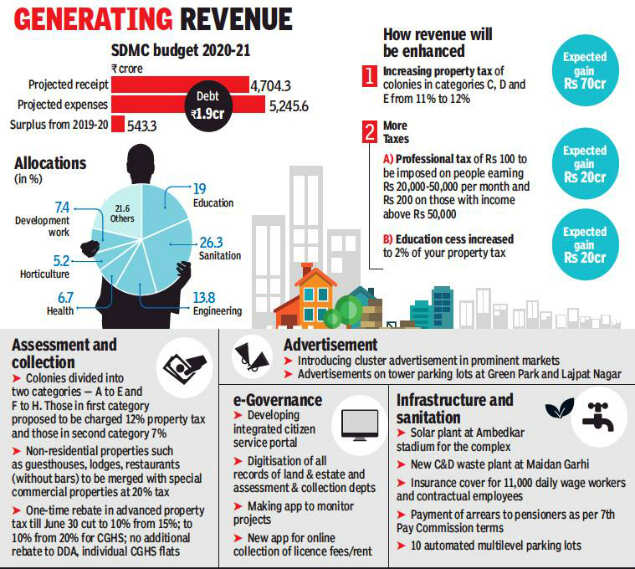

People living in colonies in C, D and E categories may end up paying more property tax if the budget proposed by South Delhi Municipal Corporation (SDMC) commissioner for financial year 2020-21 is implemented.

To cover up the deficit and increase revenue collection, it has been proposed to increase the tax for such colonies from 11% to 12%.

In the budget presented on Friday, SDMC commissioner Gyanesh Bharti proposed merging of the current three slabs into two. As of now, properties in categories A and B pay 12% property tax, C, D and E 11% and F, G, H 7%. It has been proposed to put categories A-E in one slab and F-H in the second.

“Properties in categories A-E will be charged 12% property tax, while F-H will have to pay 7%. The increase is nominal, so the hike in tax won’t be much,” Bharti said.

It has also been proposed to increase the property tax for 100 square metre residential properties in category D from Rs 3,520 to Rs 3,840 annually.

Bharti also proposed levying of professional tax, in addition to increase in transfer duty and education cess by 1%. Currently, 1% education cess is levied on the taxable amount, which has been proposed to be increased to 2%.

“We need to look for new sources of revenue to tide over the financial crunch. That’s why we have proposed a new tax, professional tax, to be levied on those earning above Rs 20,000 per month,” said Bharti.

For non-residential, commercial colonies in categories A-E, the property tax has been proposed to be increased from 12% to 15% and 10% to 12% for F-H categories. As of now, the tax is 15% on categories A and B, 12% on C, D and E and 10% on F, G and H. Tax on 100 sq metre commercial properties in category D has been proposed to be increased from Rs 3,840 to Rs 4,800 annually.

The commissioner also emphasised upon generating revenue from advertisements and parking. “We aim to introduce the concept of cluster advertisements in prominent markets, convert regular advertisement boards into LEDs, identify new sites for unipoles and flex signage to increase revenue from Rs 130 crore to Rs 160 crore annually,” said Bharti.

The civic agency claimed that DMRC has agreed to pay service charge at 75% on operational properties, apart from property tax.

Taking a cue from New Delhi Municipal Council, SDMC has started work on a policy to earn revenue from cell towers on wheels (COW). Earlier, the standing committee had been informed that there were about 500 COWs stationed near parks and government land illegally and SDMC was losing around Rs 2 crore as revenue from them every year.

To deal with the increasing garbage, SDMC has planned to make operational by September 2020 a waste-to-energy plant on 15 acres and a scientific landfill on 32 acres at Tehkhand. “To achieve 100% waste segregation in all wards, we propose to provide five-day training to sanitation workers,” said Bharti.

For controlling the stray dog population, SDMC has proposed one more sterlisation centre at Tehkhand. To identify the dogs after sterlisation, the civic agency will make them wear reflective collars.

In South Corporation, of the 1,370 colonies 59 fall under category C, 82 in D and 99 in E. A senior SDMC official clarified that the proposal was for only increasing the tax rates and not the factors on the basis of which the building’s annual value is calculated.