The roads and highways are all poised to bounce back through government measures to fight the recent slowdown. The Union Minister of State for Road, Transport, and Shipping has stated that the Government aims to boost corporate investment in roads and shipping sector, along with introducing business-friendly strategies that will balance profitability with effective project execution. According to data released by the Department of Industrial Policy and Promotion (DIPP), construction development including Townships, housing, built-up infrastructure and construction development projects attracted Foreign Direct Investment (FDI) inflows worth US$ 25.05 billion were recorded in the construction development sector between April 2000 and March 2019. Therefore, the construction equipment sector is hopeful of the upcoming progress.

The government, through a series of initiatives, is working on policies to attract significant investor interest. A total of 200,000 km of national highways are expected to be completed by 2022.

Indian Construction Equipment Market; Industry Viewpoint

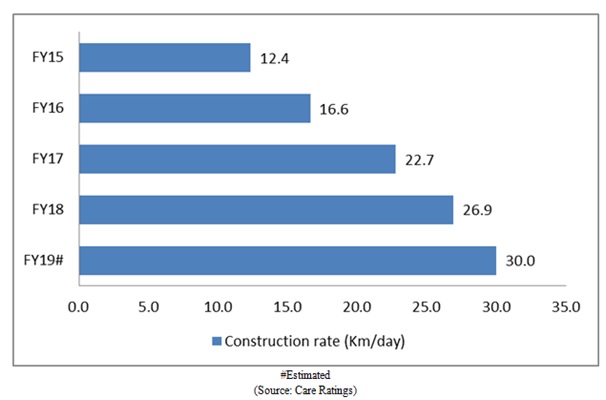

As per the Ministry of Road Transport and Highways data, in FY 2017-18 total of 9,829 km roads were constructed, followed by 10,855 km national highways during FY2018-19. However, 2019 is seeing a demand compression due to various reasons.

The construction of road projects has slowed down in the last financial year 2018-19 and it is continuing. This scenario seems to continue for some more time before an immense activity begins. This is impacting the construction equipment sector. The liquidity challenges around NBFCs have inevitably also impacted the industry.

Moreover, the National Highways Authority of India (NHAI) has large debts and the Ministry of Road Transport and Highways (MORTH) is exploring ways of raising money. One more point is that 2019 is an election year, which has contributed to the overall stress for the construction equipment sector.

But we cannot over cruise as in 2019 various stages of implementation work from 2018 are in motion. Due to various reasons, 2019 did not reflect much of a huge takeoff in the machinery section, but it soon will.

The budget impetus for Indian Construction Equipment Market

Finance Minister NirmalaSitharaman on July 5, 2019, said there will be a comprehensive restructuring of the National Highways Programme to ensure the creation of National Highways Grid of desirable capacity. Presenting the Budget for 2019-20, she said the government has already approved Rs 10,000 crore for the FAME II scheme on April 1, 2019, to encourage faster adoption of electric vehicles by providing the right incentives and charging infrastructure. She also noted that the government has allocated Rs 350 crore towards interest subvention for MSMEs for 2019-20.

Funds to be raised for the National Highways Authority of India (NHAI) have been hiked by 21 per cent in 2019-20 as the government prepares a blueprint for executing Bharatmala projects in a time-bound manner.

The authority has the approval to raise Rs 75,000 crore during the current year and government support of Rs 36,691 crore has been sanctioned.

In FY19, Rs 62,000 crore, a mix of debt raised from banks, toll revenue, and a road monetisation scheme, was to be raised.

This financial year, the allocation has been made to the NHAI for major works under the BharatmalaPariyojana, entrusted to the organisation for execution. The money will come from the Central Road Infrastructure Fund (CRIF), Permanent Bridges Fee Fund (PBFF), and Monetisation of National Highways Fund (MNHF).

The provision is mainly for expenditure on maintaining national highways is financed from Central Road Infrastructure Fund. The works are executed on an agency basis by the Public Works Department of the States, Border Roads Organisation, National Highways & Infrastructure Development Corporation Ltd (NHIDCL) and NHAI.

Key investments and developments for Indian Construction Equipment Market

The construction of highways reached 9,829 km during FY18 which was constructed at an average of 26.93 km per day. The Government of India has set a target for the construction of 10,000 km of the national highway in FY19. The total length of roads constructed under Prime Minister’s Gram SadakYojana (PMGSY) was 47,447 km in 2017-18. According to the BJP’s manifesto, Modi 2.0 is expected to pump Rs 100 trillion into infrastructure development by 2024.

Under Modi 1.0, India became the world’s fastest developer of highways. In the last five years, India constructed approximately 39,000 kilometres of highways-a jump of nearly 60% from the UPA-2 tally.

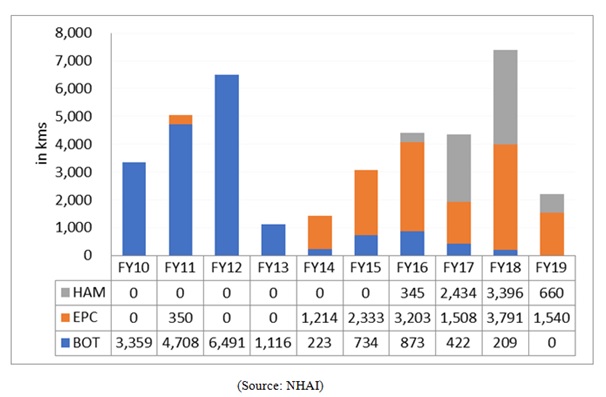

Similarly, Modi 1.0 awarded more contracts as compared to UPA-2. According to NHAI data, UPA-2 awarded contracts for building 17,461 kilometres of the road while Modi 1.0 awarded contracts for building 21,448 kilometres of roads.

Modi 2.0 aims to build 60,000 km of national highways in the next 5 years. According to data published by NHAI, the total length of India’s national highways was 1,32,500kilometres as of March 31, 2019. Such massive additions bode well for the sector. As mentioned in the BJP’s manifesto, Modi 2.0 is expected to bring in new technologies in road construction and maintenance activities.

Another reason for the government to support the road construction sector is that it creates mass employment opportunities. Employment generation has been one of the key challenges the government has faced.

The government expects its Bharatmala scheme to create 100-million man-days of employment during the construction phase. Moreover, improved economic activity (due to the addition of infrastructure) will create another 22 million jobs.

Since Engineering, Procurement, Construction (EPC) and Hybrid Annuity Models (HAM) are likely to be preferred options of the government to facilitate road building going forward, companies with a presence in both these segments would gain traction.

Contrary to a popular belief that banks are reluctant to fund HAM projects, a Crisil report suggests that 90% of awarded HAM projects worth Rs 1 lakh crore have already secured debt funding. This would boost the confidence of private players.

Some of the key investments and developments in the Indian roads sector are as follows:

- A total of 892 km and 2,345 km national

highway projects were awarded and constructed, respectively between April

–August 2018. - In March 2019, National Highway projects

worth Rs 1,10,154crore were inaugurated. - As of October 2018, total length of

projects awarded was 6,400 kms under BharatmalaPariyojana (including residual

NHDP works). - As of August 2018, a total length of

34,800 km road projects have been proposed to be constructed, under

BharatmalaPariyojana Phase-I. - As of August 2018, Government of India

has approved highway projects worth Rs 2 billion (US$ 29.83 million) to improve

connectivity among Gujarat, Maharashtra, Rajasthan, Madhya Pradesh and Diu

Fund allocation for Indian Construction Equipment Market

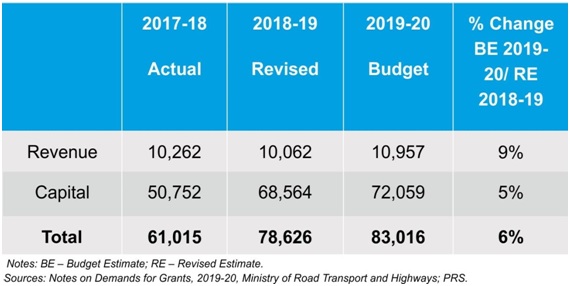

The total expenditure on the Ministry of Road Transport and Highways for 2019-20 is estimated at Rs 83,016 crore. This is 6% higher than the revised estimates for 2018-19.

In 2019-20, while revenue expenditure of the Ministry is estimated at Rs 10,957 crore, capital expenditure is estimated at Rs 72,059 crore. In 2014-15, the ratio between revenue and capital expenditure was 50:50. In 2015-16, this ratio changed, with the Ministry spending more funds on capital expenditure. Since then, the Ministry has increased its capital expenditure significantly. In 2019-20, 87% of the Ministry’s spending is estimated to be on capital expenditure.

Table 1: Budget allocations for the Ministry of Road Transport and Highways (in Rscrore)

Expenditure of the central government

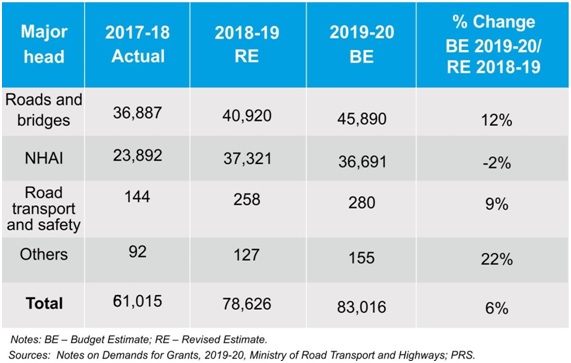

In 2019-20, of the total expenditure, the highest allocation is towards roads and bridges at 55% (Rs 45,890 crore). This is followed by allocation towards the National Highways Authority of India (NHAI) at 44% (Rs 36,691 crore).

Table 2: Expenditure heads for the Ministry of Road Transport and Highways

In 2019-20 the Ministry has allocated Rs 3,150 crore towards maintenance of roads and highways (including toll bridges). This is Rs 469 crore (17%) higher than the revised estimates of 2018-19.

The Ministry has allocated about 1% of its budget towards maintenance of NHs. This is for a total NH length of 1.14 lakh km. In comparison, in 2019-20 the US government seeks to allocate $23.74 billion (51% of its total budget on highways) towards its National Highway Performance Program, to improve the condition and performance of their National Highway System (roughly 2.2 lakh miles of length).

Opportunities for Indian Construction Equipment Market

Surveys show that adequately maintaining road infrastructure is essential to preserve and enhance those benefits. But a backlog of outstanding maintenance has caused irreversible deterioration of the road network. If insufficient maintenance is carried out, roads can need replacing or major repairs after just a few years. That deterioration spread across a road system very quickly results in soaring costs and a major financial impact on the economy and citizens.

With this in mind, the importance of maintenance needs to be recognized by decision-makers. To preserve the assets by preventive maintenance and to balance the long-term need, Road Asset Management programmes or systems can be applied in different countries, to benefit different road stakeholders. This activity drives the demand for pavers and compactors. Infrastructure projects have resulted in the demand of compactors, especially in rural infrastructure. The investment in rural road projects under PMGSY continues and the opportunities in this segment continue to be high. This is expected to have a positive impact on the road-paving equipment demand as with the demand for construction of rural roads, there will be an increased demand for road equipment.

Challenges of Indian Construction Equipment Market

The biggest challenge that the industry is facing is the taxation problem. Road equipment industry which gets charged 18 percent GST, is also taxed an additional 5-15 percent as Lifetime Tax when the machine is required to be road registered. This makes the equipment more expensive. Contactors payments and delay in allotment of new projects have also contributed to slow down. Rental also need to pick up, the penetration of rental players to this market is still low. Many players are inclined towards engaging rental fleets in their projects to reduce the owning cost.

Conclusion

The Ministry of Road Transport and Highways has fixed an overall target to award 15,000 km projects and construction of 10,000 km national highways in FY19. A total of about 295 major projects including bridges and roads are expected to be completed during the same period. This will significantly increase the demand of construction equipment.

Info- NHAI, Ibef, Business Standard, India today, Prsindia.org