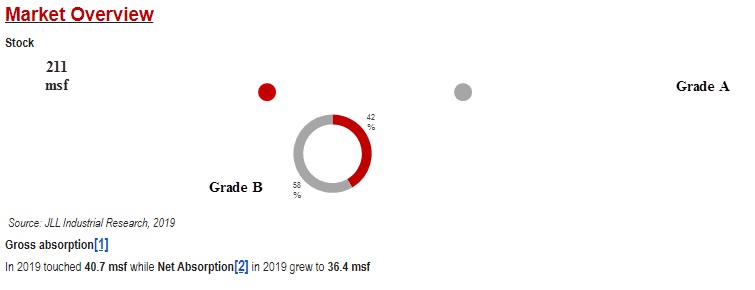

In what could be a key indicator of consumer demand and growing confidence, the Indian warehousing sector has shown a robust growth at 25% y-o-y with the total warehousing space at 211 mn sq. ft. at the end-2019 compared to 169 mn sq. ft., a year ago.

Not just that, the total warehousing stock of India is expected to cross 375 mn sq ft by 2023 with an increased share of Grade A stocks. Strong demand is expected to drive the market absorption and keep the vacancy below 10%.

Snapshot of the key trends that define the sector’s performance in 2019:

| Grade | Share in Absorption (%) |

| A | 55% |

| B | 45% |

Source: JLL Industrial Research, 2019

In the latest report by JLL India Industrial Services, 2019 witnessed a 15% y-o-y growth in total net absorption in Grade A & B warehousing space in top eight cities. The Delhi NCR region followed by Mumbai and Bengaluru remained the top three cities in terms of warehouse space absorption in 2019. These three cities together account for more than 20 mn sq. ft of absorption. Interestingly, other cities such as Kolkata, Chennai and Pune continued their strong show.

| City | Net Absorption in 2019 (mn sqft) |

| Ahmedabad | 2.7 |

| Bengaluru | 5.9 |

| Chennai | 3.2 |

| Hyderabad | 1.9 |

| Kolkata | 3.7 |

| Mumbai | 7.0 |

| NCR Delhi | 7.8 |

| Pune | 4.2 |

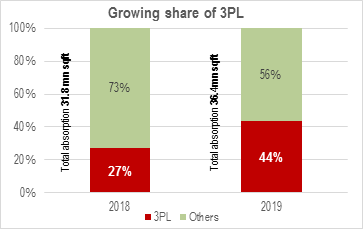

The market has also witnessed 3PL (third party logistics) emerging as the largest occupier of space as the sector received two pronged growth: one from the sector’s self-expansion and other from demands transcending form other sectors who are shifting to asset or less liability or asset light model of leases through 3PL players.

Source: JLL Industrial Research, 2019

[1] Gross Absorption is all transactions that happened in the market including renewals

[2] Net Absorption is the net warehouse space occupied

“Sectors such as 3PL and ecommerce are prompting the market to develop more Grade A warehousing space as occupiers make the transition to spaces with global level specifications. This is further being enabled by liquidity infusion by global investors as in the longer run, increased capital will ensure that more quality space is being built to fulfil the demand for warehouses not only in tier I but going forward in tier II cities”, said Yogesh Shevade, Head – Industrial Services, JLL India.

Given that transportation, contribute to a significant operation cost of logistics, if the infrastructure challenges are addressed, India’s logistics and warehousing sector will see significant growth, and foreign capital will remain an integral part of this.

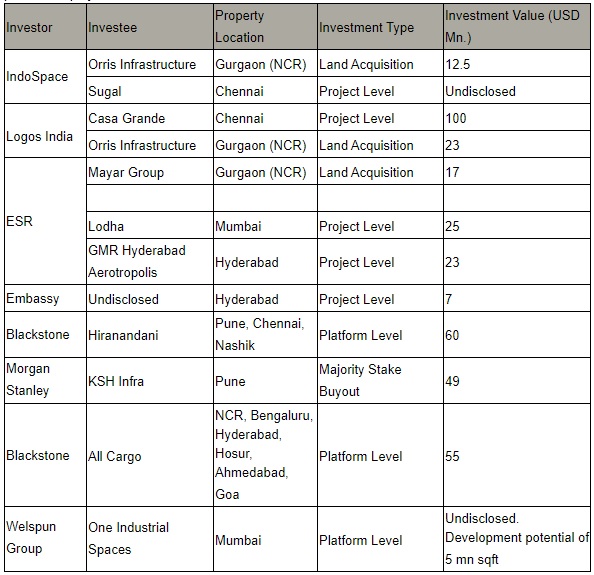

Investments in 2019 – YTD, January 2020

Larger funds and developers willing to create a mark in the bigger spectrum of Indian warehousing are evaluating regional developments having strong tenant profile with a combination of land & stabilised assets. It provides them with the opportunity of having a stable source of financials from the existing occupiers while they are also able to build and create inventory in future years catering to the upcoming demand. Below investments concluded in 2019, reflect similar trend where the likes of Blackstone, ESR or Morgan Stanley have invested in a combination of platform or project level deals.

“2019 was rounded off with the entry of some large players in the Indian warehousing market like Blackstone. The larger investors have adopted customized investment strategies to tide over slow supply of ready-made investment grade assets vis-à-vis demand and at the same time ensuring that they own quality-rent yielding warehousing space in the future. The existing players have expanded their footprint not just in existing locations but also in newer locations to in order to widen their offerings to the occupiers”, said Sandeep Narayan Singh Deo, Head – Industrial Capital Markets, JLL India