Props {AMC} is India’s 1st SaaS-based Real Estate Data & Portfolio Management platform Props {AMC}.

It Helps individuals, corporates & enterprises to organize their real estate holding/s or investments on one single, integrated, intuitive and transparent interface. Users are given access to real estate data including title records, government rates, land reservations, recent transactions, land zoning, building level info and more.

The team of Constrofacilitator sat down on a conversation with Anand Moorthy, Founder & CEO, Props {AMC}, to discuss about some pivotal topics. During the conversation he shared insights on Props {AMC}, which includes a complete insight on the work, technology as well as product offering. These were very efficiently broken in point wise by Anand Moorthy, Founder & CEO, Props {AMC}.

Here are the details of the conversation.

1. Please give a brief on Props AMC and its offerings

Props{AMC} is India’s 1st SaaS based Real Estate Data & Portfolio Management platform Props{AMC} helps individuals, corporates & enterprises to organize their real estate holding/s or investments on one single, integrated, intuitive and transparent interface.

Props{AMC} is powered by proprietary tools, data and services enabling smart reporting and sharing of information of any real estate asset with multiple stakeholders. It strives hard to actively manage every data and information affecting managed real estate asset’s performance. This helps to generate assessment report covering all the major areas of importance for it to be a marketable asset.

Props{AMC} also delivers services through empanelled and in-house knowledge partners who bring in domain expertise in every aspect of real estate through a diligent model of modernized reporting and asset management

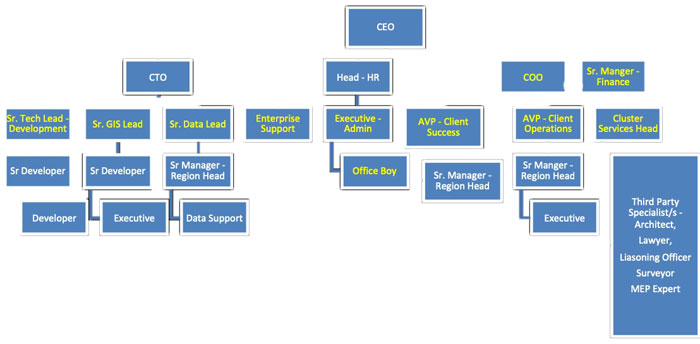

2. Please help us with an Organization chart (with names and designations) and the areas of expertise?

Here are the details given;

ANAND MOORTHY Founder & CEO

18 years of real estate experience in Advisory, Business Development, Property Management and Investments with Developer, Retail, Entertainment, Real Estate Fund, NBFC and Private Banking in India. Managed assets worth more than $400 Mn with an average performance of 16%+. Worked with – RBS, Karvy, E-city Ventures, ILF&S-Milestone, Globus & Essel Group(Fun Cinemas)

NATASHA MOORTHY Co-Founder & CPO

12 years of experience in Organization Learning & Development and Human Resources. She has worked as full time and as a freelancer with Hospitality, Telecom, Retail, F&B, Banking sector. Certified in 16 PF psychometric modules. Worked with – BPL Telecom, Royal Palm Plaza, Essel Group (Fun Cinemas)

VENKAT RAGHAVAN Chief Technology Officer

Over 20 years of experience in all aspects of software development. Expertise in creating scalable, consumer facing full stack SaaS and mobile products, overseeing end-to-end engineering & product development lifecycle and building cross functional teams. Worked with – Fidelity Investments, GE Healthcare, Mscripts & ScanCafe

3. What are the core values that will drive the future of Props AMC?

Props{AMC} core value proposition is to make real estate non speculative, highly liquid and transparent along with dramatically cutting transaction time for all stakeholders in the real estate business for better decision making through complied & insightful web based dashboard.

4. Kindly highlight the business objectives over the next 12 months?

- Increase free trail accounts for real estate owner and information seekers to the tune of 1 lac users

- establish to key stakeholders in the real estate business (developers, brokers, banks, valuators, law firms, real estate funds, real estate investors, home buyers that PropsAMC is the 1st integrated platform with data, services and management of properties). Most importantly the platform is bringing cost and time to/for information dramatically down and legible

- attracts investors and real estate talent to be part of an unique practice which will change way how one owns, manages and markets their real estate / properties

5. What are the marketing plans to achieve these business objectives?

Digital Marketing including adverts on Facebook, LinkedIn, Instagram, Twitter and MoneyControl to create brand name and drive free singups.

6. What are the possible/likely challenges in the process of expansion?

- Educating the right audience, to move away from the orthodox way to managing and marketing owned properties

- moving from physical ownership to managed or fractional ownership

- fund raise

- digitization of data and hiring of senior management

7. What are your long term goals?

- integrate publicly available property related records in a legible and sequenced manner to benefit real estate transaction and title

- to bring properties under an easy investible asset class along with stocks, mutual funds, etc by making them transparent on all information for faster transaction

- build an unique platform to showcase complied assets for faster transaction

8.Can you highlight some of the services that you offer along with Financial Requirements?

Our Products:-

1. Real Estate{Suite} – helps individuals & enterprises to organize their real estate holding/s or investments on one single, integrated and intuitive interface. It is powered by proprietary tools and services enabling financial inclusion, transparency & marketability to the real estate investments

- B2C – Real Estate Suite (RES) – for property owners

- B2B – Real Estate Suite (RES) – Enterprise Version for Asset Managers

- Services – for both B2C & B2B clients we provide the customers with Legal, Valuation and Technical services to make their property marketable

Attaching a client manual which establish “12 Insights” which any HNI with multiple properties would like to have, very similar to how he / she manages financial assets or business through assets managers also attaching a tutorial video to help you navigate the tools.

2. Zone {Matrix} is a GIS enabled Data platform to get credible, insightful data on ‘Property Rights‘ and ‘Property Transactions‘.

Platform integrates multiple data points related to land and building including ownership, reservation, land use zoning, transactions, ready reckoner, mean sea levels, road width, open area ratio within a radius, neighbourhood social amenities, etc of a particular city. We are now focusing on many other data points to the above layers for creating a comprehensive place for real estate information / fact finding which is not easily accessible or legible at present to bring transparency for all real estate stakeholders Attaching the client manual on Zone Matrix.

9. Who are the organization’s primary target audience – demographically & geographically?

Demographically – Age 30-55 and professionals in – Private wealth management, lawyer, valuator, developer, C.A., Real Estate Advisor, Architect, Lenders, Trustees and Govt of India

Geographically – real estate portfolio management in any part of the globe and at present for real estate factsheet and services in Maharashtra and Gurgaon.

10. How would you like to be perceived amongst your major stake holders?

A technology company focusing on real estate asset class by bringing customized data and asset management for all stakeholders involved enabling seamless transaction experience.

11. What are the key drivers for a company operating in industry such as yours, in India?

- Technology and data efficiency

- declaration of real estate assets by individuals and enterprises

- Validation of Ownership and Valuation

12. How does a change in Govt. regulation affect your way of functioning?

- Stroke of a pen!!! can change things for a company like us… for example if the GOI makes compulsory for people to declare their assets and needs a platform

- if the govt decides to integrate different departs dealing in real estate to bring information (this actually is already an intent with Niti Ayog – EoDB) – somehow it is not taking off

13. What are the key issues and challenges that businesses such as yours face?

- Funds to grow team and infrastucture

- Digitization of data

- Acceptability with property owners, lenders or managers for them to become organized and complied to any transaction (lease / sale / mortgage)